Minerva Market View for Nov 29, 2023

Indices continue to trade in a narrow range. This can lead to explosive moves.

Good evening! The major indices continue to trade in a tight trading range. This has usually been followed by upside moves:

Positioning and Market View

All the indicators we track continue to bode well for the rally to continue. The S&P 500 posted a gain today, and more importantly, the up days have been on higher volume than the down days since the recent bottom:

The Nasdaq shows similar characteristics:

SPY 0.00%↑ breadth indicators are healthy:

And today, Fed speakers seemed to indicate that they would be open to cutting rates even without a slowdown/recession if inflation were to continue moving lower. This can add further wind to the sails of the rally.

Portfolio and Performance

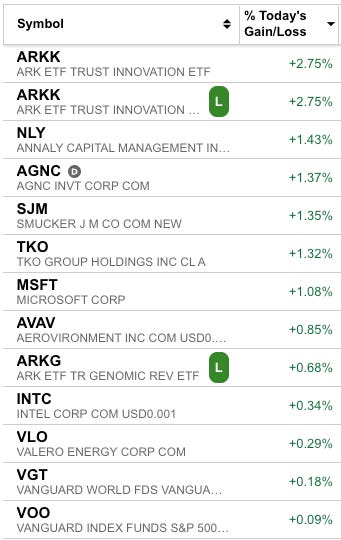

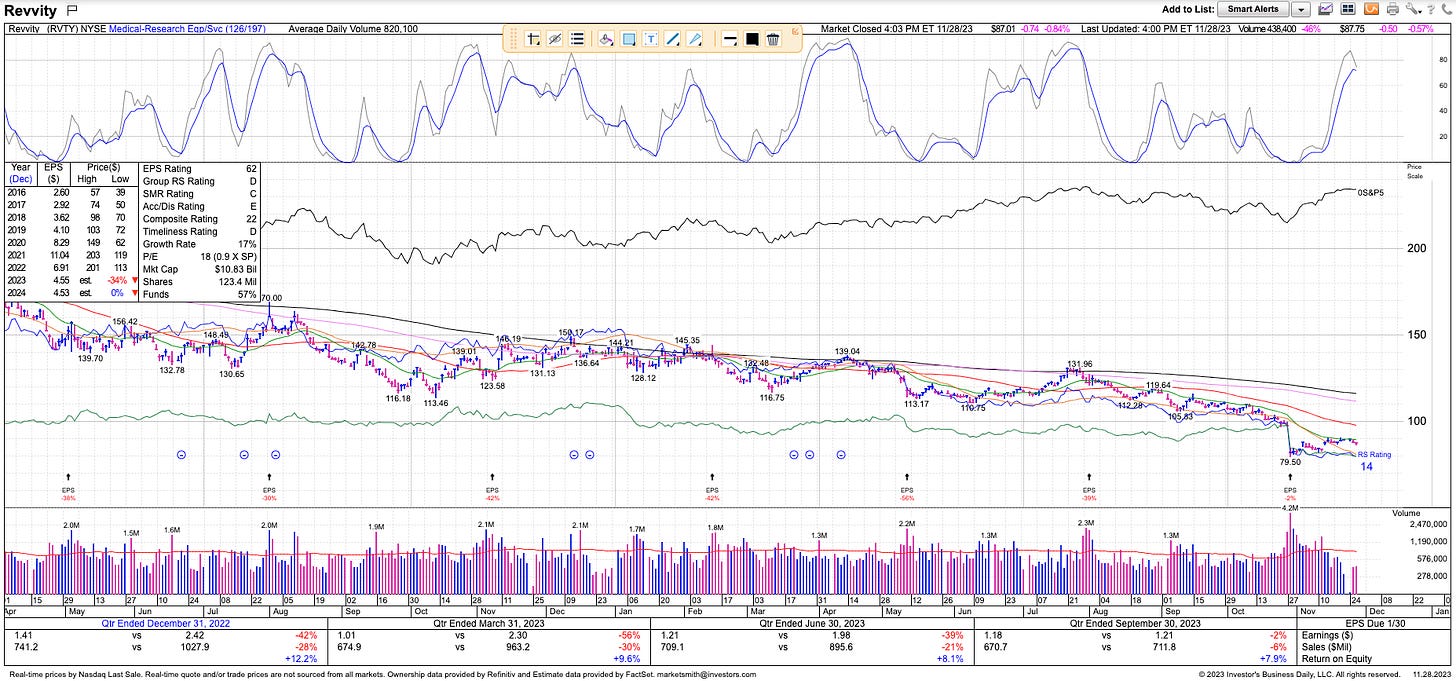

Today was a reversal of yesterday, with our alpha book down, and beta saving the day. We have several HVAC stocks such as FIX 0.00%↑ WSO 0.00%↑and LII 0.00%↑ in our portfolio as a play on the IRA (Inflation Reduction Act), and today the entire sector took a hit, dragging down our long/short book. Winners included ARKK 0.00%↑ and the M-REITs AGNC 0.00%↑ and NLY 0.00%↑.

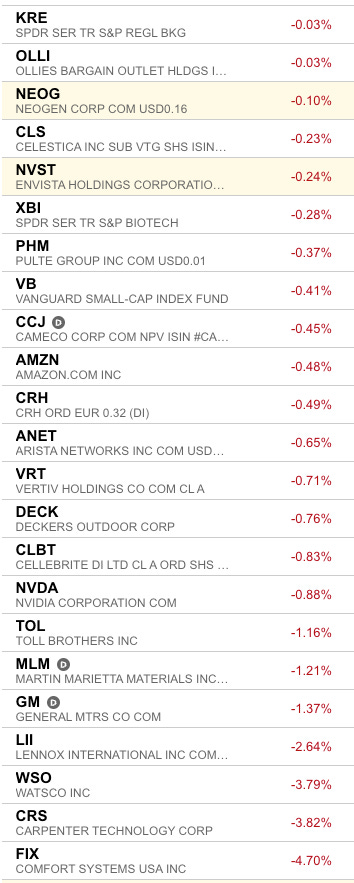

For the week, we’re still up vs. the S&P because of outperformance on Monday. We shorted NVST 0.00%↑ and NEOG 0.00%↑ on weak fundamentals and technicals today, as posted on Twitter:

We also covered our shorts on CSIQ 0.00%↑ HR 0.00%↑ and MPC 0.00%↑ due to unfavorable price action and got stopped out on our recent long COCO 0.00%↑.

