Minerva Market View for Nov 7, 2023

Markets are likely to remain subdued but trend upwards, offering a chance to buy dips

Good evening! Today was a calmer day in the markets compared to last week. This pattern will most likely continue for the rest of the week as the indices digest the huge gains from last week.

Positioning and Market View

Our view of this market remains that this is a huge liquidity-fuelled rally caused by the Treasury’s decision on the QRA as well as the Fed holding on rates. Right now, bad news is being received as good news. Until this pattern persists, the risk/reward benefits being net-long.

At the same time, this week will likely be quieter than last week and also offer dips for careful buyers to get long.

Here are our usual supporting charts:

The S&P/ SPY 0.00%↑ shows signs of building on its gains, without reaching an overbought condition yet:

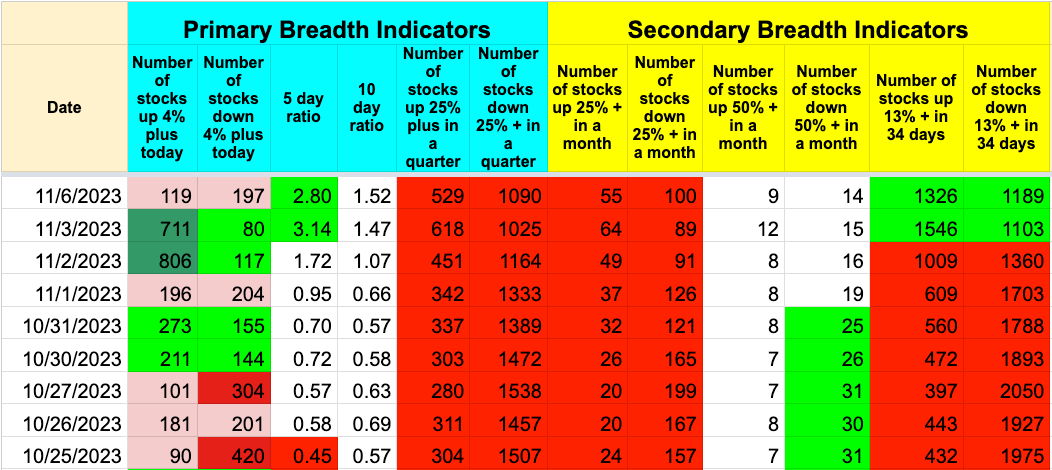

Primary and secondary breadth thrust indicators are supportive:

At the same time, the rip in junk stocks/sectors has likely run its course. The most shorted stocks (with the highest short interest) corrected in aggregate today:

This gives us a great opportunity to again get tactically long/short on the strongest vs. weakest stocks.

Portfolio and Performance

Our portfolio delivered minor gains tracking the broader indices today, with ELF 0.00%↑ being the standout at ~6% gains:

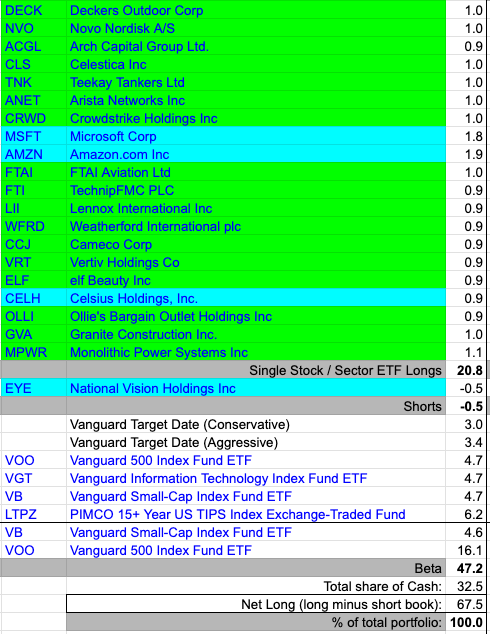

We added to MSFT 0.00%↑ and AMZN 0.00%↑ on strength and opened a new position on CELH 0.00%↑ as a bet on its earnings tomorrow. We also shorted EYE 0.00%↑ as shared on Twitter earlier:

We also trimmed our long-term bond positions and will likely get out of those altogether as longer-term rates have again started climbing:

We’re currently close to 70% invested in our overall portfolio, including trading and long-term positions. We will continue building our long and short book based on price action over the coming days.

