Minerva Market View for Feb 27, 2024

The rally continues its ascent in its channel. Here's what we're watching.

Good evening! The market continues its ascent in the well-defined channel that we discussed in our last post. A minor dip within this channel could take it down to about 5000 on the S&P, where it would also meet with its rising 20-DMA:

As of now, we don’t see anything serious that can throw the rally off its tracks, although there are a few large bond auctions this week as well as the PCE report. Today the rally broadened to small- and mid-caps, with those indices outperforming the large caps.

We’ve discussed various breadth thrusts that have been firing since November in support of a strong rally. Now hear this from Wayne Whaley, award-winning market historian:

Assuming a positive close for February, which is the most likely path, this indicator would also turn green. As if the above post wasn’t clear, Whaley added today: “Not sure the significance of such has had time to sink in but of the 10,000s of scans I have performed in my lifetime the DJF Barometer signal posted Friday night is the only +25 case study in my domain perfect back to 1930.”

So the bulls have the upper hand and there is no point fighting this rally. A correction, even if we finally get it, is not likely to exceed 8-10% but will most probably be around the 5% range. In any case, it is difficult to predict, and better to ride the rally with the wind at our backs, using puts and selective shorts for protection.

Portfolio and Performance

Our portfolio continues to do great as we're tilted towards the small / mid-cap, high-growth names that found favor today: QRTEB 0.00%↑ ELF 0.00%↑ BPMC 0.00%↑ COIN 0.00%↑ TNC 0.00%↑ CLS 0.00%↑ CRWD 0.00%↑ CLSK 0.00%↑ ANF 0.00%↑ GEO 0.00%↑ BLBD 0.00%↑ CRSP 0.00%↑

PODD 0.00%↑ TFX 0.00%↑ and HR 0.00%↑ shorts also did well.

On the other side of the ledger, a small position in LUNR 0.00%↑ still managed to put a dent due to its outsized fall today. IRTC 0.00%↑ (short) TCOM 0.00%↑ GOOGL 0.00%↑ HTHT 0.00%↑ rounded off the losers today.

Watchlist

For tomorrow, these are the names we’re looking at:

Long: WFRD 0.00%↑ ASPN 0.00%↑ DKNG 0.00%↑ SQ 0.00%↑ TDW 0.00%↑ $BYDDY

Hedges: Puts on QQQ 0.00%↑ OKTA 0.00%↑

Worth checking out

A great read on US economic growth and what’s powering the rally:

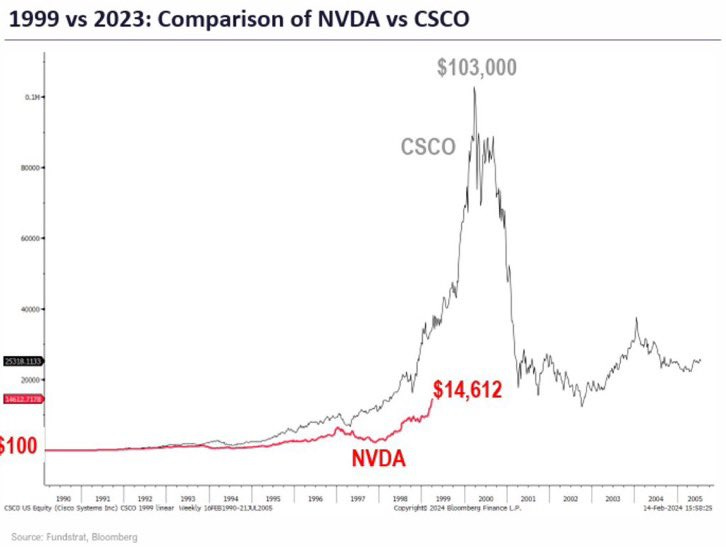

Interview with the man of the times, Jensen Huang of NVDA 0.00%↑:

Lex Fridman’s interview with Bill Ackman has interesting insights:

That’s all for now. Happy Trading! Make sure to follow @MinervaCap on Twitter for real-time updates.

Thank you very much for your notes. Would you mind putting abit more color on how you manage your portofolio and build a position? Do you use stops? You manage to buy in one day only?

I also see you have biotech names in your portoflio, what is your thesis in buying and shorting stocks in this sector? Thanks