Minerva Market View for Dec 6, 2023

A dip in the major indices is playing out, as we had anticipated. Here's how we're positioned.

Good evening! As we had cautioned yesterday, the major indices dipped today with the S&P/ $SPY down -0.4% and Nasdaq/ $QQQ down -0.6%. The rotation we’d suggested seems to be taking place: small-caps/ $IWM and the equal-weight S&P/ $RSP managed to post small gains today.

The broad picture remains one of caution. Here are our usual charts:

These charts combined with the weak seasonality in the first half of December that we shared yesterday mean that we continue to exercise caution by avoiding buys, locking gains with tight stop-losses, and adding some shorts, which we will cover below.

Portfolio and Performance

We continue to trim exposure to $VOO (we are completely out of $VGT now). We also booked gains on $CLS today. We added a couple of positions ($HOOD and $AER) on breakouts today, but they don’t seem to be doing well. We’ve also bought calls on $DG as a play on earnings tomorrow.

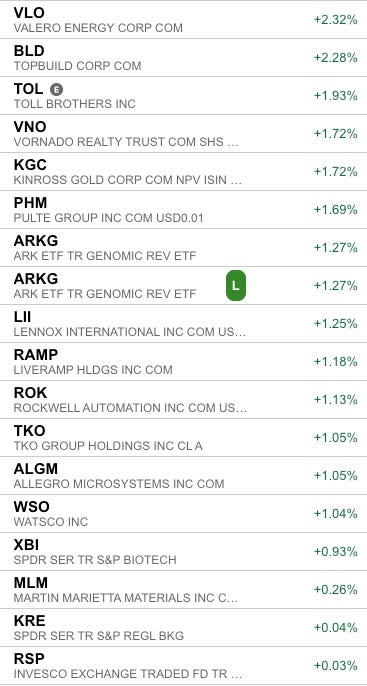

Here’s how we fared today, with losers outnumbering the winners. But some tickers are doing well in this environment as well, as you can see below:

Watchlist

For tomorrow, we will be looking at these tickers and add them based on price/volume action:

No new longs

Shorts: $IE $XPRO $PTEN $CHX $GH $APA $FLYW $OGN $YUMC $NVST $HAS $APTV $RVTY $FNGU

Worth checking out

Citrini has had some great calls this year and the above update is unlocked for free viewers. Some of the shorts we’ve covered above address his latest trade:

That’s all for now. Happy Trading!