Minerva Market View for Dec 4, 2023

As we expected, the rotation from mega-caps into small-caps and market-weight to equal-weight is proceeding in earnest. Here's how we're positioning.

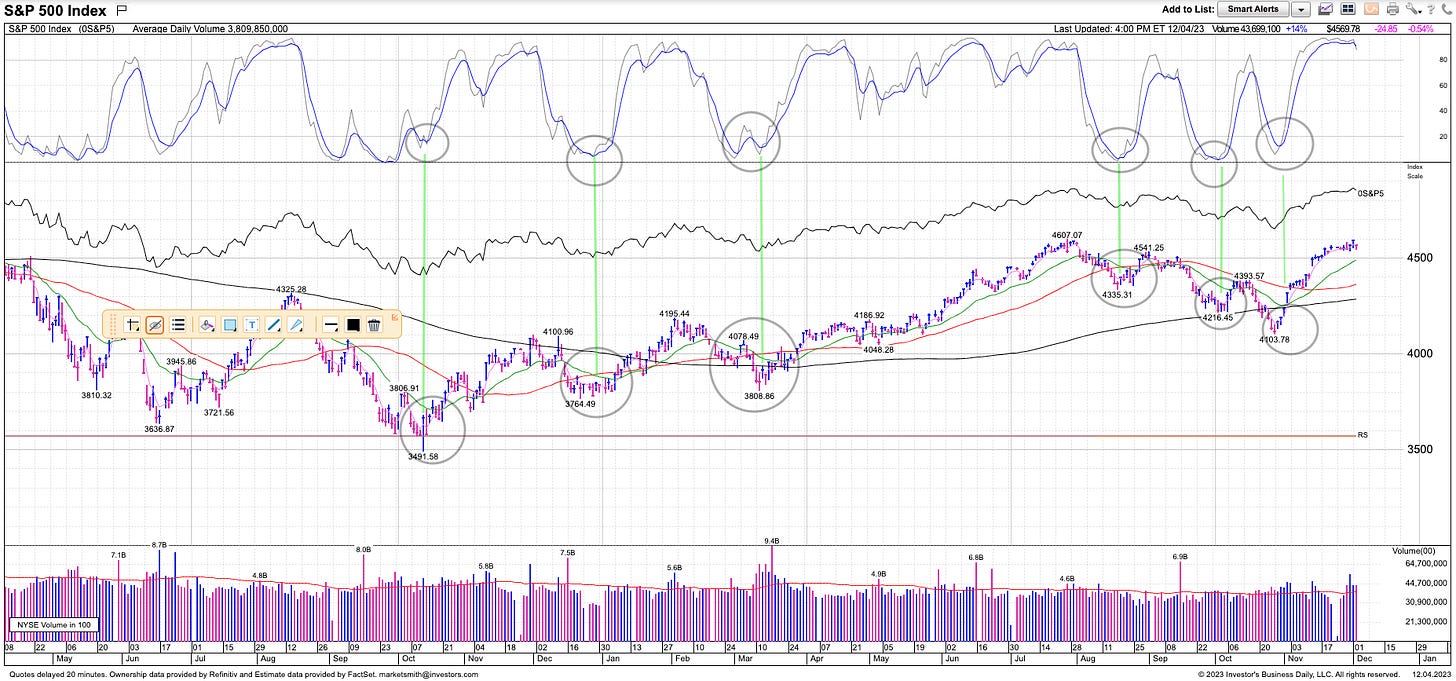

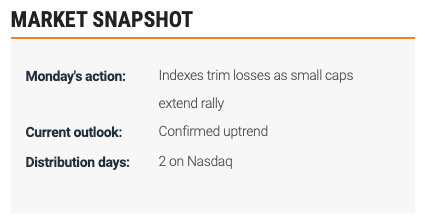

Good evening! As we mentioned in our post yesterday, the rotation from mega-caps and market-weighted indices to small-caps and their equal-weight counterparts is on in full swing.

