Minerva Market View for Dec 5, 2023

Markets are short-term overbought and need some time to regain their strength before resuming the rally.

Good evening! The markets seem to be taking a much-needed break here for some time and we’ve booked profits on many of our positions from the November rally.

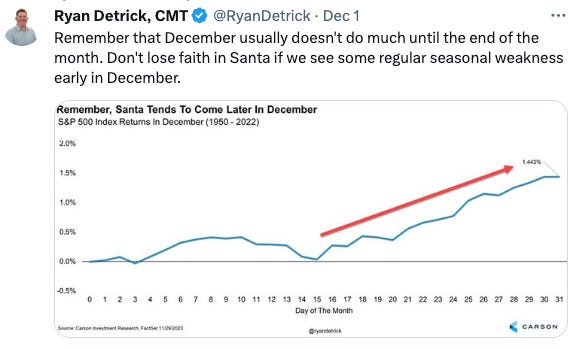

As we shared in our Dec 1 update, and to repeat it here, the first half of December can be expected to have ups and downs, and it’s really in the second half that we tend to see gains:

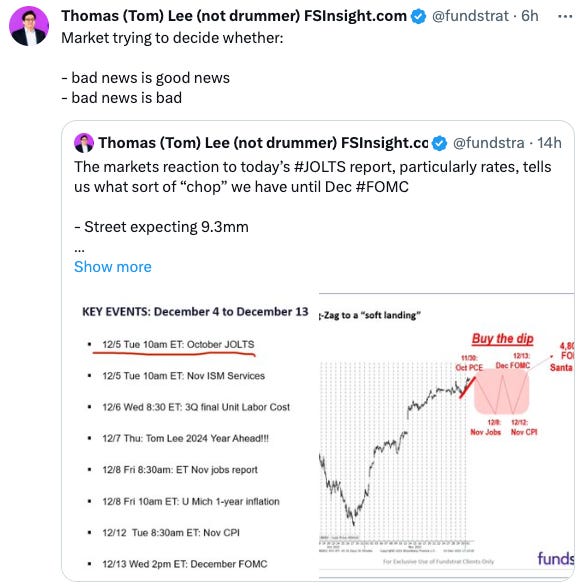

The employment report that came out today was initially perceived to be positive for the markets as the number of openings reduced without much dip in layoffs/unemployment. However, the market seemed to be undecided:

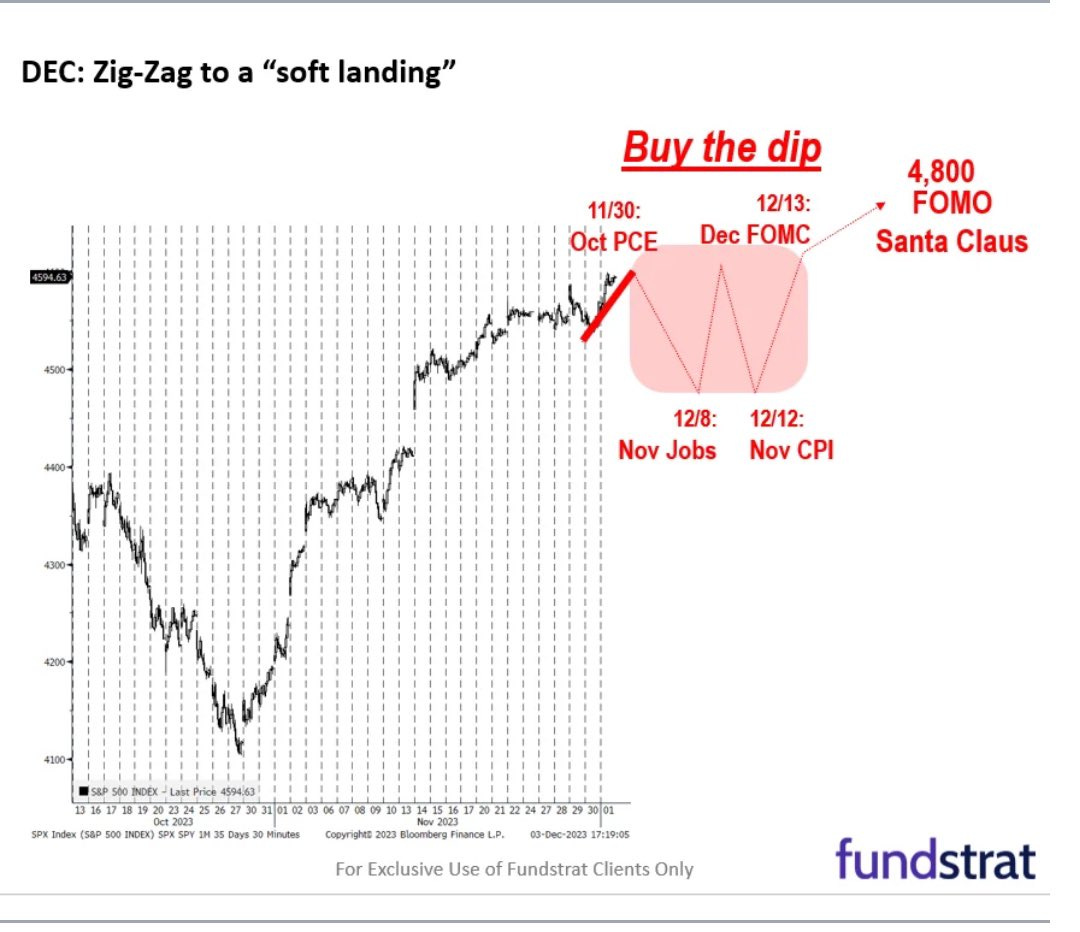

Here’s Tom Lee’s projection for SPY 0.00%↑ in more detail, which also shows a rally post-Dec 13:

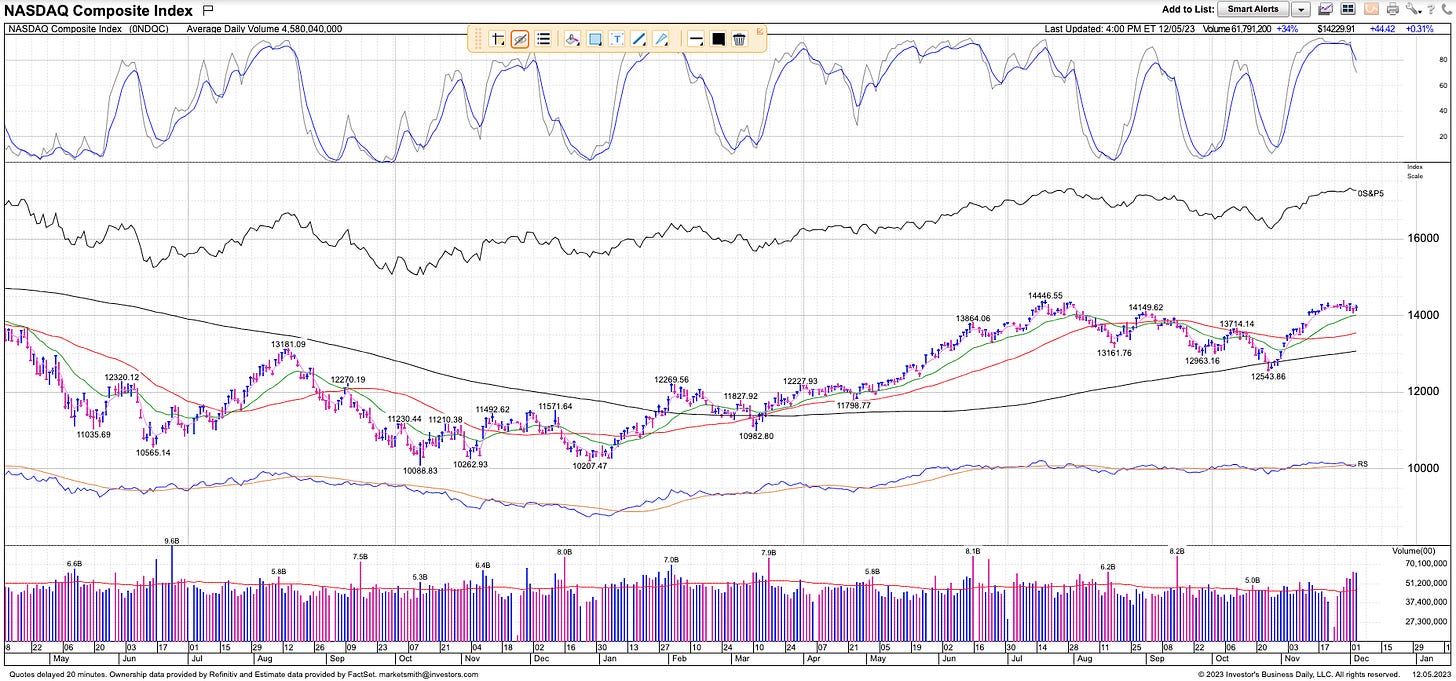

These are of course ballpark guidances and may or may not come to fruition as depicted. Also, in an interesting change of character, investors seemed to flock back to the Mag-7 stocks such as MSFT 0.00%↑ NVDA 0.00%↑ AAPL 0.00%↑ , etc., and the rally in small-caps reversed. Here are the important charts and commentary:

We let the market’s price and volume action guide us, and right now, the guidance from these two major indices is one of caution. That paired with the seasonality charts shared above means it’s better to hold rather than buy here. If you have a lot of gains from the November rally, it’s also not a bad idea to lock some of those in at this point. At the same time, this is not a time to panic and sell everything, as we’re still in a confirmed uptrend.

Portfolio and Performance

In our portfolio, we trimmed our exposure to VOO 0.00%↑ and VGT 0.00%↑ (which were our largest holdings) along with the mega-caps in the last couple of days, and have brought our net-long exposure down to 54%. Despite that, being long means that we’ve also taken a hit along with the market. Here are the positions that moved the most today:

Watchlist

For tomorrow, we will be looking at these tickers and add them based on price/volume action:

Long: FFIV 0.00%↑ AER 0.00%↑ WWD 0.00%↑ GE 0.00%↑ RPD 0.00%↑ CRM 0.00%↑

Short: AGL 0.00%↑ OGN 0.00%↑ ALB 0.00%↑ WHR 0.00%↑ VET 0.00%↑ FMC 0.00%↑ RVTY 0.00%↑ APTV 0.00%↑ OI 0.00%↑ SSRM 0.00%↑ NVST 0.00%↑

F5 FFIV 0.00%↑ is in a buy range from a double-bottom base and had 4x the average volume on Nov 30:

Worth checking out

The realtor lawsuit could also have impacts on homebuilders. We have PHM 0.00%↑ and TOL 0.00%↑ in our portfolio. Toll Brothers reported and had a good uptick after-hours:

That’s all for now. Happy Trading!