All these changes net out to a net-long position that continues at 81%.

Watchlist

For tomorrow, we’re watching:

Long: SKX 0.00%↑ : strong fundamentals and breaking out of a cup base on strong volume, although it has had a straight run up so might need to cool here.

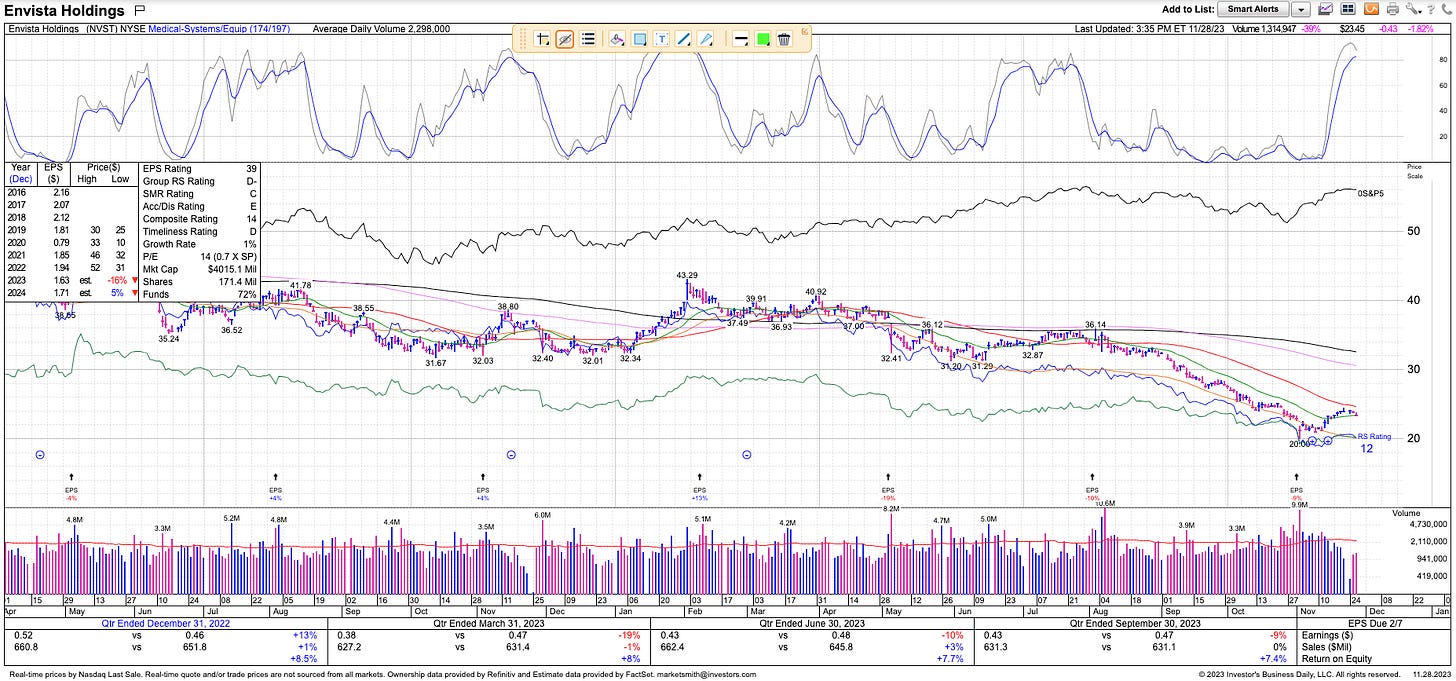

Shorts: DAR 0.00%↑ LSCC 0.00%↑ RVTY 0.00%↑ all look weak on fundamentals and technicals and don’t have a high short interest (fewer chances of a squeeze):

Worth checking out

The big news today was the passing of Charlie Munger, Warren Buffett’s right-hand man at Berkshire Hathaway. Back in the day, I’d enjoyed reading Poor Charlie’s Almanack, a collection of his quotes and wisdom. A new edition is coming out soon, which I am looking forward to reading:

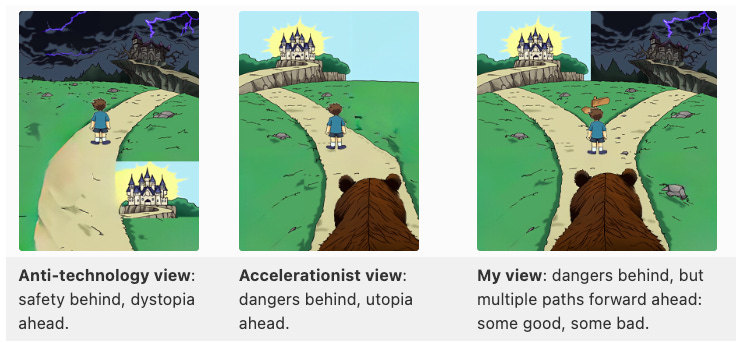

Among other things, Vitalik Buterin’s essay “My techno-optimism” is worth a read:

And I am looking forward to watching this Blockworks interview with Marko Papic:

That’s all for now. Happy Trading!