Minerva Market View for Nov 27, 2023

Markets continue to build constructively. They've been due for a pullback, which should be an opportunity to add.

Good evening! The Minerva portfolio turned in a decent performance on Wednesday and Friday despite NVDA 0.00%↑ not performing well since earnings.

Positioning and Market View

As of now, our expectation continues to be for this rally to continue into year-end. A pullback is widely anticipated and could be a good time to add more positions.

The S&P500 / SPY 0.00%↑ chart still looks constructive:

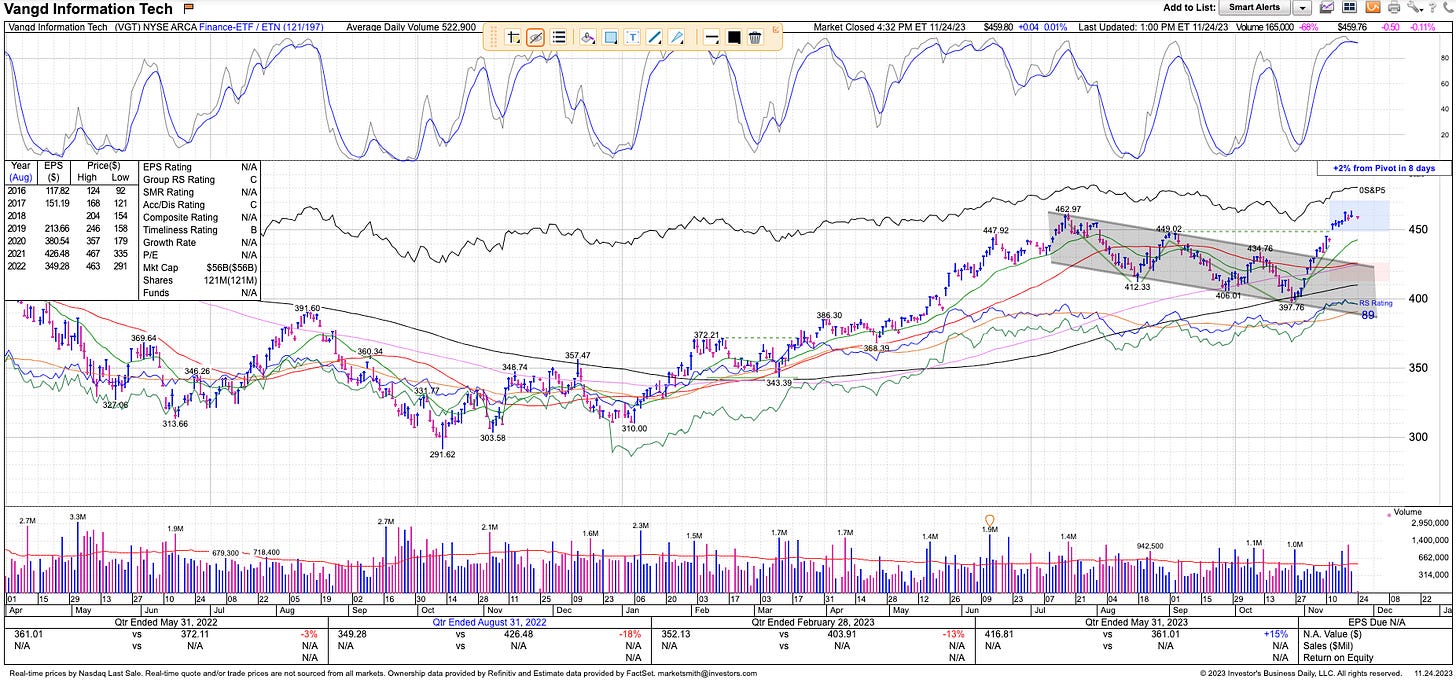

The Nasdaq as represented by our preferred ETF VGT 0.00%↑ is still in the buy zone:

The rally this year has been broader than just the Mag-7 stocks (as inaccurately reported by the media). Jonah Lupton posted this showing how many stocks with market caps > $5B have gained more than 100% YTD:

There are various technical indicators in support of the rally continuing:

Portfolio and Performance

We continue to remain 80% net long. On Wednesday, we gained 0.5% in our trading portfolio with stocks such as FIX 0.00%↑ VRT 0.00%↑ AMZN 0.00%↑ gaining ~2%.

