Minerva Market View for Nov 6, 2023

We expect the rally to continue and are positioning accordingly.

Good evening! We had a spectacular week last week and this is already shaping up to be one of our best months this year by performance.

Positioning and Market View

As we’ve shared here and over Twitter, we’ve progressively increased our portfolio exposure since the bottom. As of Friday, several key momentum thrusts have been triggered and are likely to add fuel to the rally as systematic strategies chase this move to the long side from a neutral/short positioning.

Here are some of the key factors supporting our view:

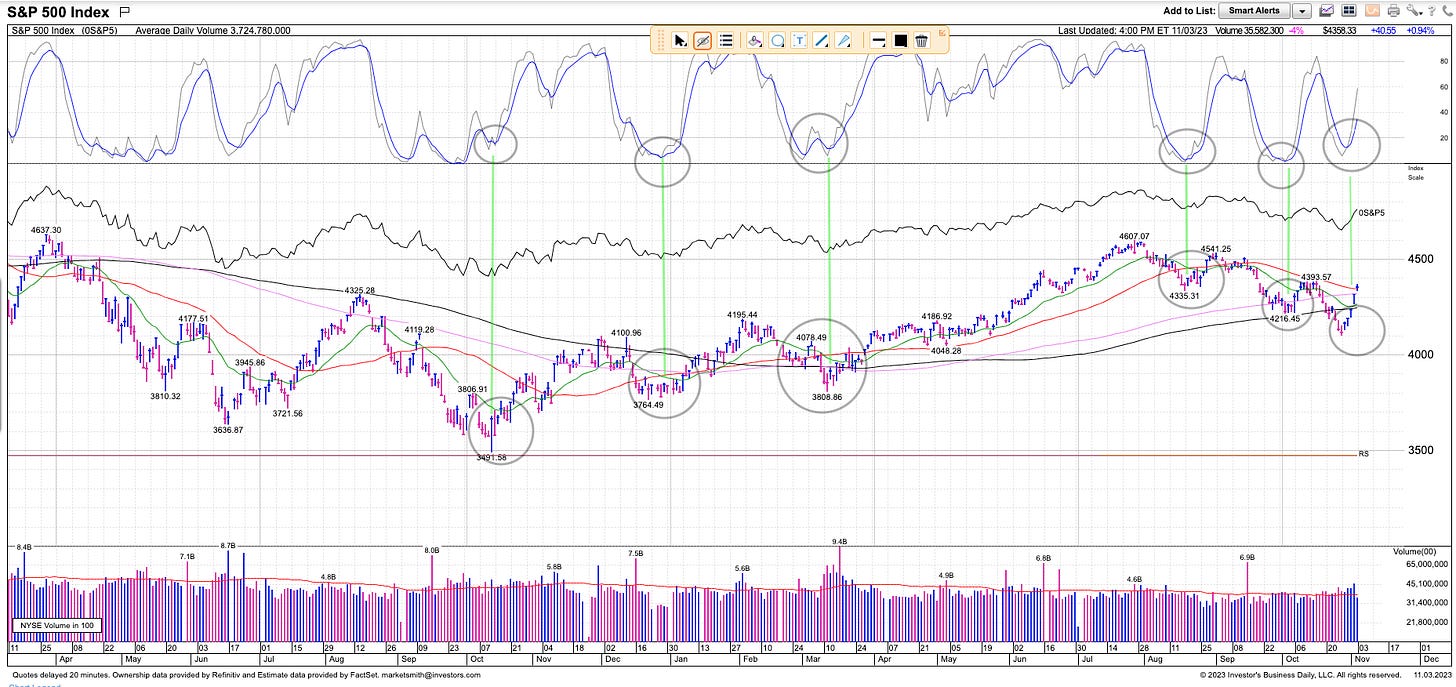

The S&P / SPY 0.00%↑ continues to move up from oversold conditions on strong price and volume:

Ryan Detrick is one of those rare people who have called most of the market moves accurately this cycle. He shared this on Friday:

The Stockbee Market Monitor also posted a strong reversal from bad breadth to solid breadth, which is indicative of a continued rally:

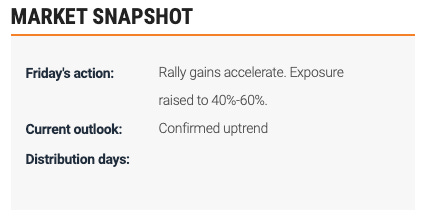

Investors Business Daily / Marketsmith have also called for increasing exposure to a range of 40-60%. This will cause a lot of momentum chasing:

There may be a few spots of volatility, but overall we expect the indices to post gains. The risk/reward is leaning towards that.