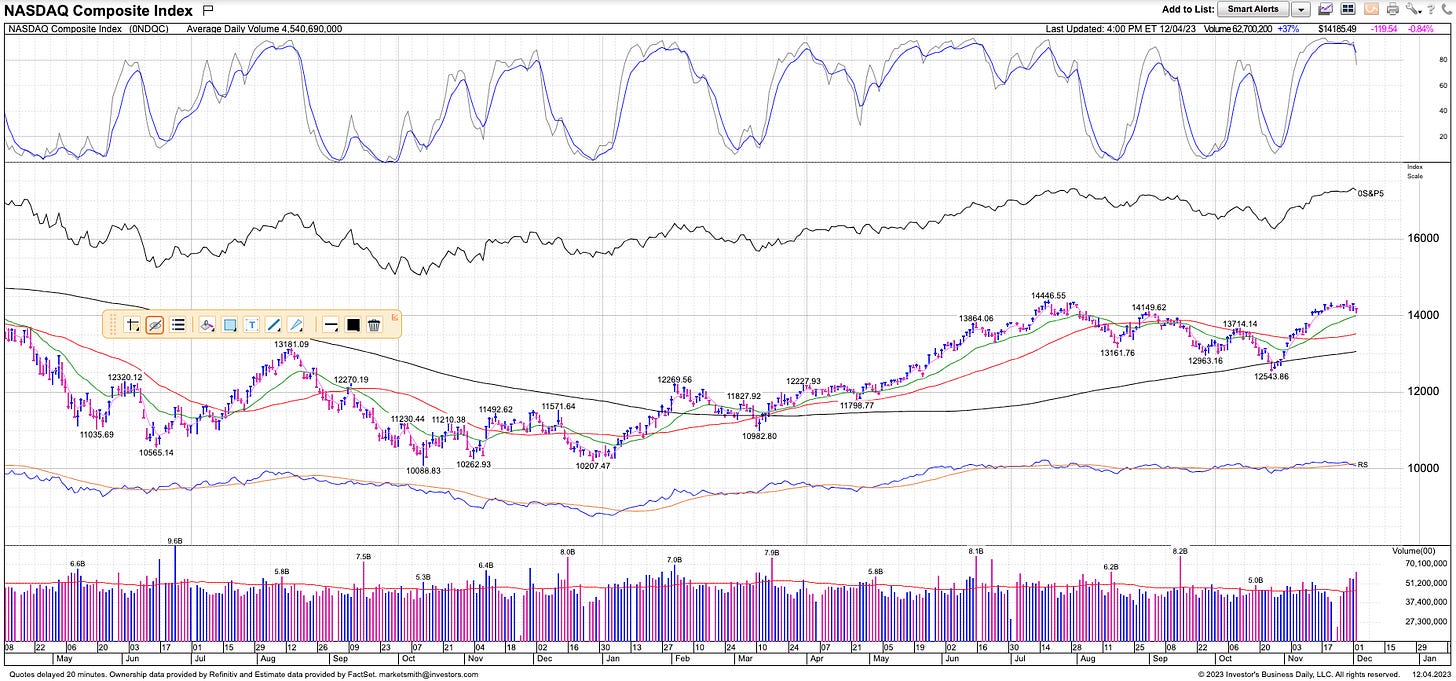

Here are our usual charts with commentary:

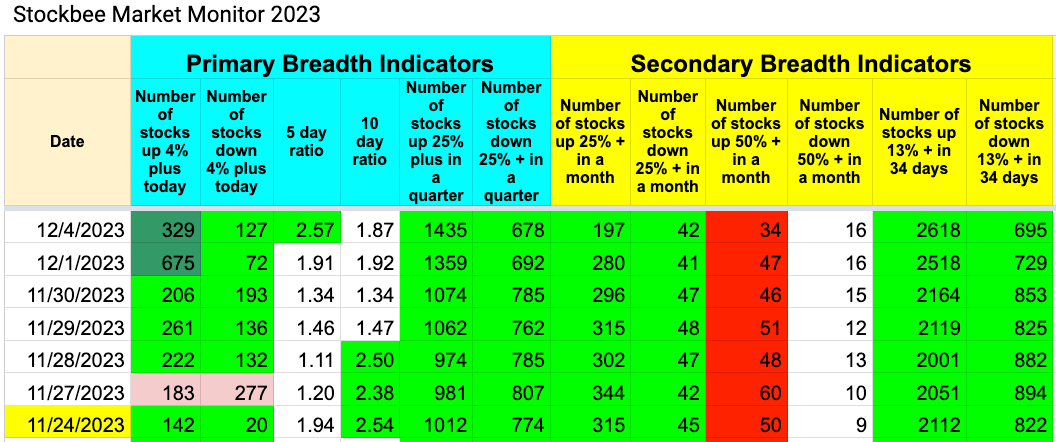

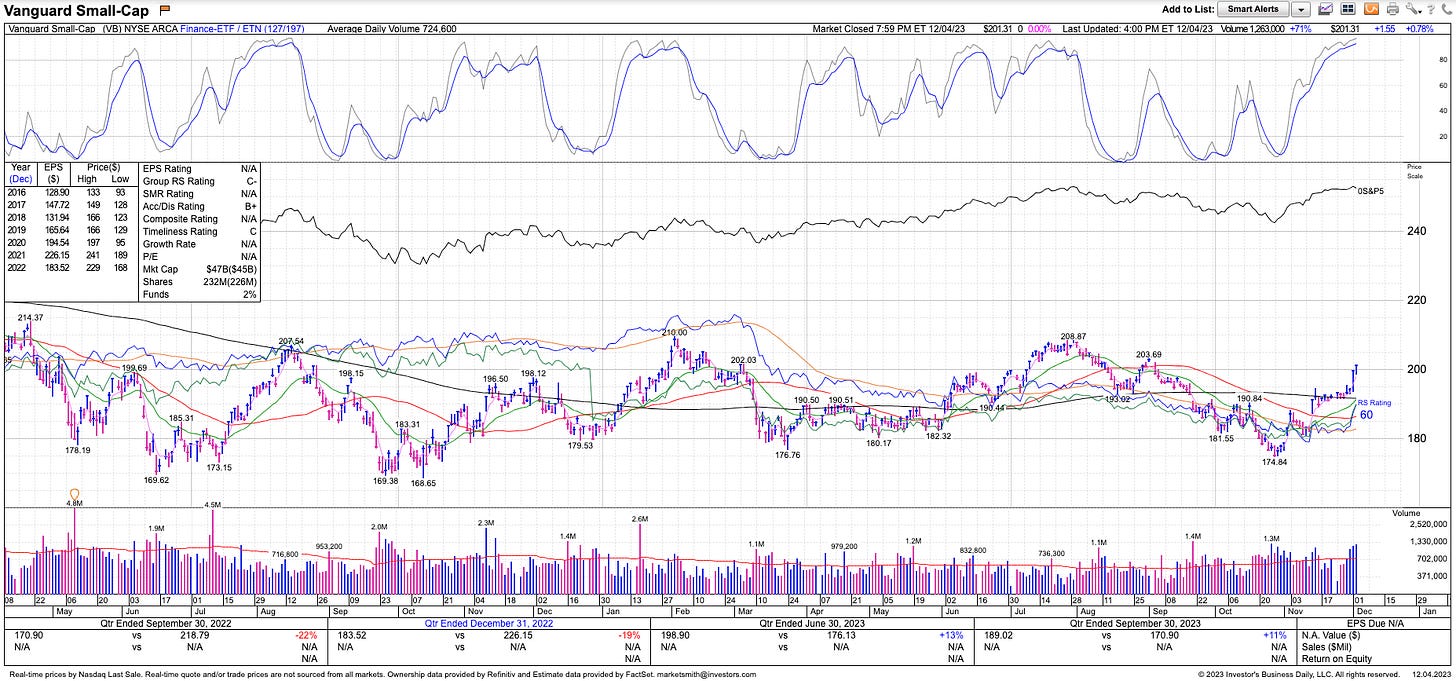

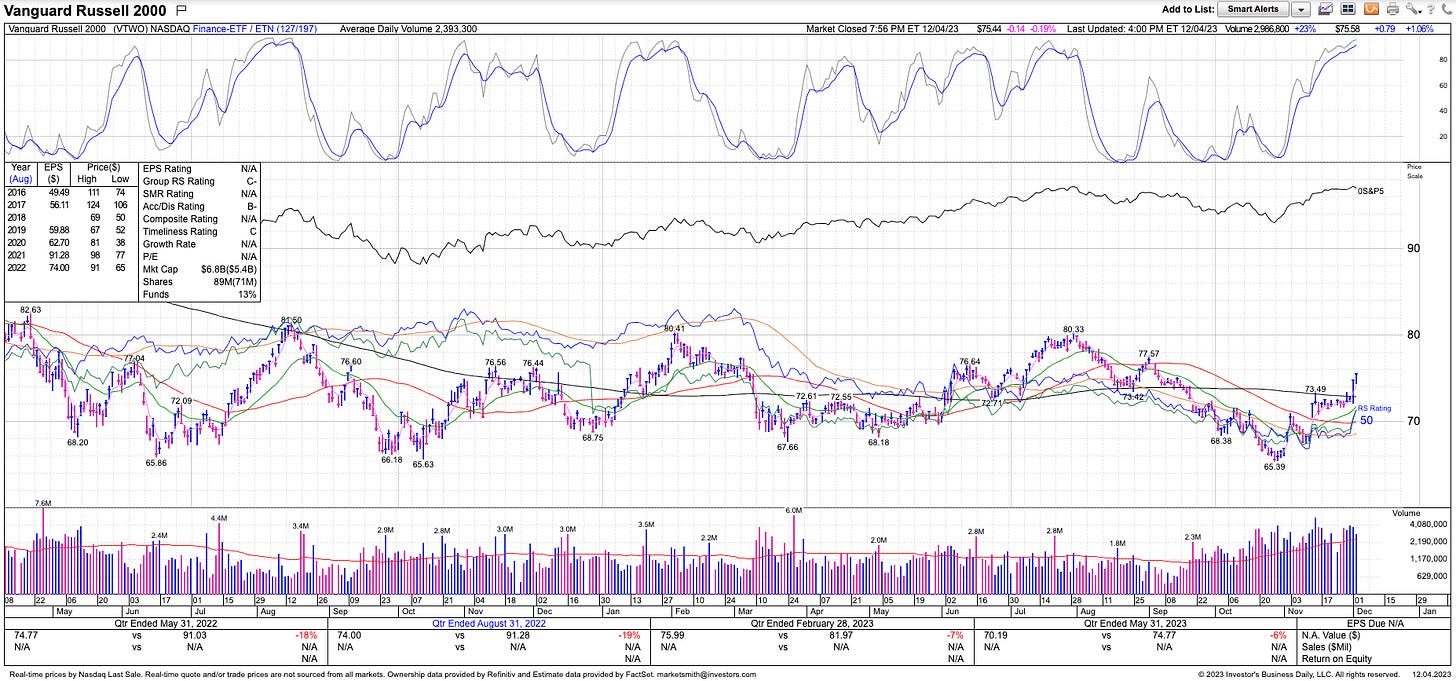

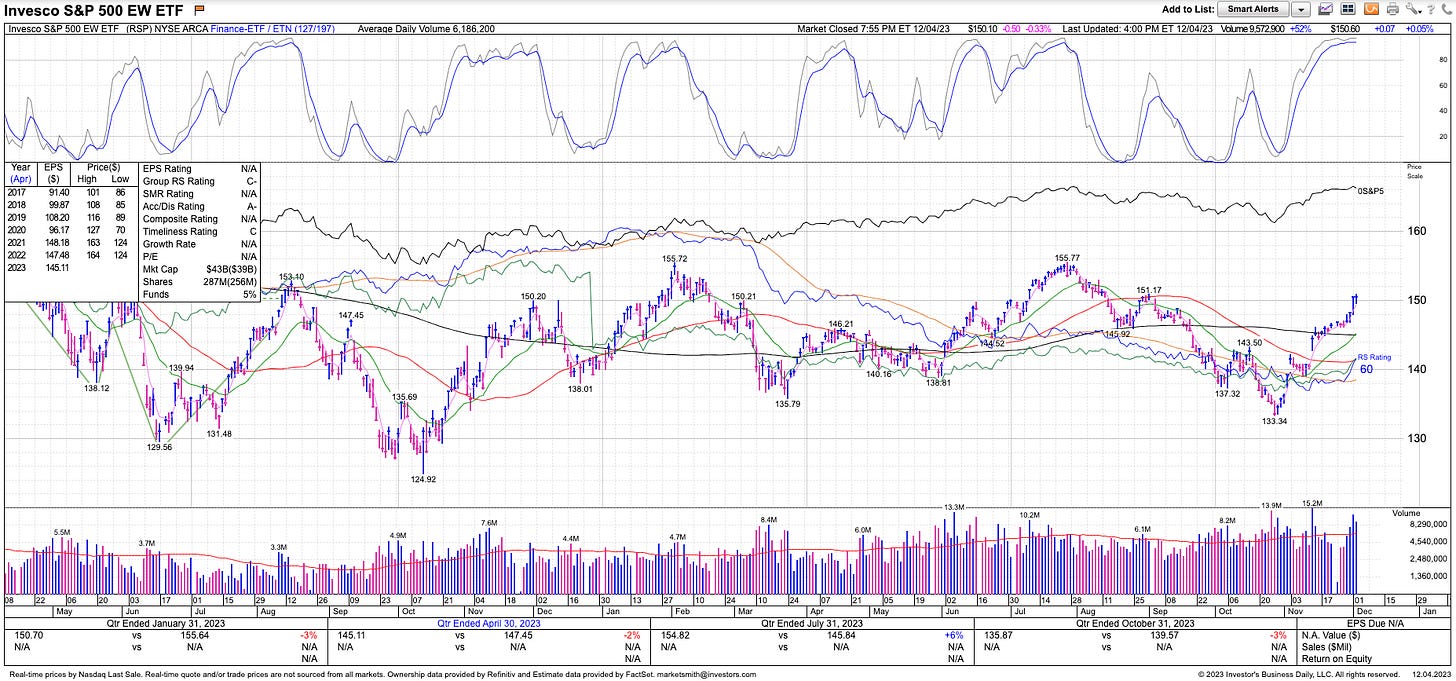

The improvement in breadth is a result of money rotating away from the Mag-7 / mega-caps / market-cap weighted indices such as QQQ 0.00%↑/ SPY 0.00%↑ and into the small-cap ETFs such as IWM 0.00%↑ / VTWO 0.00%↑ / VB 0.00%↑ and equal-weighted indices such as RSP 0.00%↑. Those charts are improving and showing momentum now:

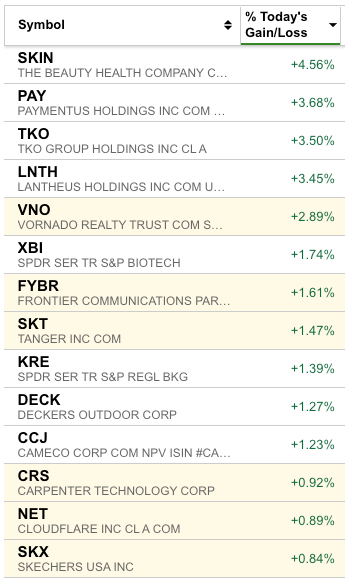

Beaten-down and rate-sensitive ETFs such as XBI 0.00%↑ KRE 0.00%↑ ARKK 0.00%↑ etc. have also been having a good time since the last few days, and this can be expected to continue.

