Minerva Market View for Oct 31, 2023

We got the bounce from the oversold levels that we were expecting. Will it lead to a continued rally?

Good evening! Here’s our Market View for Tuesday, October 31st:

Positioning and Market View

We finally got the pop from oversold conditions that many (including us) had expected. However, the important question is whether this can lead to a sustained rally attempt. Right now, the market internals look weak. We would need to see continued follow-through on strong volume to switch to a long position.

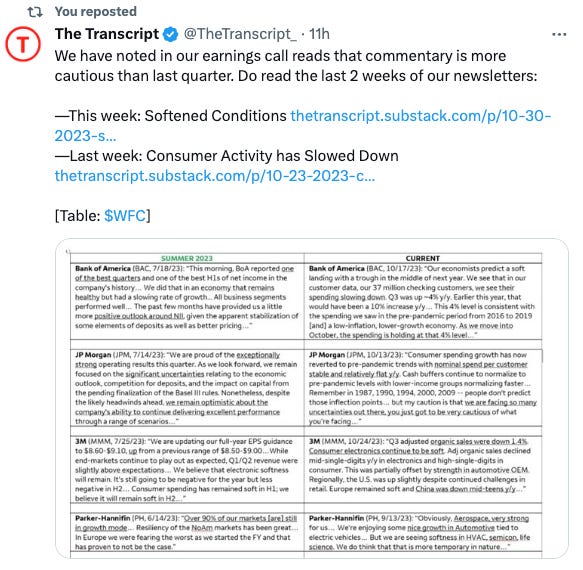

There are broadly two camps of forecasters: one expecting a Santa Claus rally, possibly for an annual high before the year-end. And the other one that expects the downtrend to continue. There are very few who are expecting a range-bound market that finishes off at close to the same levels after a frustrating up-and-down chop. And often, the market delivers the most painful and unexpected outcomes. So that could be a possibility we need to be prepared for. And in such an outcome, a well-constructed long-short basket will outperform.

