Minerva Market View for Nov 3, 2023

Are we witnessing the start of a new rally?

Good evening. We were well-positioned for the rally and have had some of the most profitable days of the year in our portfolio recently!

Positioning and Market View

We have been increasing our net-long exposure and cutting shorts over the last few days as documented here and on Twitter/X. This has worked out great for us.

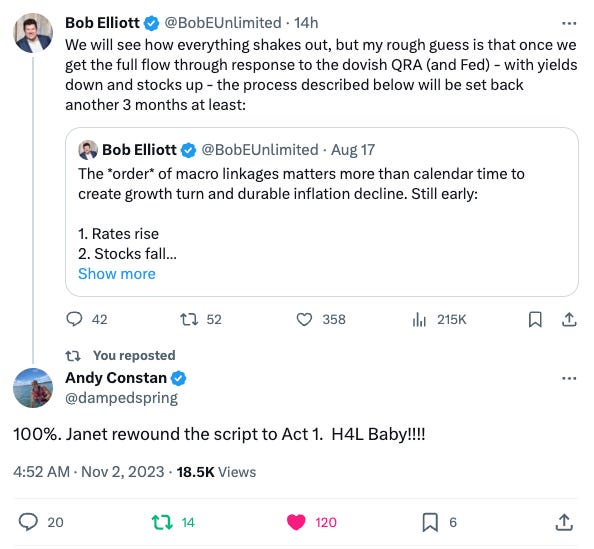

Of course, anything can happen in the markets, but it increasingly looks like the rally has legs. Technical and breadth indicators have almost all turned positive now.

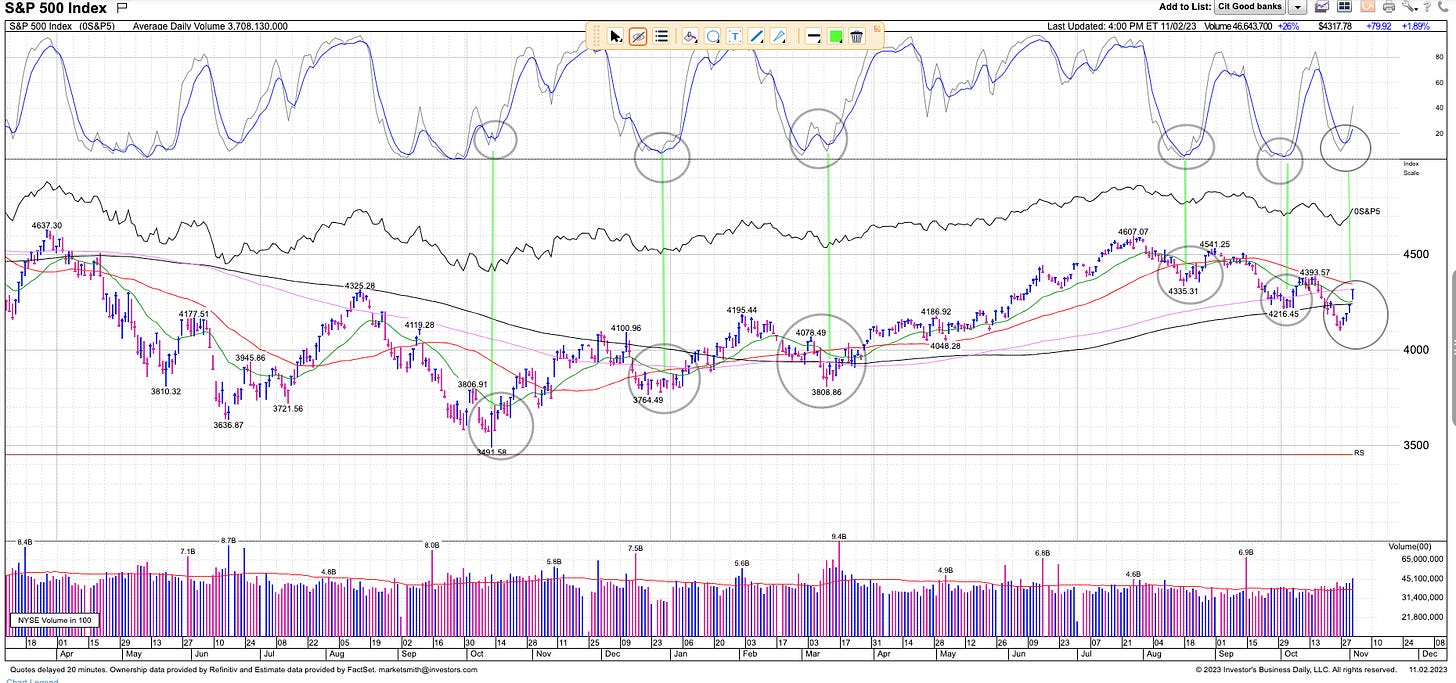

Price on the major indices is the first and best indicator that we like to use to judge market direction. As this updated chart of the SPY 0.00%↑ / S&P 500 shows, we are in a strong rally mode from oversold conditions, accompanied by strong price and volume gains:

At the same time, even though it might feel like it, we’re not near overbought levels yet. Of course, we could see some minor dips in the days to come, but currently, the risk/reward is tilted to the upside.

