Minerva Market View for Oct 25, 2023

Markets staged a rally attempt today. This will need to be followed through by stronger gains for the rally to stick.

Good evening! Here’s the Minerva Market View for Wednesday, Oct 25, 2023:

Portfolio performance and current positioning

Today was a quiet day in our trading portfolio, as we want to see further strength in the market before we commit fully to the long side.

We closed some of our shorts today. Despite being net short, our careful selection of longs and shorts helped us deliver a small gain today. This is what we ideally want in a long/short portfolio during uncertain times — protect capital and deliver small gains whether the major indices go up or down.

On the long side, SFM 0.00%↑ posted strong gains for us (up ~3% today).

Market View

The market didn’t show strong price action today. After the close, some earnings came in weak, notably GOOG 0.00%↑ / GOOGL 0.00%↑ (down -6% after-hours), although MSFT 0.00%↑ did post strong results and gains. The futures have also been mostly choppy.

Until the market declares itself firmly back in an uptrend with strong price action on strong volume, we will tiptoe back into some selected long positions, and maintain our shorts with trailing stop losses.

Watchlist

Here’s our watchlist for tomorrow, almost equally balanced among longs and short candidates. Make sure to follow us on X (Twitter) @MinervaCap for updates on positions during the trading day.

Longs: CELH 0.00%↑ AAOI 0.00%↑ GEO 0.00%↑ FXI 0.00%↑ NVO 0.00%↑ ACGL 0.00%↑ CLS 0.00%↑ ANET 0.00%↑ AVAV 0.00%↑ CRWD 0.00%↑ ZS 0.00%↑ ACGL 0.00%↑ ACMR 0.00%↑

Shorts: AAP 0.00%↑ CFG 0.00%↑ DFS 0.00%↑ DG 0.00%↑ LPX 0.00%↑ MS 0.00%↑ SRC 0.00%↑ TPR 0.00%↑ WBA 0.00%↑ ZI 0.00%↑

Worth noting

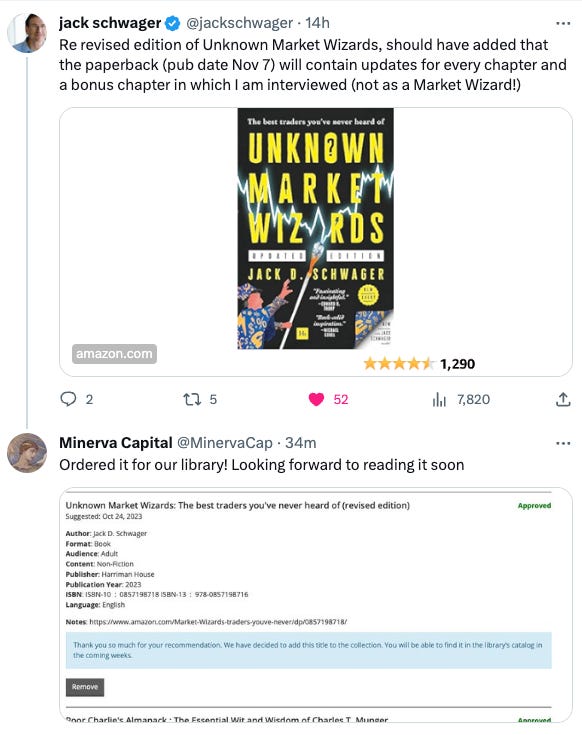

ICYMI, here are some interesting items we tweeted about:

That’s all for now - happy trading!

Disclaimer: This post is for professional investors only and is shared with other like-minded investors for the exchange of views and informational purposes only. Please see the disclosures and disclaimers for more details and always note, we may be entirely wrong and/or may change our mind at any time. This is NOT investment advice, please do your own due diligence.

Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.