Minerva Market View for Nov 30, 2023

Major indices pulled back a little today but our portfolio continues to do well.

Good evening! Today the S&P and Nasdaq both pulled back a little but the Minerva portfolio continues to do well thanks to our stock selection.

Positioning and Market View

The markets are still in an uptrend, and the trend is your friend until it bends. The major indices are going through a stretch of consolidation but nothing looks too worrying yet.

The only red flag was that the dip was on higher than average volume on both the SPY 0.00%↑ and the QQQ 0.00%↑ but otherwise the indices are above all their key moving averages (which are all pointing up), thus maintaining the upward trend:

Of our favored ETFs to gain beta exposure, VOO 0.00%↑ was down with the S&P but VGT 0.00%↑ actually posted gains today, in sync with the Tech sector as opposed to QQQ 0.00%↑ which has other industries as well.

Breadth was also fine with a ~2:1 advance-to-decline ratio on the NYSE and almost similar on the Nasdaq:

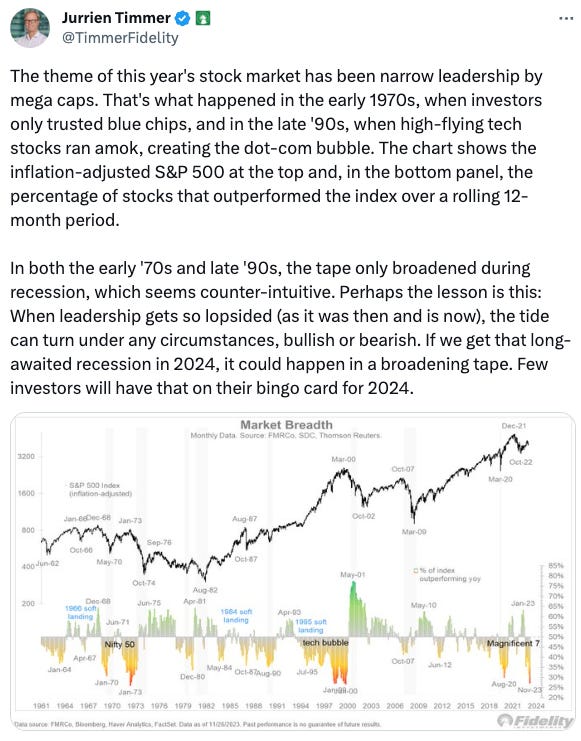

There has been a lot of commentary that the entire advance this year has been due to the “Magnificient 7”. So it was interesting to see some research pointing out that it is not unusual to see that:

Tomorrow, we have the core PCE report coming out, which can add to some uncertainty/volatility, although it is widely expected that inflation is cooling down.

Portfolio and Performance

For all the ups and downs of the day, our portfolio had a solid performance today, with several gainers and a few losers, leaving us with a net gain on the day:

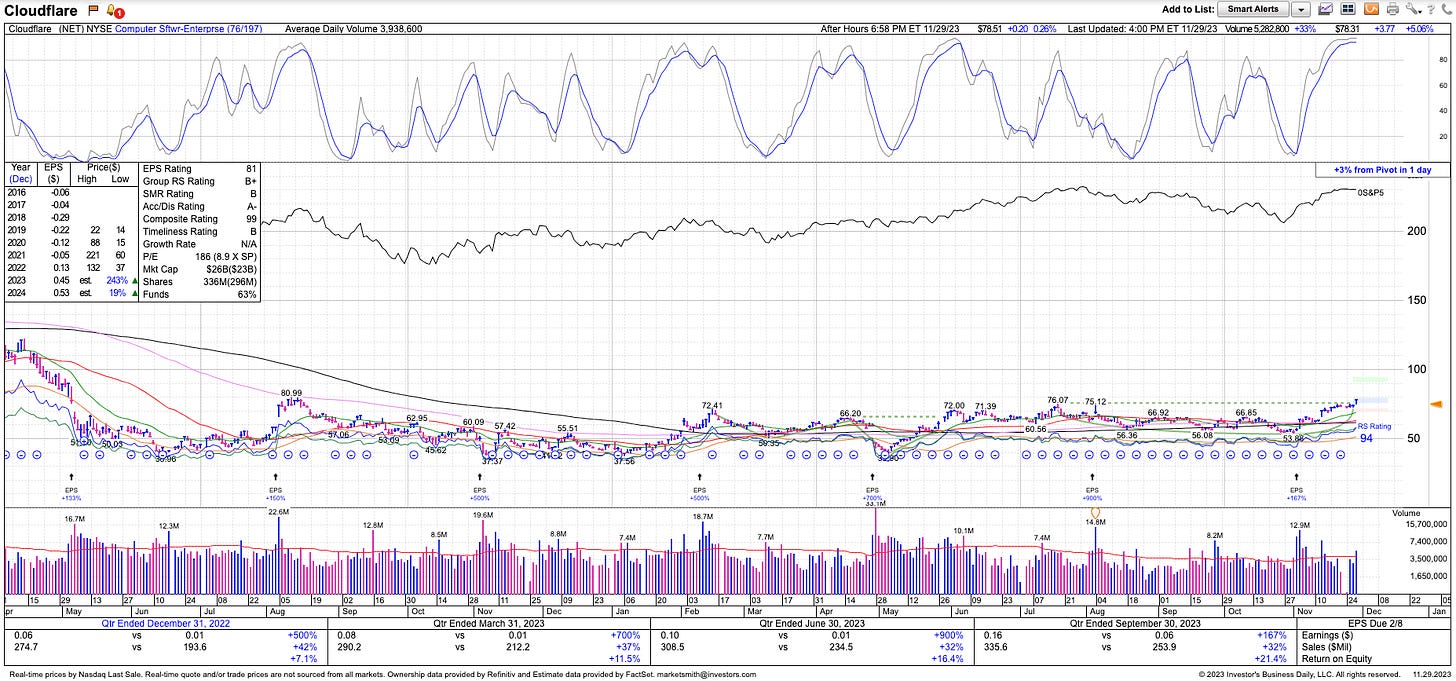

We bought NET 0.00%↑ SKX 0.00%↑ KGC 0.00%↑ and PLTR 0.00%↑ based on strong breakouts from properly formed bases as well as fundamentals in line with valuations:

We also got stopped on our GM 0.00%↑ short which shot up on news of renewed forward guidance, dividends, and buybacks. We’re currently at 85% net-long and might look to trim VOO 0.00%↑ and some flagging stocks to get down to 80%.

Watchlist

For tomorrow we’re looking at:

Macro: TLT 0.00%↑ (long-term bonds) FXY 0.00%↑ (Japanese Yen)

Short: UAL 0.00%↑ ALGM 0.00%↑

Worth checking out

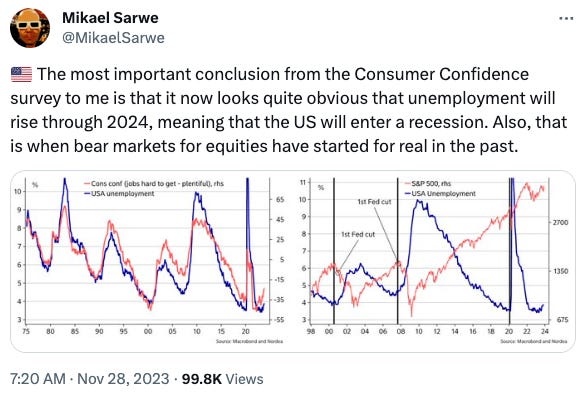

Recession still remains a possibility in 2024:

The right strategy from a trading perspective is to ride the bull until then and then go short:

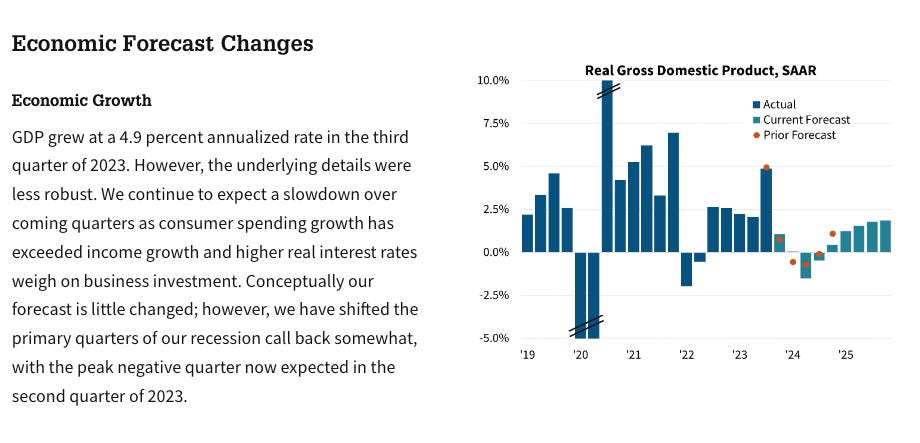

Fannie Mae economists expect the economy to slow in 2024, resulting in a mild recession, before rebounding in 2025:

That’s all for now. Happy Trading!