Why Short Selling is a Better Portfolio Hedge than Puts, Bonds, Gold, or Commodities

Short selling can protect portfolios better in today's markets as compared to bonds, commodities, gold and other traditional diversifiers given uncertainties around inflation and interest rates

Short selling continues to be one of the most misunderstood and underutilized forms of portfolio hedges - even among experienced traders, many of whom admit they haven't had much luck with it.

Search for short selling books and resources and you will come up with a fraction of the resources dedicated to the long side. There are very few technical patterns dedicated to it (except for some overhyped ones like head and shoulders).

In the next few posts, I will cover:

Why short selling can be a more effective portfolio hedge than other traditional hedging strategies such as put options, bonds, gold, or commodities.

Short selling myths

How to effectively implement shorting in a portfolio

First, let's start with comparing shorting to other hedges:

Put options are the most commonly used form of hedge but they are expensive. And let's admit it, most often we end up buying puts after the market has already started crashing and the realized gains (after netting out all the costs and losses) tend to be minimal, because you need to get not only the direction right but also the timing.

Bonds are typically seen as a safe investment, but they are not a good hedge against inflation. As the last couple of years have painfully reminded us, bonds can drastically lose value in inflationary and rising rate environments.

Commodities can be volatile assets, and their prices can fluctuate wildly. Oil which has the largest representation in commodity baskets is impacted by various other moves. This makes them less effective as portfolio hedges than short selling.

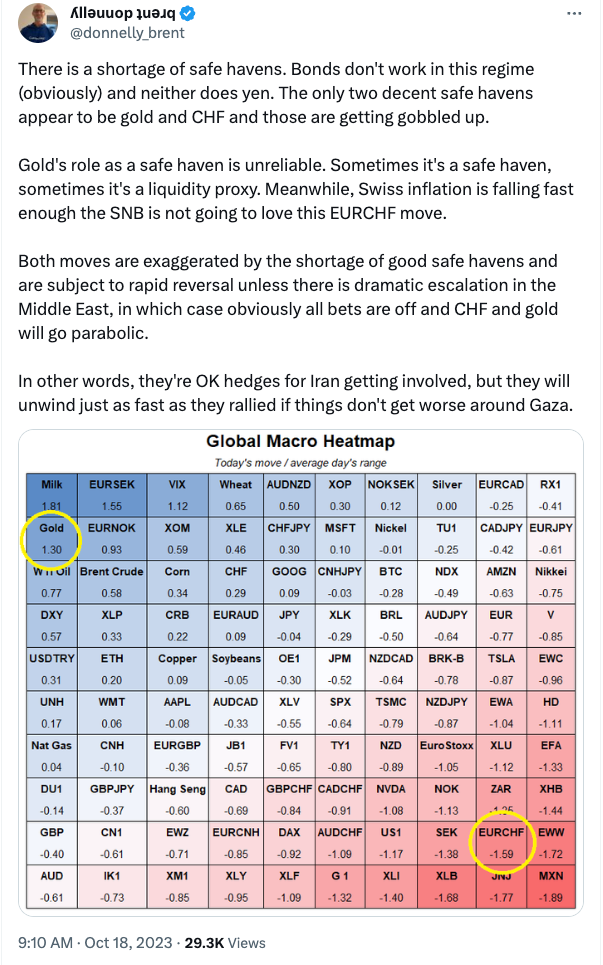

Gold has elements of geopolitical risk premium, inflation hedge and liquidity proxy all mixed up and it's difficult to tell when it can actually be a hedge against declining equities.

Short selling, on the other hand, is a more flexible hedging strategy. You can short sell specific securities, industry sectors, or markets that have a good chance of declining more than the broader market.

Unlike running constant put strategies which have insurance costs, short selling can also generate profits.

Of course, no hedging strategy is perfect. Short selling can be a risky strategy, and it is important to understand the risks involved before using it. However, in today's markets, short selling can be an effective portfolio hedge whether used in combination with or in lieu of other traditional hedging strategies.

In the next few posts, I will go through common myths about short selling and how to overcome some of the challenges. It is not just like doing the opposite of buying long positions. But, it is so underutilized that it can be a powerful tool during choppy markets or corrections.

But first, let us hear it from some experts (click on images to go to the source):

Michael Harris makes some similar observations here. But instead of just exiting all your positions, if you’re going to time the market, my preference would be to short the weaker stocks:

Why diversifying long-only (using defensive sectors) doesn’t work:

Why gold and other “safe havens” don’t always work when you want them to:

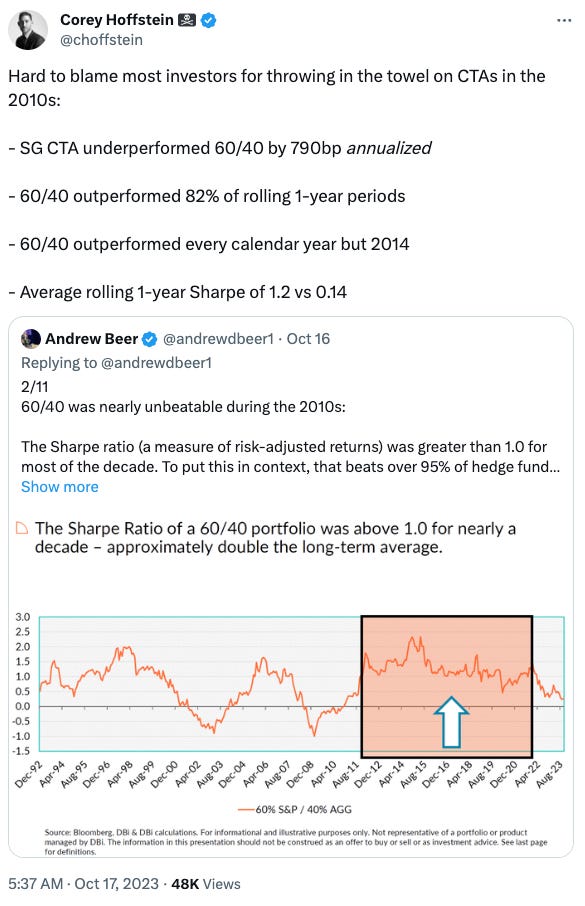

CTAs (Commodity Trading Advisors) haven’t worked historically either:

In the next few posts, we will cover how short selling can be properly implemented to protect a long-only portfolio, and some common myths around it.

I would love to hear from you on what you think - please share your feedback in the comments or over Twitter / Substack Notes - and make sure to follow me while you’re there!