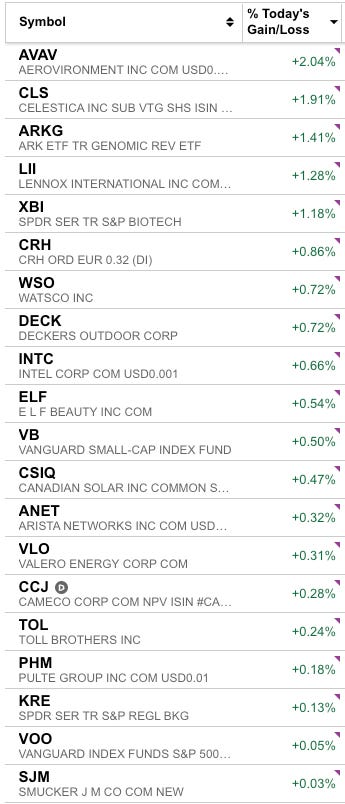

On Friday, stocks such as AVAV 0.00%↑ CLS 0.00%↑ and ARKG 0.00%↑ were the winners helping us eke out a gain slightly better than the SPY 0.00%↑. NVDA 0.00%↑ detracted from performance on both days.

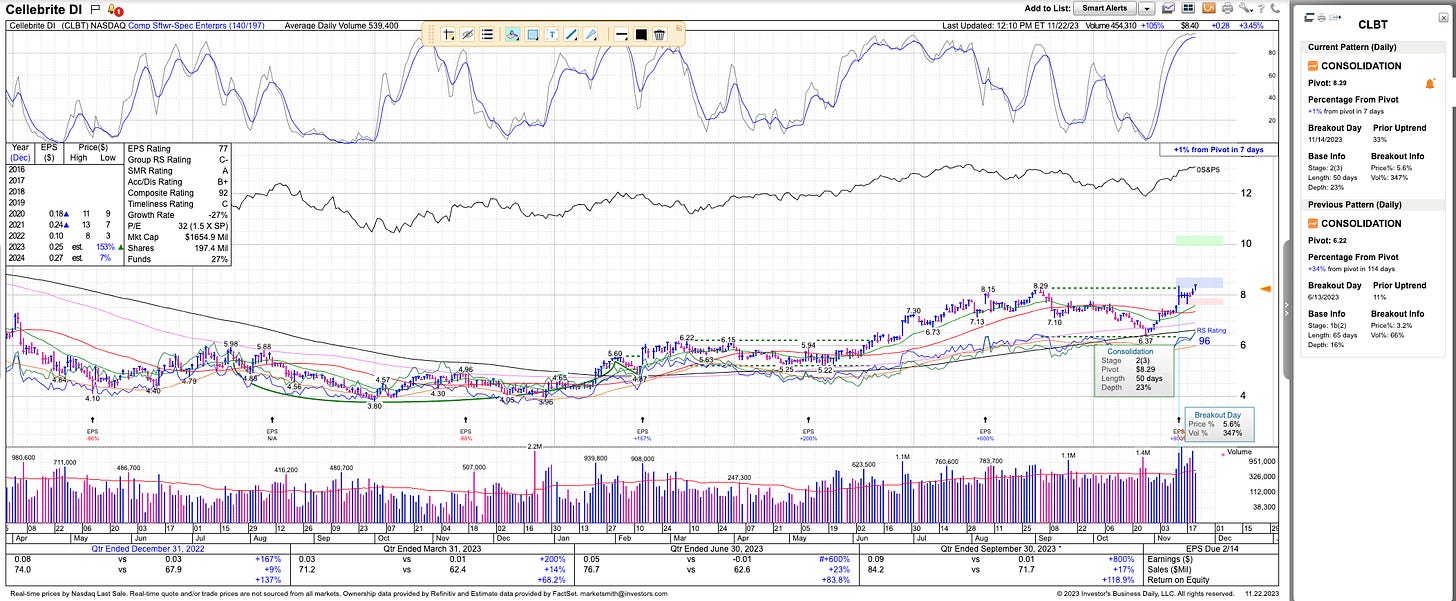

We bought CLBT 0.00%↑ in the Minerva portfolio on Wednesday. It has strong growth and is coming out of a stage 2 base on heavy volume:

Watchlist

For tomorrow, we have just a couple of names we’re looking at:

Long: DRS 0.00%↑ NVO 0.00%↑ SKT 0.00%↑

Short: ABR 0.00%↑

We also have alerts set at price target levels on various other stocks and will post live on Twitter @MinervaCap should any of them get triggered.