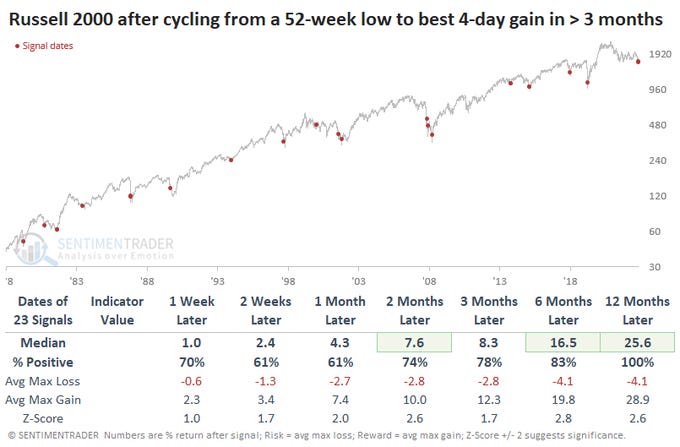

And it is not just the large caps. As we shared on Twitter, this is the 24th time the Russell 2000 (represented by the IWM 0.00%↑ / VTWO 0.00%↑ ETFs) closed at a 52-week low, then surged to its best 4-day rally in at least 3 months. A year later, the small-cap index was higher 100% of the time with a median return of +25.6%.

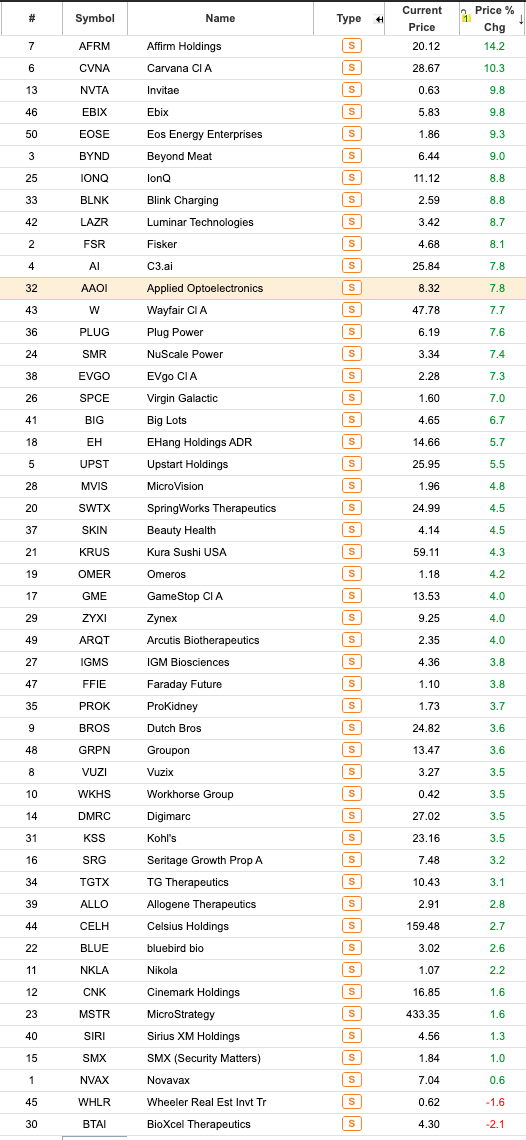

The trashiest stocks (with the highest short interest) showed large gains today, as is typical at the start of rallies from corrections. We booked our gains on AAOI 0.00%↑ on this short squeeze:

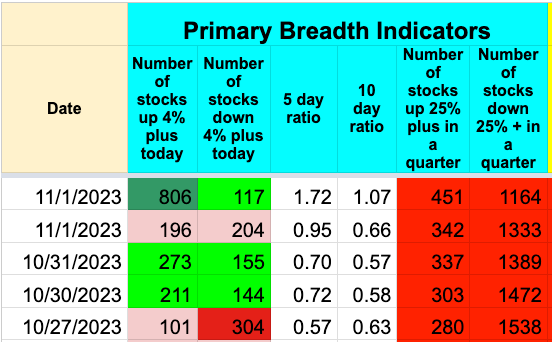

Breadth indicators like the Stockbee Market Monitor are also showing green, which is especially a strong signal when it comes after red days. It can of course improve further but the signs are pointing in the right direction:

Of course, seasonality is also in favor of the bulls with the strongest trading months being November and December.