Given this broad picture, here’s how we’re positioning.

Portfolio and Performance

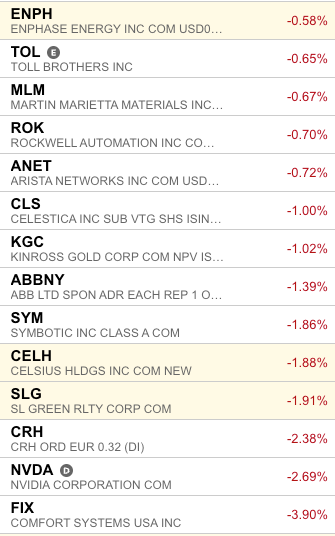

As we discussed yesterday, we’ve exited out of VOO 0.00%↑ and VGT 0.00%↑ in our trading portfolio (we still hold it in our long-term portfolio). Here are our holdings that moved the most today. Those highlighted in yellow are today’s buys/additions:

We’re currently 78% net-long i.e. we trimmed our net-long positioning by 10% today.

Watchlist

For tomorrow, we will be looking at these tickers and add them based on price/volume action:

Long: XRT 0.00%↑ FFIV 0.00%↑ GE 0.00%↑ RPD 0.00%↑ RCL 0.00%↑

Short: ALB 0.00%↑ NEP 0.00%↑ MTCH 0.00%↑ ON 0.00%↑

Rotate: We will also continue rotating out of VOO 0.00%↑ and VGT 0.00%↑ to VB 0.00%↑ VTWO 0.00%↑ and RSP 0.00%↑ in our long-term portfolio as well.

Worth checking out

Podcast on the office CRE space. Interestingly, we have taken positions in VNO 0.00%↑ and SLG 0.00%↑ recently as part of the short-term bounce.

Jack Schwager has written some of the best books of interviews with “Market Wizards”. He is coming out with a revised edition of his book Unknown Market Wizards:

That’s all for now. Happy Trading!