Watchlist

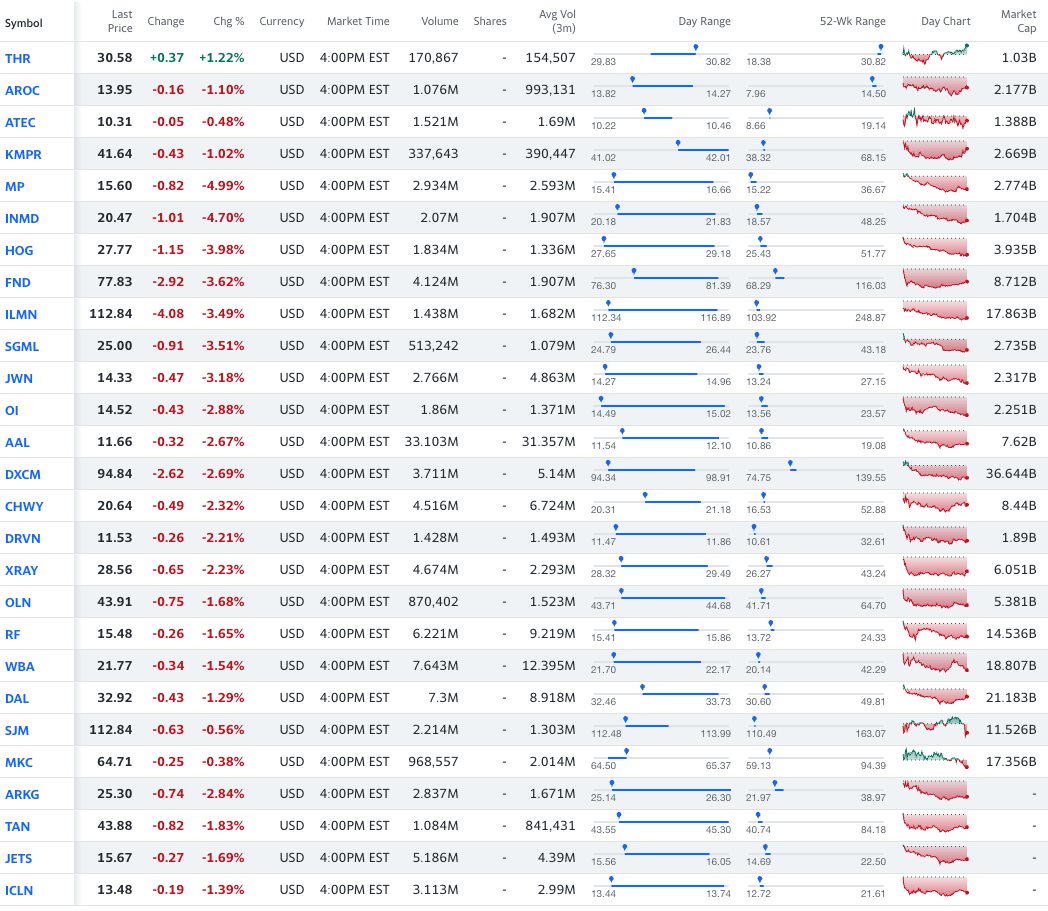

Here’s what we’re watching for tomorrow:

ETFs: VOO 0.00%↑

Stocks: THR 0.00%↑ AROC 0.00%↑

Short: ATEC 0.00%↑ KMPR 0.00%↑ MP 0.00%↑ INMD 0.00%↑ HOG 0.00%↑ FND 0.00%↑ ILMN 0.00%↑ SGML 0.00%↑ JWN 0.00%↑ OI 0.00%↑ AAL 0.00%↑ DXCM 0.00%↑ CHWY 0.00%↑ DRVN 0.00%↑ XRAY 0.00%↑ OLN 0.00%↑ RF 0.00%↑ WBA 0.00%↑ DAL 0.00%↑ SJM 0.00%↑ MKC 0.00%↑

Short ETFs: ARKG 0.00%↑ TAN 0.00%↑ JETS 0.00%↑ ICLN 0.00%↑

ICYMI

This was a great interview with Sahm Adrangi of Kerrisdale Capital on how he got started with his short-focused hedge fund:

That’s all for now! If you like our work, please share it with your network. We believe in sharing actionable trade ideas in liquid US-listed stocks/ETFs that all investors, big or small, can execute. We just got started on Substack a couple of weeks back and could use the added support!

Happy Trading!