Minerva Market View for Feb 23, 2024

NVDA helps the market get back on its feet. Here's how we're positioned.

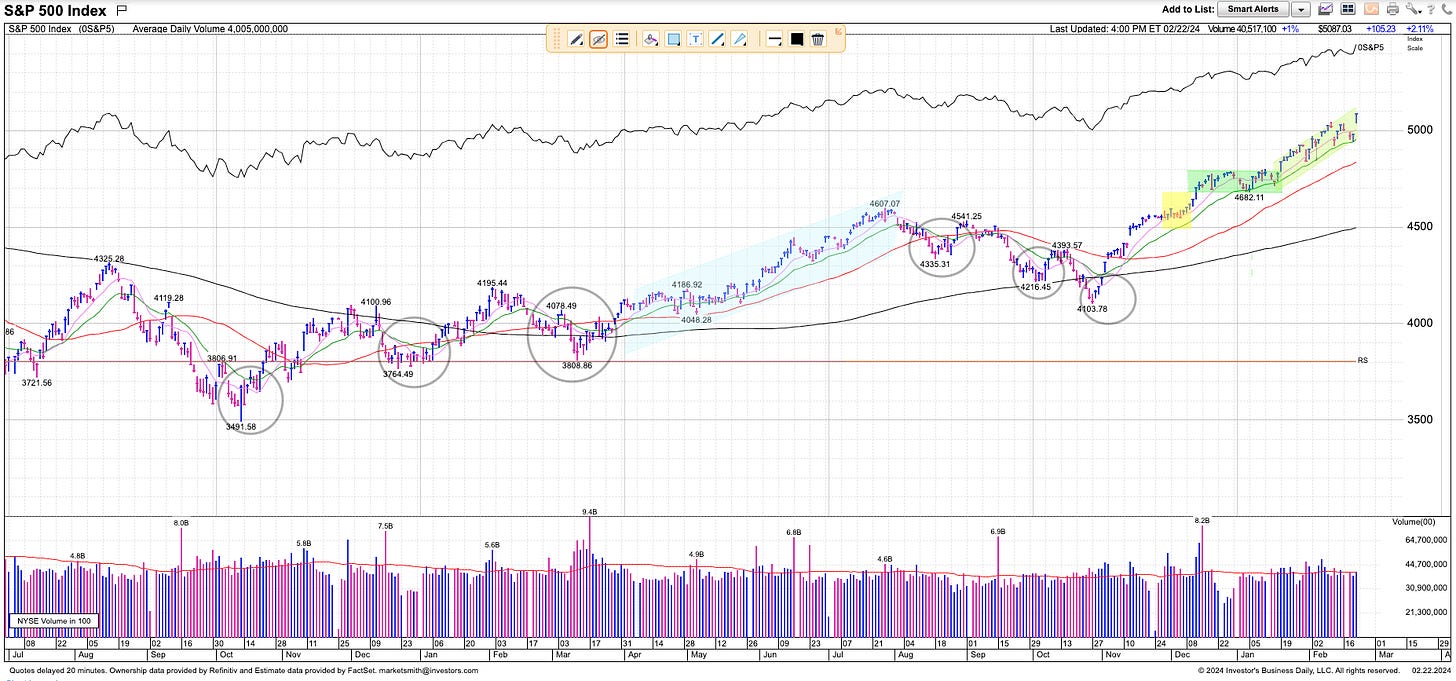

Good evening! NVDA 0.00%↑ can be single-handedly credited with saving the rally for now. We have been in this upward-sloping channel since Jan 19 (shown in light green in the chart below), when we broke out of about a month-long consolidation phase:

This has been a confusing time for market participants with a strong market defying weak seasonal patterns and technical divergences. In support of the rally, we’ve had some major breadth thrusts with near-perfect records:

It also helps that we’re in a “power trend” which has been identified as a strongly bullish pattern by the IBD team:

As such, it doesn’t make sense to fight this momentum until it breaks. Agile traders can still try to time the rally as it bounces back and forth within the channel. We’ve been using SPY 0.00%↑ puts and ARKK 0.00%↑ shorts for that. However, most of our portfolio is long-only for now.

Portfolio and Performance

We had several winners on the board today – and they weren't all about AI: NVDA 0.00%↑ TCOM 0.00%↑ ELF 0.00%↑ CLS 0.00%↑ CRSP 0.00%↑ BLBD 0.00%↑ META 0.00%↑ UTI 0.00%↑ ANF 0.00%↑ BIDU 0.00%↑ HUBB 0.00%↑ NVO 0.00%↑ ORCL 0.00%↑ NFLX 0.00%↑ STLA 0.00%↑ CRWD 0.00%↑ HTHT 0.00%↑. We had some losses on the short side and in a new LYFT 0.00%↑ position.

Watchlist

For tomorrow, these are the names we’re looking at:

Long: REVG 0.00%↑ IBN 0.00%↑ NXPI 0.00%↑ CAH 0.00%↑ ANET 0.00%↑ SN 0.00%↑ TOL 0.00%↑ SERA 0.00%↑ CLSK 0.00%↑ QRTEA 0.00%↑ DOCN 0.00%↑

Short: WOLF 0.00%↑ SGML 0.00%↑

Worth checking out

We are nowhere close to the bubble phase yet – but looks like one may be beginning to form:

That’s all for now. Happy Trading! Make sure to follow @MinervaCap on Twitter for real-time updates.

Disclaimer: This post is for professional investors only and is shared with other like-minded investors for the exchange of views and informational purposes only. Please see the disclosures and disclaimers for more details and always note, we may be entirely wrong and/or may change our mind at any time. This is NOT investment advice, please do your own due diligence.

Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.