Minerva Market View for Oct 26, 2023

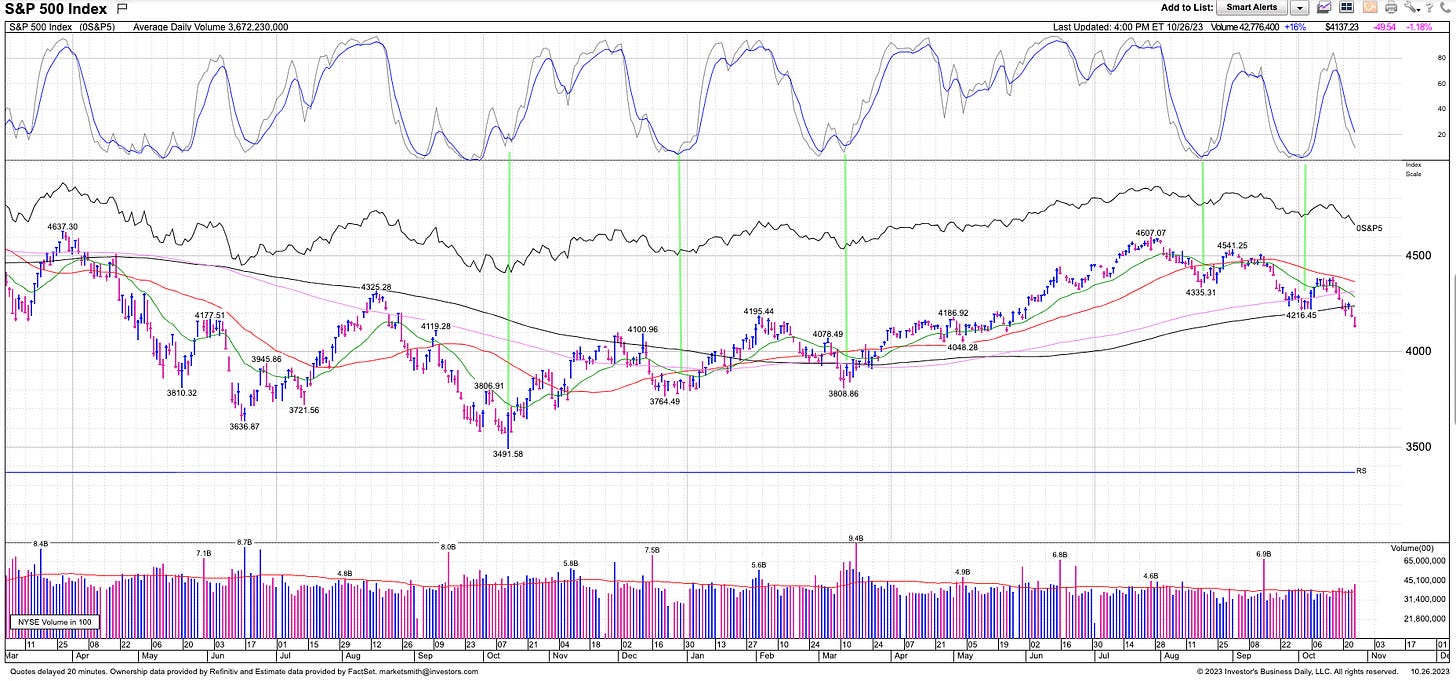

We're now almost close to oversold but haven't received a buy signal on the S&P yet. We may see a pop soon, which should be faded.

Good Evening! Here’s the Minerva Market View for Friday, Oct 27, 2023:

Positioning and Performance

We had a decent day in the markets today, with our trading long / short portfolio returning +0.16% vs. the SPY 0.00%↑ decline of -1.2%.