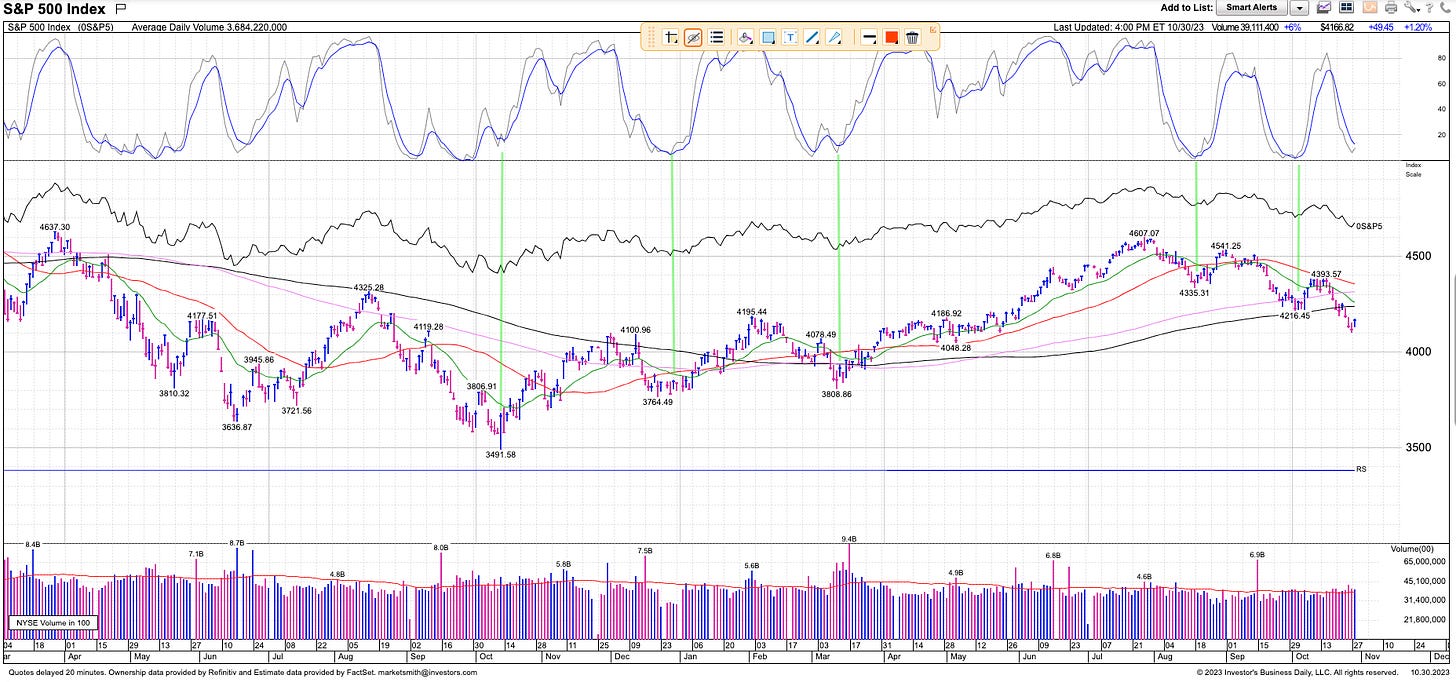

Anyway, we are approaching the market with an open mind and will follow where the tape leads us. Here’s an updated chart of the S&P 500 with the stochastics in the upper box. We want to see the fast line (gray) pierce the smoother line (blue) accompanied by powerful price and volume action to be convinced that the rally has legs, just like the 5 tradeable moves up in the past year:

Performance

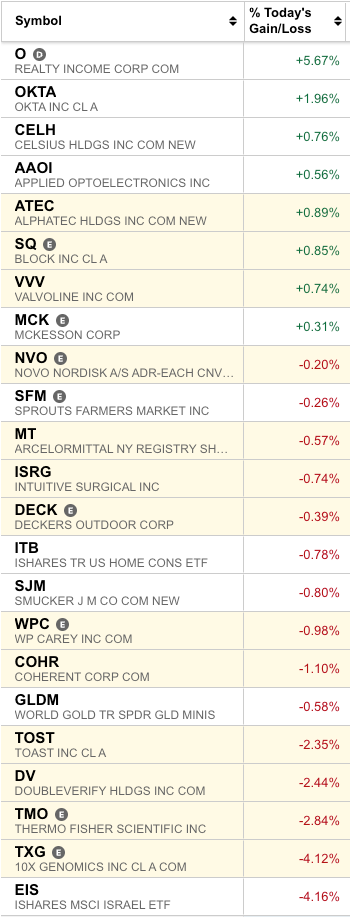

We were net-neutral going into today. We had narrowed our trailing stop losses on our existing shorts and were duly stopped out of many of them today. We also added a few short and long positions from our watchlist (highlighted in yellow below). Overall, our trading portfolio combined with our longer-term, long-only portfolio returned a neutral performance today. We’re still marginally up month-to-date compared to the -2.8% MTD return on the SPY 0.00%↑.

We added DECK 0.00%↑ and NVO 0.00%↑ on the long side and shorted ATEC 0.00%↑ TOST 0.00%↑ COHR 0.00%↑ DV 0.00%↑ ISRG 0.00%↑ MT 0.00%↑ SQ 0.00%↑ TMO 0.00%↑ TXG 0.00%↑ VVV 0.00%↑ WPC 0.00%↑ to retain an overall net book that is about 1-2% long with the remaining in t-bills and MMFs. Our short positions are sized half that of the longs since they tend to be more volatile.

