Minerva Market View for Dec 3, 2023

We had a great day on Friday. We see the bull rally continuing and sector/style rotations happening under the surface.

Good evening and I hope you had a great weekend. We had a great day on Friday with our portfolio handily beating the S&P for the day and the week.

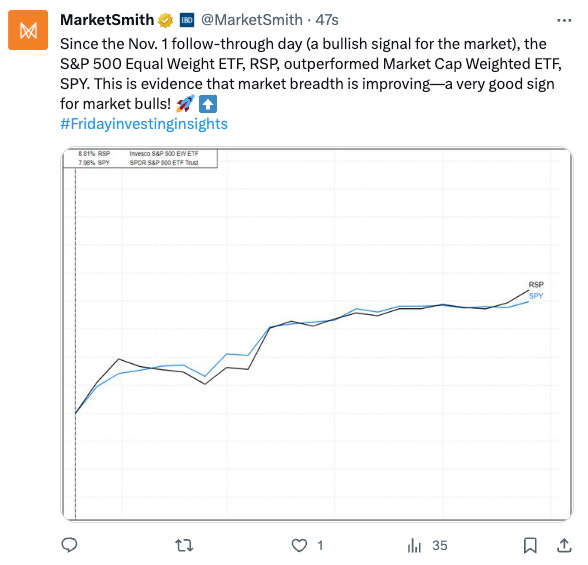

The primary theme I see developing is a sector rotation from mega-caps / SPY 0.00%↑ / QQQ 0.00%↑ into small-caps and the more aggressive and beaten-down sectors.

Portfolio and Performance

We had several positions that gained more than 1% on Friday: SYM 0.00%↑ ARKK 0.00%↑ARKG 0.00%↑ KRE 0.00%↑ WSO 0.00%↑ VRT 0.00%↑ DECK 0.00%↑ CRS 0.00%↑ XBI 0.00%↑ PHM 0.00%↑ LII 0.00%↑ CRH 0.00%↑ VB 0.00%↑ AGNC 0.00%↑ NLY 0.00%↑ PAY 0.00%↑ TOL 0.00%↑NET 0.00%↑ FIX 0.00%↑ AVAV 0.00%↑ RAMP 0.00%↑ PLTR 0.00%↑RSP 0.00%↑:

Here are all the losers:

We’re currently 88% net-long.

Watchlist

Long ETFs / sectors: RTH 0.00%↑ TAN 0.00%↑ GDXJ 0.00%↑ XME 0.00%↑ XAR 0.00%↑ MTBA 0.00%↑

Long stocks: SKT 0.00%↑ DBX 0.00%↑ FFIV 0.00%↑ AER 0.00%↑ WAB 0.00%↑ WWD 0.00%↑ GE 0.00%↑ RPD 0.00%↑ VNO 0.00%↑ BILL 0.00%↑ ENPH 0.00%↑ J 0.00%↑ ACM 0.00%↑ CELH 0.00%↑ U 0.00%↑ WELL 0.00%↑ DVA 0.00%↑ BYND 0.00%↑

No new shorts and we will likely close out all our existing shorts based on price action.

Sell: in our trading portfolio, we booked our gains from the recent run-up in VGT 0.00%↑ and will also look at exiting out of VOO 0.00%↑ MSFT 0.00%↑ AMZN 0.00%↑ ANET 0.00%↑ since their relative strength is deteriorating versus the smaller caps.

Worth checking out

Per @jasongoepfert:

The most important ETF in the world shows that the S&P 500 has enjoyed 4 large unfilled gaps in only 3 weeks.

It suffered a deep loss last year but since the inception of the fund has indicated breakaway momentum.

It's not something we tend to see during ongoing bear markets.

Breadth thrust is still improving:

That’s all for now. Happy Trading!