Minerva Market View for Nov 8, 2023

Markets likely to continue digesting earlier gains, but point to further gains.

Good evening! Broadly similar action as yesterday with the markets continuing to digest gains. Exceptions were Technology which zoomed ahead after stellar earnings from DDOG 0.00%↑ and the Energy sector which fell broadly along with Crude / OIL 0.00%↑. This meme summarizes it best :)

Positioning and Market View

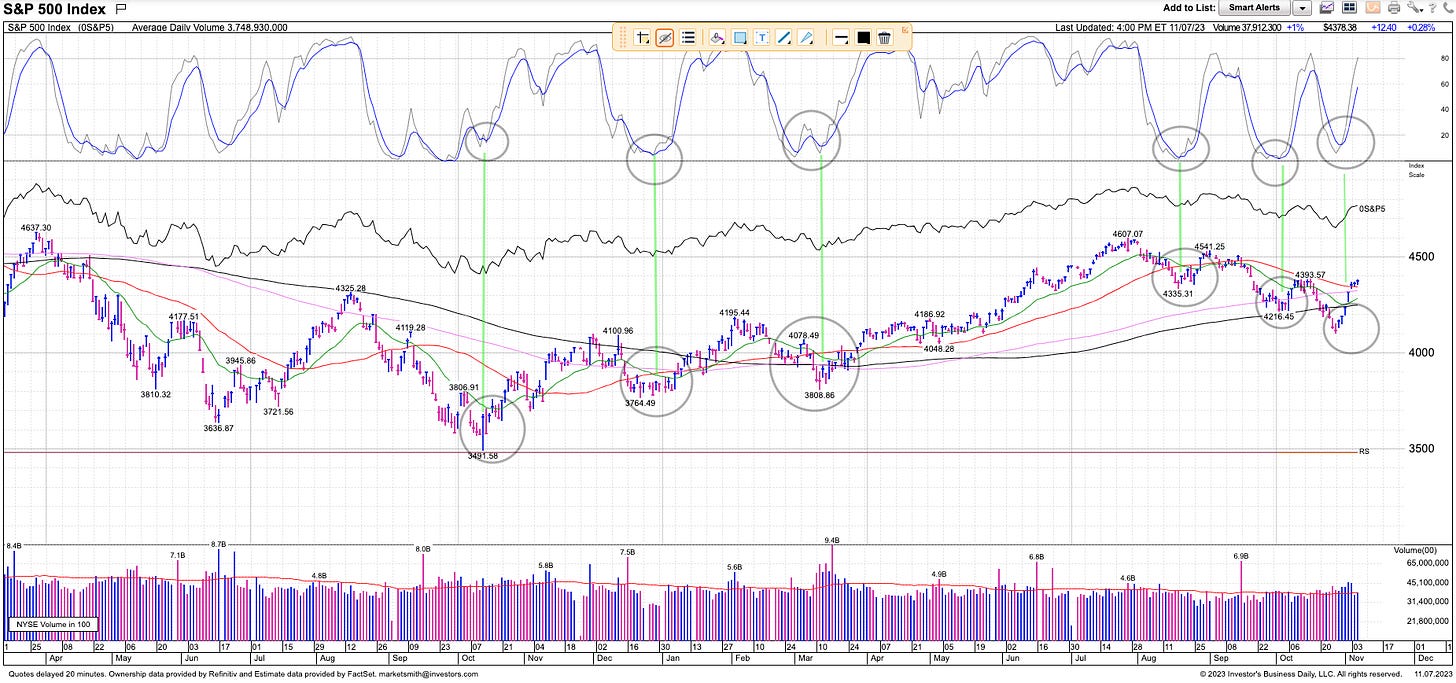

Our broad positioning remains the same as yesterday: the market continues to consolidate its gains and offers opportunities to buy on dips. The S&P 500 / SPY 0.00%↑ is getting close to the overbought zone on the daily chart, but is not showing signs of reversing yet:

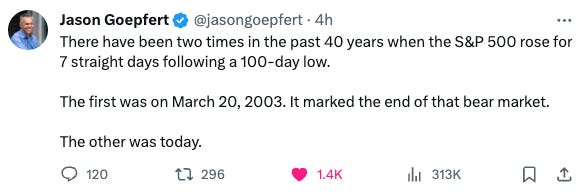

Several technical / breadth indicators and market gurus lend support to this view:

Some of the junk stocks that had popped are now seeing corrections, affording great opportunities to get selectively long and short.