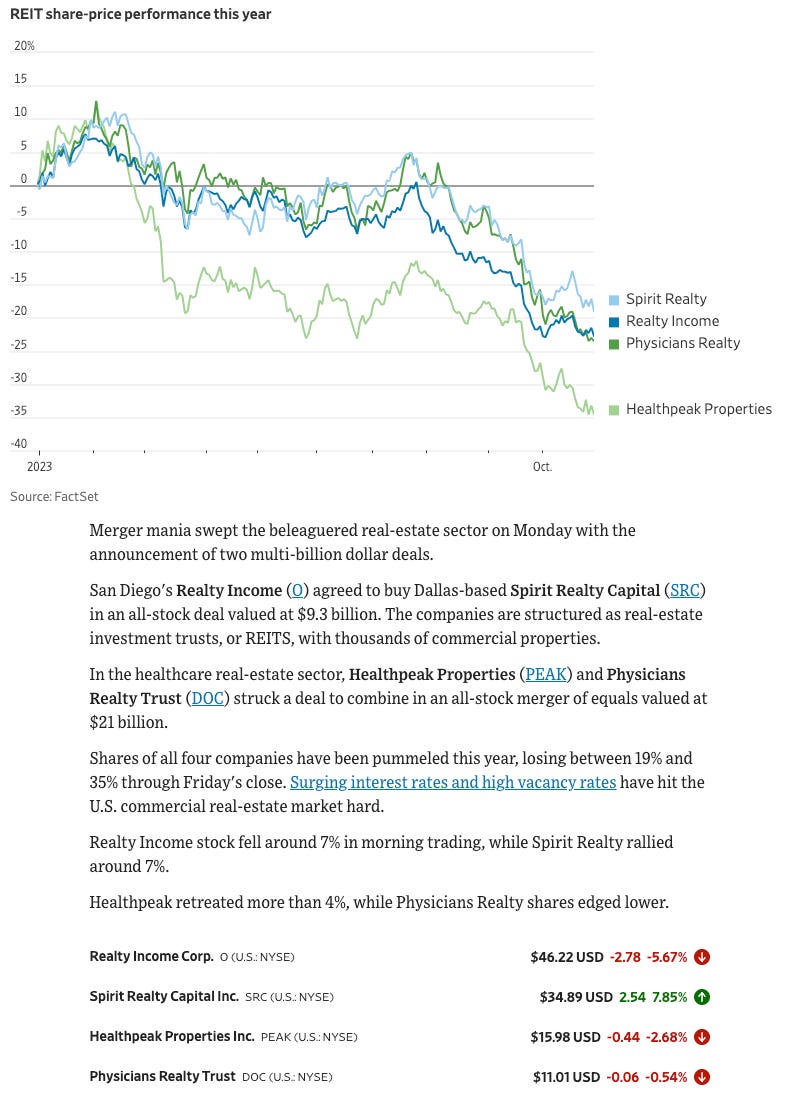

Our short in O 0.00%↑ delivered ~6% gains for us today, showing the predicive power of our short algos. WSJ ran a story on this space today (It’s Merger Monday for REITs) excerpted below. This leads us to believe there’s further downside in O 0.00%↑, PEAK 0.00%↑ , and DOC 0.00%↑.