Worth checking out

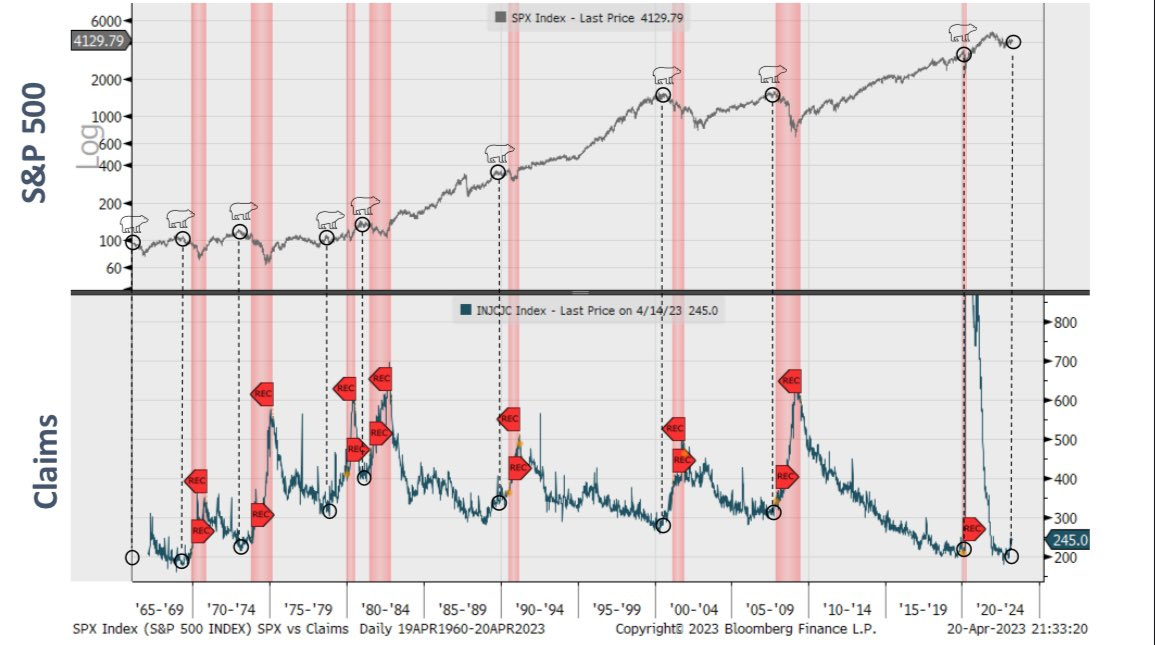

This thread from Denny Dayan is worth checking out for timing on when a material decline in stocks may happen (hint: it’s not anytime soon):

This is confirmed by one of the renowned bears Michael Kantro, who has been calling for a recession for some time now. But I’d flip his reasoning around to say that stocks won’t decline materially too far ahead of a recession - it’s more likely that it happens almost concurrently. And a recession is not on the cards until at least Q2 2024 based on how the economy is performing.

That’s all for now. Happy Trading!