Portfolio and Performance

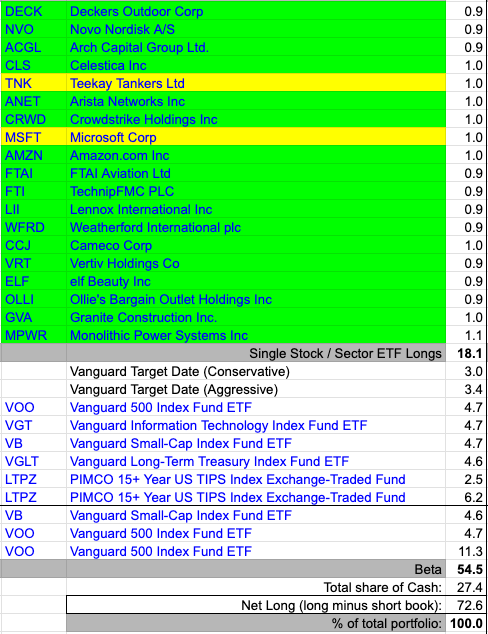

We’re currently over 70% invested in our overall portfolio, including trading and long-term positions:

We will continue adding exposure this week based on the market action to take it to 90%-plus. Of the above names, we’re looking at adding to TNK 0.00%↑ and MSFT 0.00%↑

Watchlist

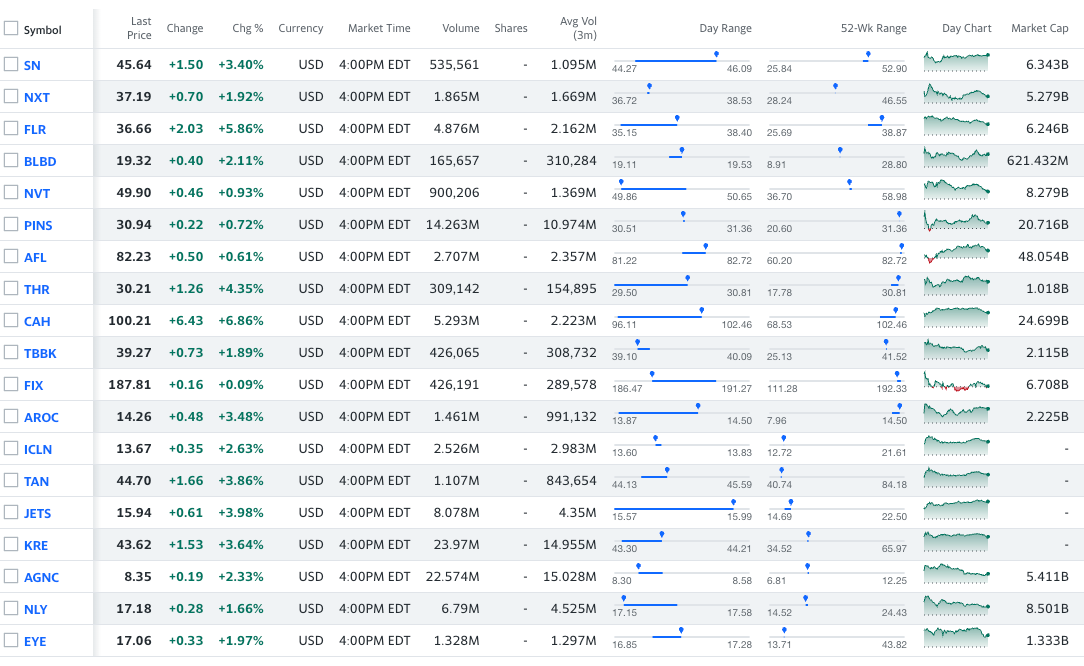

For tomorrow, we are looking at adding the below based on their price action and relative strength:

ETFs: ICLN 0.00%↑ TAN 0.00%↑ JETS 0.00%↑ KRE 0.00%↑ - these are shooting up from extremely oversold levels and the bounce could continue

Long stocks: FLR 0.00%↑ BLBD 0.00%↑ NVT 0.00%↑ PINS 0.00%↑ AFL 0.00%↑ THR 0.00%↑ CAH 0.00%↑ TBBK 0.00%↑ FIX 0.00%↑ AROC 0.00%↑ $ AGNC 0.00%↑ NLY 0.00%↑ - good fundamentals and technicals

Short: EYE 0.00%↑ - picked up on our short scan and is overbought and overvalued. Could dive on earnings as it has done the last few times.

ICYMI

A great podcast episode of Mike Gyulai’s journey in the markets:

That’s all for now! If you like our work, please share it with your network. We believe in sharing actionable trade ideas in liquid US-listed stocks/ETFs that all investors, big or small, can execute. We just got started on Substack a couple of weeks back and could use the added support!

Happy Trading!