Portfolio and Performance

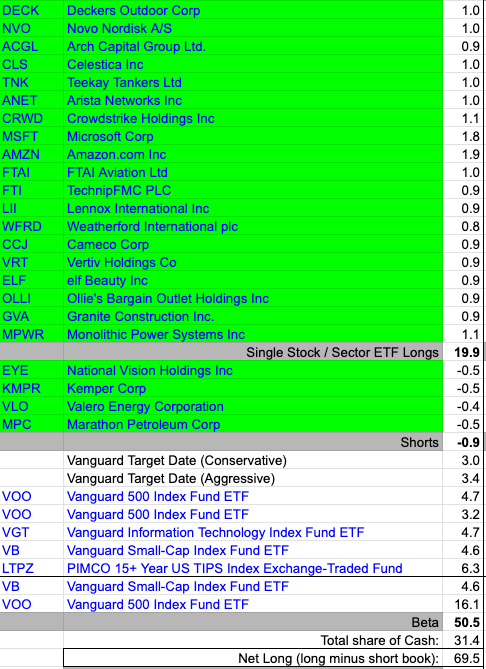

Our portfolio continues to deliver steady gains. Major gainers today were the tech stocks such as CRWD 0.00%↑ AMZN 0.00%↑ and MSFT 0.00%↑. The energy sector stocks such as WFRD 0.00%↑ and FTI 0.00%↑ detracted. CELH 0.00%↑ was also a disappointment and we got rid of it.

Our large allocations to longer-term bonds in the form of LTPZ 0.00%↑ and to the tech sector in the form of VGT 0.00%↑ in the long-term portfolio helped immensely today with both posting gains of about 1%.

We shorted KMPR 0.00%↑ VLO 0.00%↑ and MPC 0.00%↑ today. Current net long positioning is close to 70%.

Watchlist

Here’s what we’re watching for tomorrow:

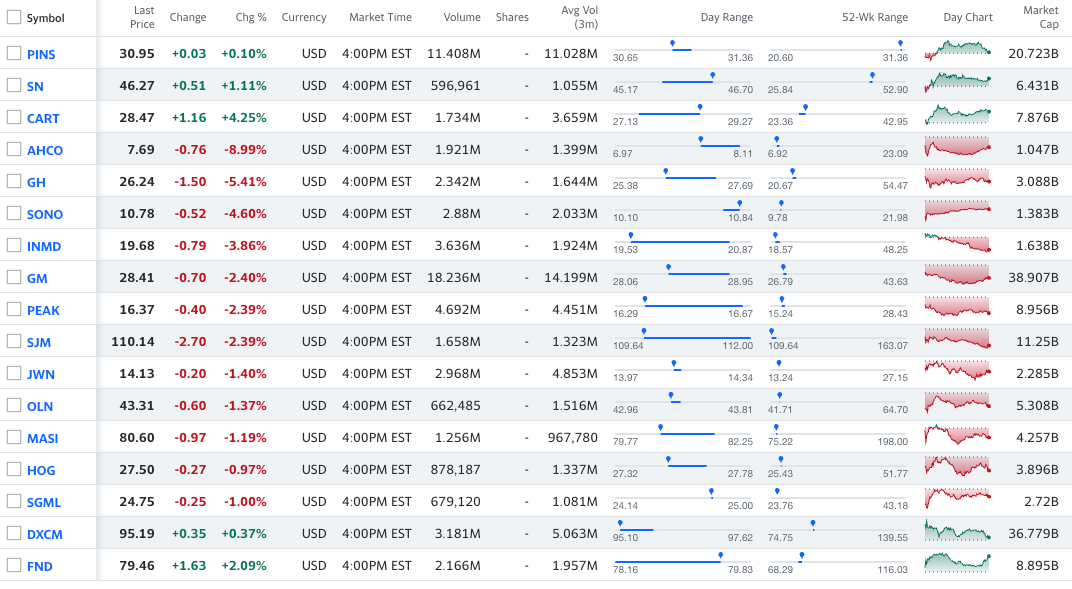

ETFs: VOO 0.00%↑

Stocks: PINS 0.00%↑ SN 0.00%↑ CART 0.00%↑

Shorts: AHCO 0.00%↑ GH 0.00%↑ SONO 0.00%↑ INMD 0.00%↑ GM 0.00%↑ PEAK 0.00%↑ SJM 0.00%↑ JWN 0.00%↑ OLN 0.00%↑ MASI 0.00%↑ HOG 0.00%↑ SGML 0.00%↑ DXCM 0.00%↑ FND 0.00%↑

Worth checking out

A great talk by Charles Harris on the ups and downs in his trading journey which included days of seven-figure gains and times when he lost it all:

Interview with Todd Simkin of Susquehanna, a hedge fund in such rarefied company as Bridgewater, on how they train traders among other things:

That’s all for now! If you like our work, please share it with your network. We believe in sharing actionable trade ideas in liquid US-listed stocks/ETFs that all investors, big or small, can execute. We just got started on Substack a couple of weeks back and could use the added support!

Happy Trading!