Minerva Market View for Oct 20, 2023

Decision time for bulls vs bears. We remain defensive.

Market view:

The market had some nasty swings today that were not indicative of strength. While we’re still net long, we cut our exposure drastically today and added a lot more on the short side.

All our short picks did well but especially worthy of calling out are ENPH 0.00%↑ (-6% and much more after hours) and AA 0.00%↑ (-8.6%).

Tomorrow being options expiry, the moves can be unpredictable. But we remain positioned defensively and based on the price action, will look at cutting more of the long exposure and adding more shorts.

The interest rate volatility on long-term bonds is likely to continue exerting pressure on stocks.

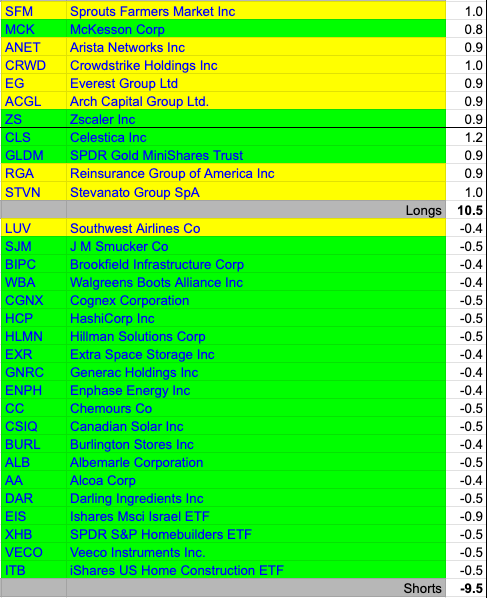

Current positioning:

On the long side, I am looking at exiting the positions marked in yellow based on the price action. And on the short side, LUV 0.00%↑ is one position I may add further to:

The shorts are typically half the size of the long positions. GLDM 0.00%↑ (Gold ETF) while counted in the long book is really a hedge, so the active trading portfolio is currently net zero on balance. I do have about 6% in longer-term investments which I cannot sell so I will look to further hedge those tomorrow based on the price action.

Watchlist:

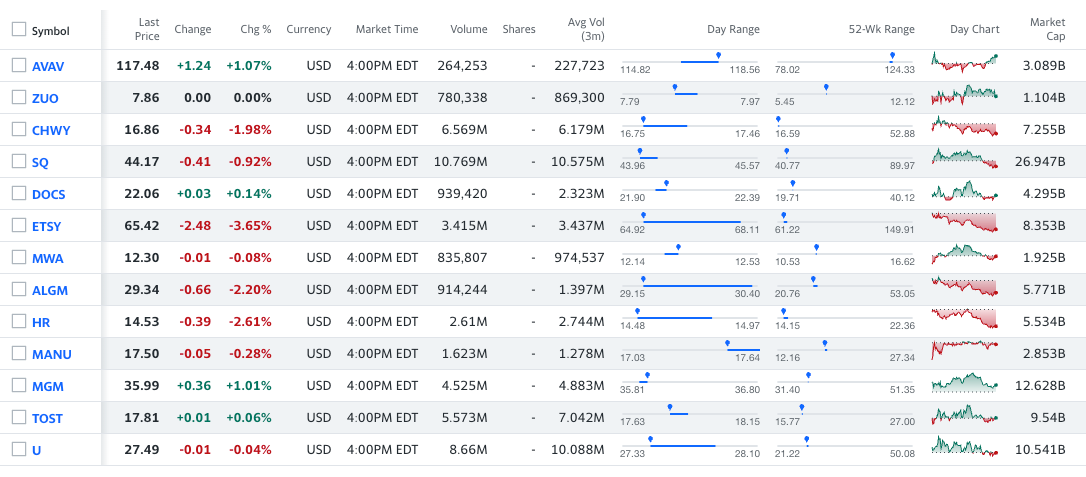

Here’s my watchlist for tomorrow:

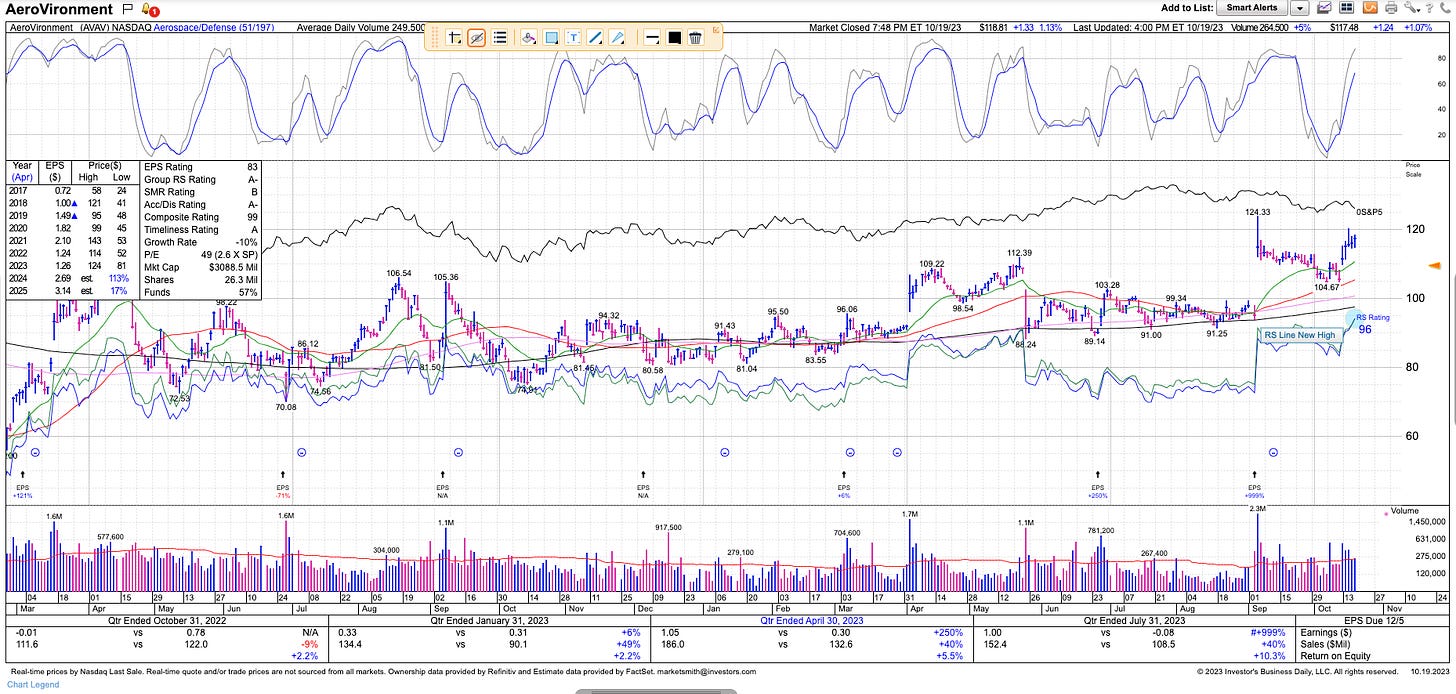

AVAV 0.00%↑ (a defense company) is the only one on the long side, as it’s a likely beneficiary of the wars and is showing good price action:

All the others are short candidates:

Capital preservation is the name of the game for now. Safe trading!