Watchlist

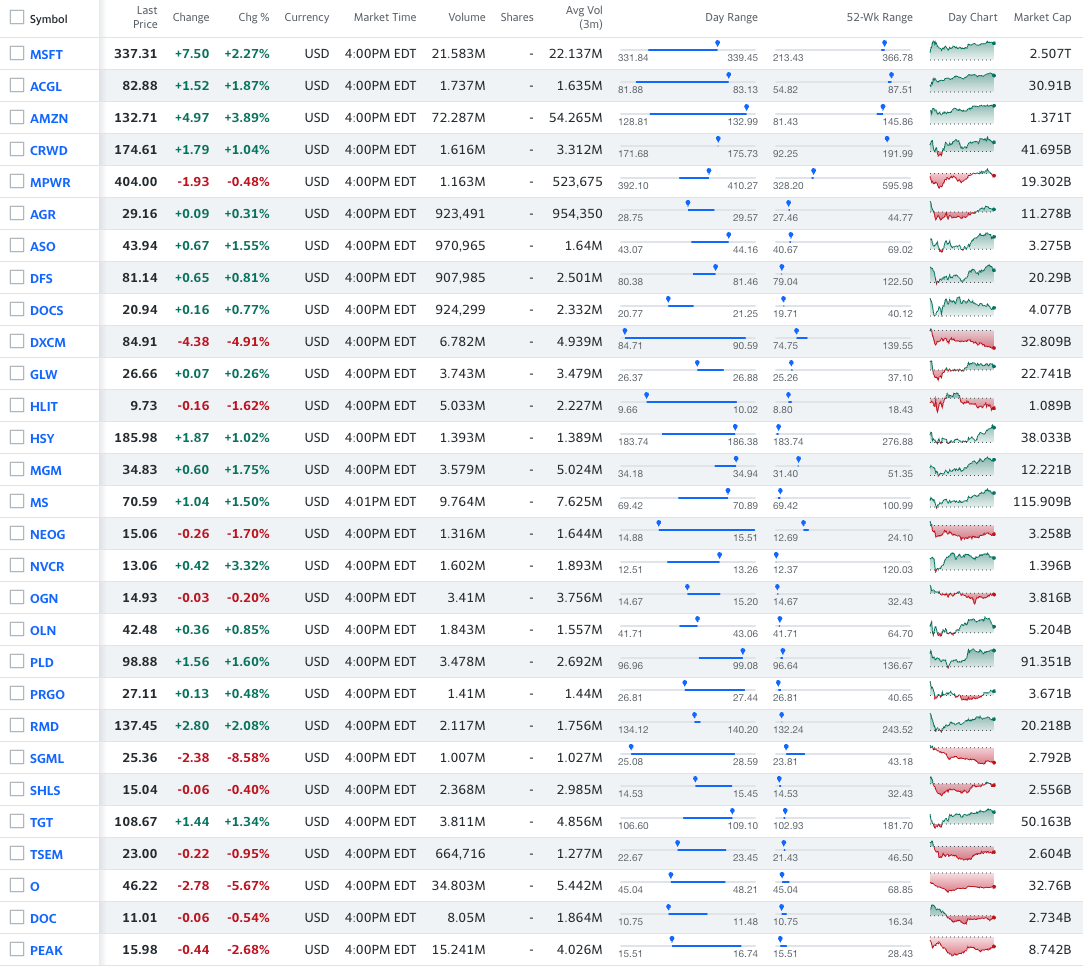

Here’s our watchlist for tomorrow. We plan to start getting long in 10-20% NAV increments if there’s favorable price action. If we can’t achieve that through stocks, we will also use index ETFs such as VOO 0.00%↑ (Vanguard S&P 500 to get to those levels).

Longs: MSFT 0.00%↑ ACGL 0.00%↑ AMZN 0.00%↑ CRWD 0.00%↑ MPWR 0.00%↑

Shorts: AGR 0.00%↑ ASO 0.00%↑ DFS 0.00%↑ DOCS 0.00%↑ DXCM 0.00%↑ GLW 0.00%↑ HLIT 0.00%↑ HSY 0.00%↑ MGM 0.00%↑ MS 0.00%↑ NEOG 0.00%↑ NVCR 0.00%↑ OGN 0.00%↑ OLN 0.00%↑ PLD 0.00%↑ PRGO 0.00%↑ RMD 0.00%↑ SGML 0.00%↑ SHLS 0.00%↑ TGT 0.00%↑ TSEM 0.00%↑ O 0.00%↑ DOC 0.00%↑ PEAK 0.00%↑

ICYMI

Some interesting things we posted/noticed since the last update - you can catch them all on Twitter/X @ MinervaCap:

That’s all for now! If you like our work, please do like / share it among your network. We believe in sharing actionable trade ideas in liquid US-listed stocks that all investors, big or small, can execute. We’ve just started on Substack a couple of weeks back and could really use the added support!

Happy Trading and Happy Halloween to those who celebrate! 🎃