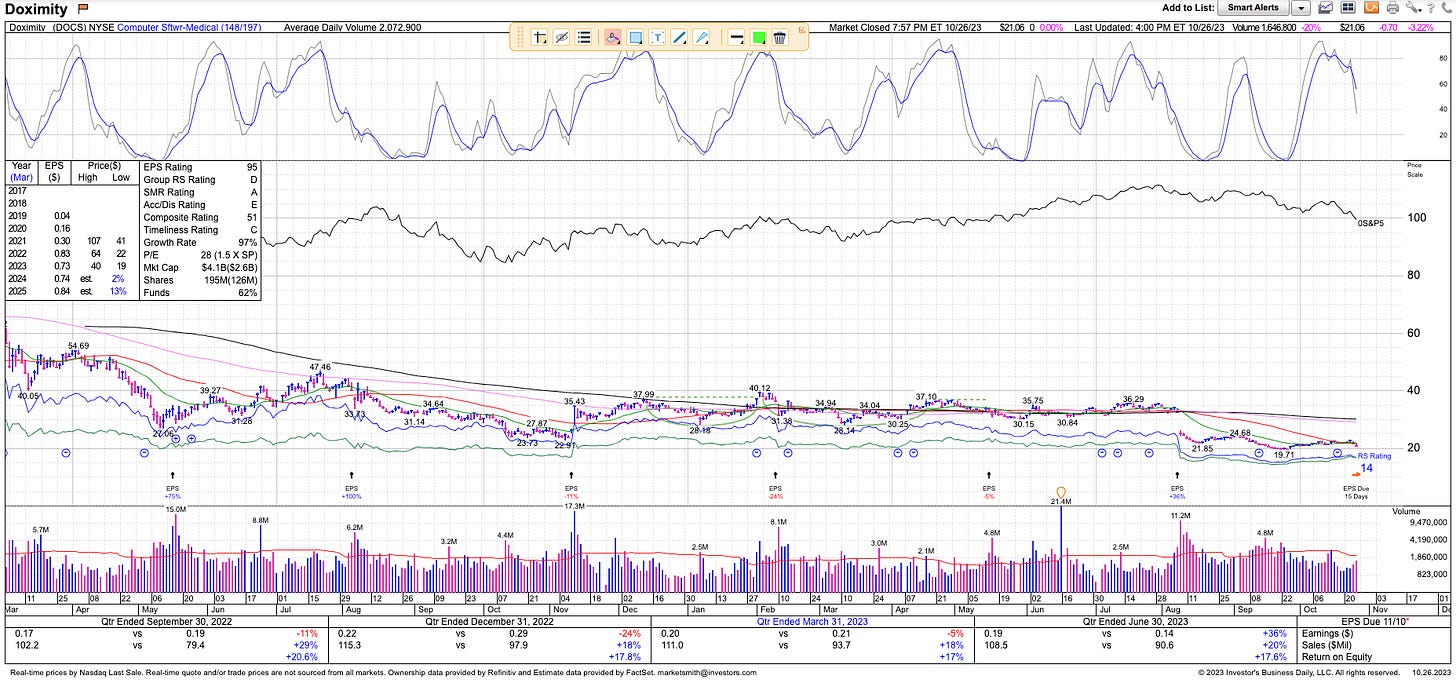

The DOCS 0.00%↑ short continues to print money for us, and should likely still see more downside as it hasn’t reached an oversold condition yet:

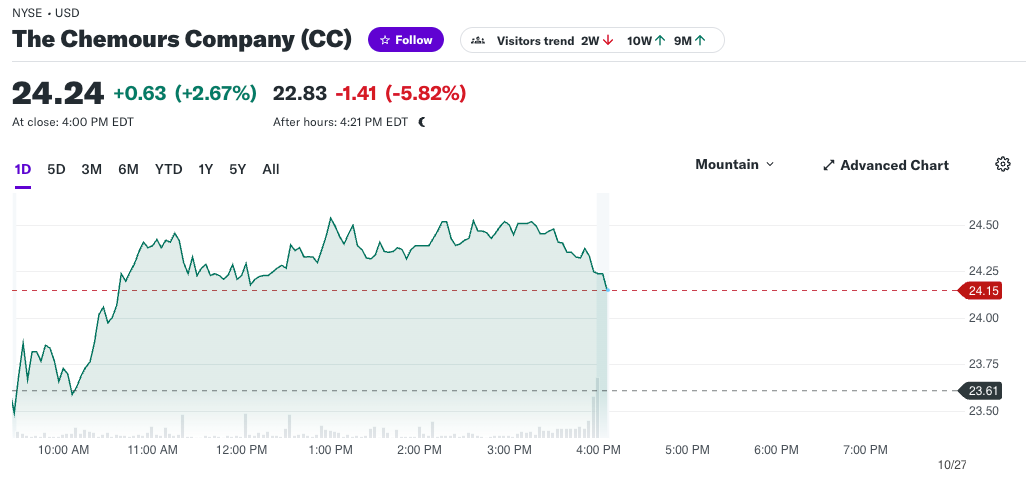

CC 0.00%↑ stock dropped after earnings and we may book a profit on it tomorrow based on how it behaves:

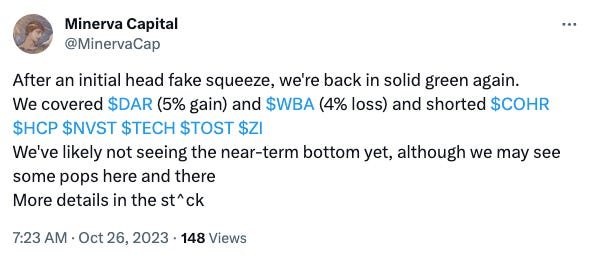

Here are our trades for the day as reported on Twitter (follow us there for updates during the trading day):

We continue to maintain a net short book of -5% with the remainder in cash (T-bills and MMFs).

Market View

The S&P has breached all major near-term support levels on heavy volume now. However, as we posted on Twitter, it hasn’t reached oversold levels yet. Most recent tradeable bottoms have been accompanied by an upward reversal of stochastics from oversold territory along with a price confirmation (see green lines below). We're not there yet:

Could we see a pop? Sure, anything could happen, especially given the strong AMZN 0.00%↑ earnings report and if a favorable PCE report comes out tomorrow morning. However, there are so many calling for a bottom, and such a lack of fear that it makes me think that any pop should be faded.

I am not in any bull or bear camp, but I’d highly recommend watching this video from David Keller, Chief Market Strategist at StockCharts where he shows the possible downside objectives for the S&P, now that it has formed a head-and-shoulders pattern:

Watchlist

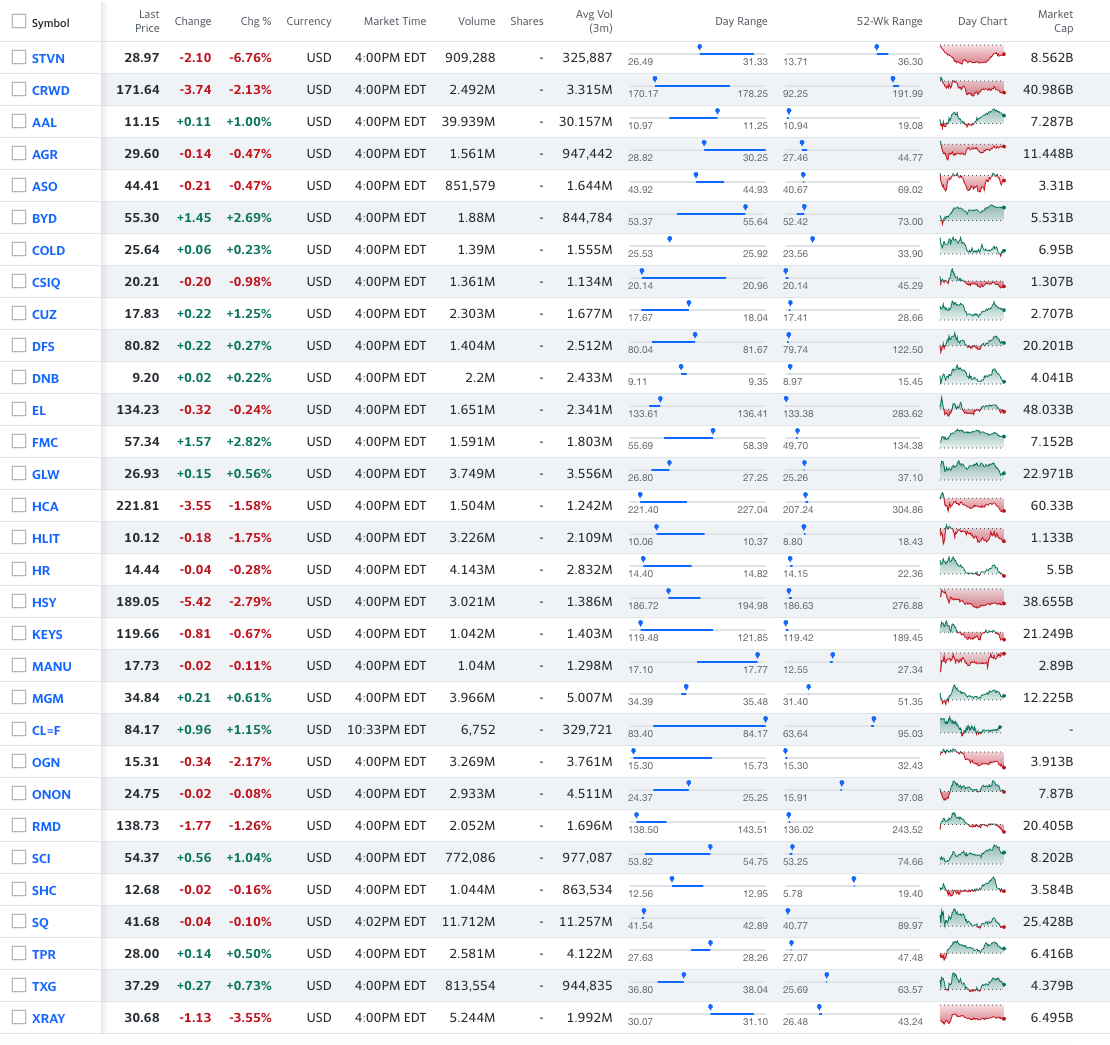

In any case, we will be ready for either outcome tomorrow, but most likely it will end up being more of chop and frustrate both bulls and bears. On the long side, we’re not seeing any strong candidates, except Gold GLDM 0.00%↑. Some low-conviction bets are STVN 0.00%↑ and CRWD 0.00%↑.

On the short side, we again have a buffet of options, but we will monitor price closely to see if any are worthy of adding: AAL 0.00%↑ AGR 0.00%↑ ASO 0.00%↑ BYD 0.00%↑ COLD 0.00%↑ CSIQ 0.00%↑ CUZ 0.00%↑ DFS 0.00%↑ DNB 0.00%↑ EL 0.00%↑ FMC 0.00%↑ GLW 0.00%↑ HCA 0.00%↑ HLIT 0.00%↑ HR 0.00%↑ HSY 0.00%↑ KEYS 0.00%↑ MANU 0.00%↑ MGM 0.00%↑ O 0.00%↑ OGN 0.00%↑ ONON 0.00%↑ RMD 0.00%↑ SCI 0.00%↑ SHC 0.00%↑ SQ 0.00%↑ TPR 0.00%↑ TXG 0.00%↑ XRAY 0.00%↑ XYL 0.00%↑ ZBH 0.00%↑

ICYMI

Some interesting things we posted/noticed today:

That’s it for now. As always, we love to hear back from you! Please share your comments / feedback with us here or over Twitter.

Happy Trading!

Disclaimer: This post is for professional investors only and is shared with other like-minded investors for the exchange of views and informational purposes only. Please see the disclosures and disclaimers for more details and always note, we may be entirely wrong and/or may change our mind at any time. This is NOT investment advice, please do your own due diligence.

Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.