Minerva Market View for Oct 23, 2023

Next week is likely to be pivotal. We remain defensive until the market gives us a right to change our positioning.

Portfolio Performance

Our neutrally positioned trading portfolio helped us protect our capital on Friday and deliver a small gain. We’ve also outperformed the S&P by a wide margin for the last week , as well as month-to-date (-0.26% vs -1.42% for the S&P).

We had a number of good calls last week, including being able to capture the carnage in solar shorts with ENPH 0.00%↑ (which we’ve since closed).

Current Positioning

Here is a picture of our trading portfolio (both longs and shorts) with the open gains / losses:

Here’s how the positions in the trading portfolio helped us deliver a +0.20% gain on Friday:

Here are the positions in ticker form:

Longs:

Shorts:

Market View

Next week is likely to be pivotal in both senses of the term: crucially important, and also acting as a pivot for a move from bearish to bullish. If that fails, and the main indices are unable to reclaim their key levels, we have very little time for the seasonal Q4 rally to take hold, and the direction may indeed turn medium-term bearish till the end of the year.

As always, we remain flexible and will let the market guide our actions. We are looking for a strong “Follow-Through Day” i.e. major market moves of +1% to +1.5% on one or more of the major indices with heavy volume for us to be able to change our stance to bullish. Until then, we will remain positioned defensively with net long exposure close to zero or less and fully allocated to treasury bills and money market funds. This also means that we will likely miss any initial part of a bull rally should one start soon, with the protection of avoiding a major correction if one were to materialize from here.

Watchlist

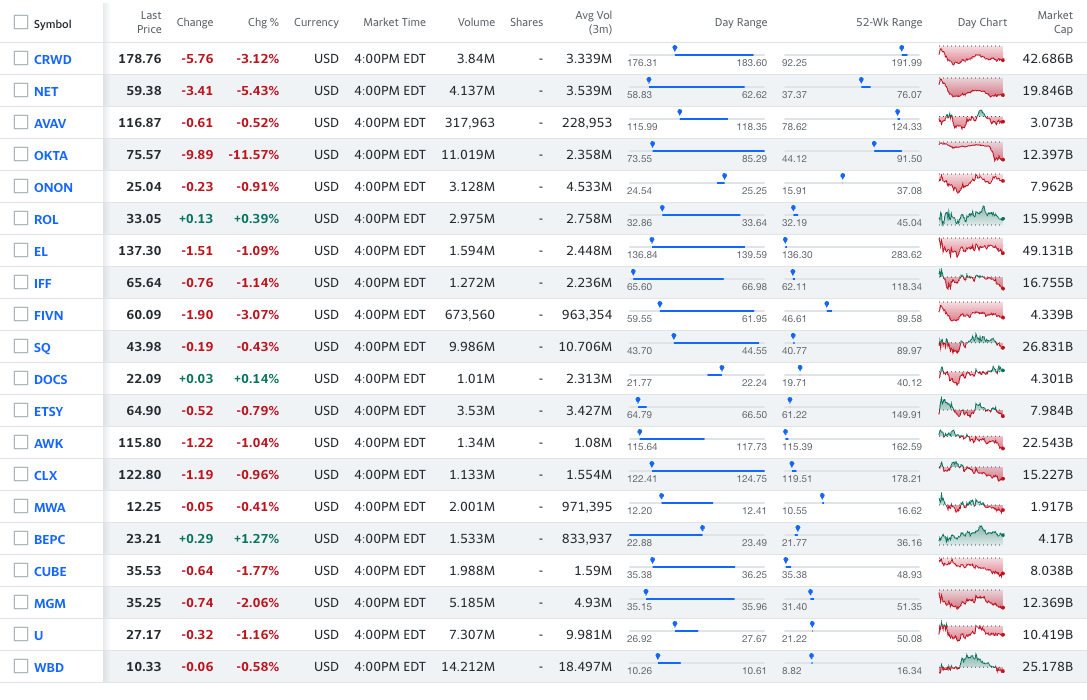

Here is our watchlist for tomorrow:

Longs:

Shorts:

CRWD and NET are a long / short bet against OKTA in the cybersecurity space, and should benefit due to the recent OKTA hack and glaring deficiencies there.

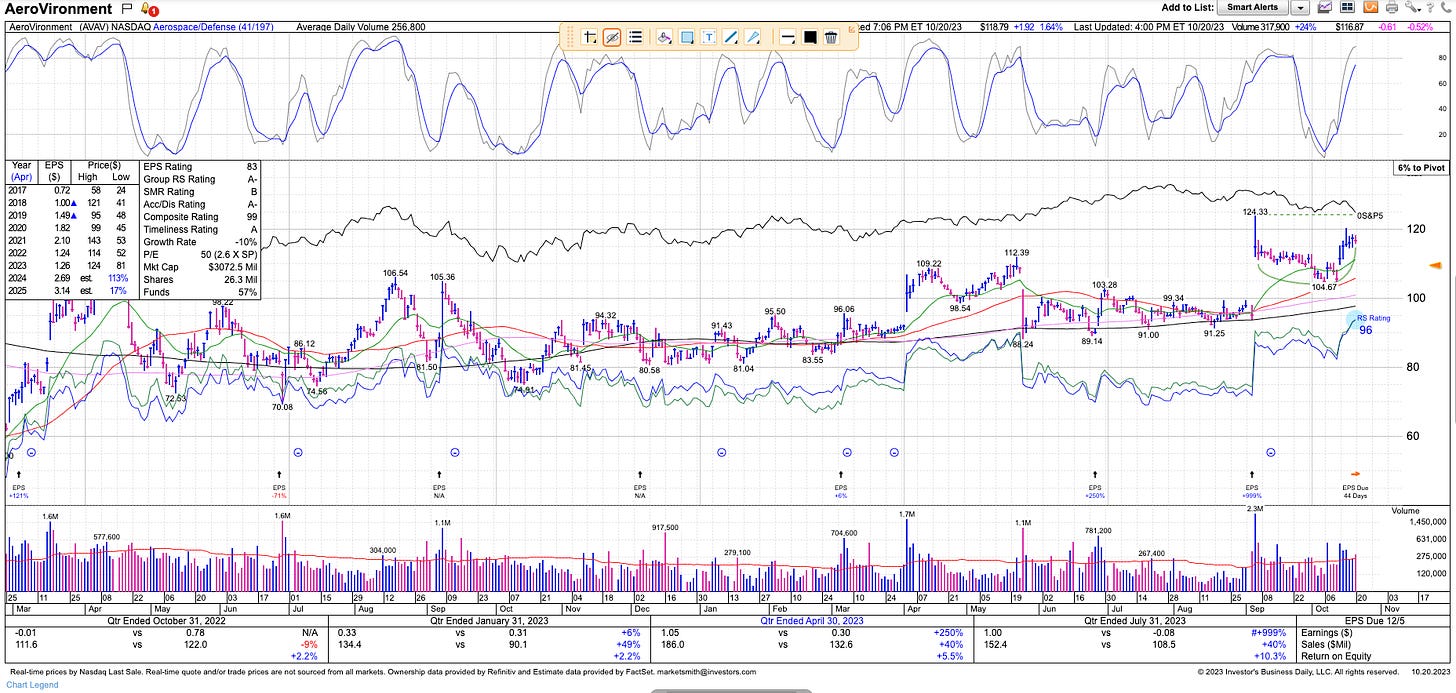

We continue to monitor AVAV to enter on the long side due to favorable price action and relative strength:

All the short positions have been picked up by our short algo which has been on fire this year.

As always, we will wait for the market open and favorable price action to confirm our trades before we enter.

Happy Trading!