Again, if this was a false rally attempt, the sign would be if we were to break the recent lows on the major indices.

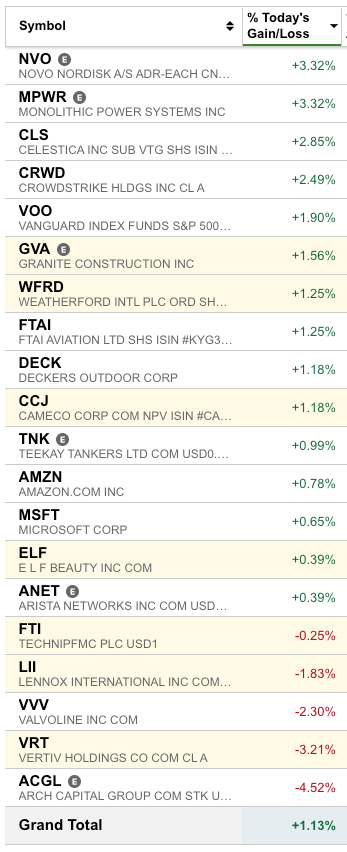

Portfolio and Performance

We increased our long exposure to over 50% of our book today, and will likely increase it by another 20-25% every day over the next couple of days to reach full allocation based on price action.

We’ve also been tactically booking gains on extended stocks / ETFs.

Here’s what we added today:

Stocks: FTI 0.00%↑ LII 0.00%↑ WFRD 0.00%↑ CCJ 0.00%↑ VRT 0.00%↑ ELF 0.00%↑ GVA 0.00%↑

ETFs: VOO 0.00%↑ VGT 0.00%↑ VB 0.00%↑ VGLT 0.00%↑

Most of these names are still looking good, except for ACGL 0.00%↑ which fell a lot today.

Watchlist

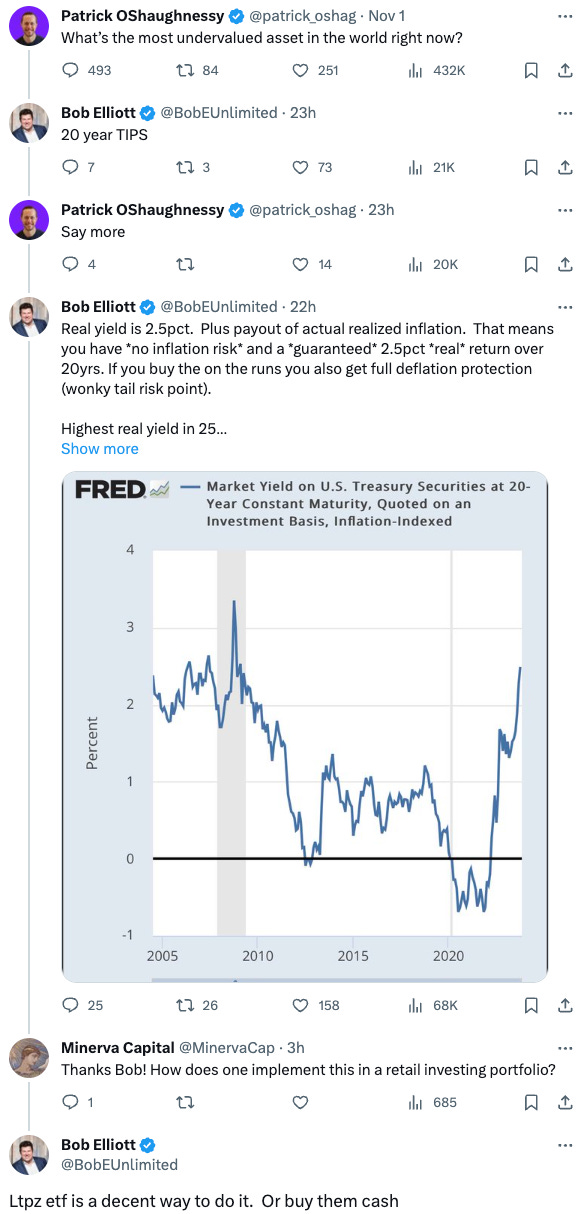

For tomorrow, we will again look at adding index ETFs (beta) to speed up our allocation: LTPZ 0.00%↑ (long duration TIPS) VOO 0.00%↑ VB 0.00%↑

Among single-name stocks we are watching:

Long: NXT 0.00%↑ PINS 0.00%↑

Short: OI 0.00%↑ LVS 0.00%↑ AES 0.00%↑ EYE 0.00%↑

ICYMI

That’s all for now! If you like our work, please do share it among your network. We believe in sharing actionable trade ideas in liquid US-listed stocks/ETFs that all investors, big or small, can execute. We just got started on Substack a couple of weeks back and could really use the added support! 🙏

Happy Trading and stay alert over the next few days!