Minerva Market View for Nov 21, 2023

The indices seem to be broadly consolidating here from the breakneck pace of the rally.

Good evening! Today was a consolidation day in the indices with the tech-heavy Nasdaq slowing down more than the S&P and the more speculative stuff like ARKK 0.00%↑ hit even harder:

We had some winners on the long side such as CRH 0.00%↑ LII 0.00%↑ and DECK 0.00%↑ and on the short side such as HR 0.00%↑ GM 0.00%↑ and VLO 0.00%↑. But broadly, our portfolio also corrected in line with our tech exposure.

Positioning and Market View

The good thing about today’s consolidation is that it was on low volume on both the S&P / SPY 0.00%↑ and Nasdaq:

At this point, it is just a normal and healthy dip following the breakneck pace of the rally so far. VGT 0.00%↑ (our preferred technology ETF) is still in a buy zone:

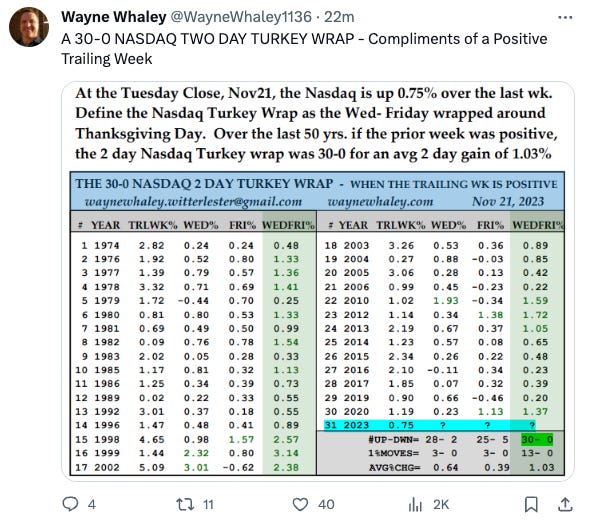

If this is indeed a bull rally, this is still early days. Also, not that we blindly follow seasonality, but we’re still in a positive stretch this week (30 for 30 going back to 1974):

NVDA 0.00%↑ smashed earnings and revenue expectations and guided upwards (a triple beat) today. However, the after-hours reaction has been muted. We’ll be closely monitoring how this impacts our other AI-related names such as CLS 0.00%↑ ANET 0.00%↑ etc.

If this dip proves to be anything deeper or on stronger volume, then we may take corrective steps to protect our profits, but at this point, there are no indications of that happening. In other news, a treasury auction performed poorly today, and the FOMC meeting minutes came out with mostly an unchanged Fed view of inflation and rates.

Portfolio and Performance

We have been using tight stops on our positions and were stopped out of TM 0.00%↑ and CRSP 0.00%↑ today. We didn’t add anything new on the long or short side based on the market action. Here are our winners and losers for today:

Watchlist

For tomorrow, we have a few short candidates and one gold miner on the long side:

Long: AGI 0.00%↑ (Alamos Gold)

Short: LUV 0.00%↑ VIAV 0.00%↑ CMC 0.00%↑ KMX 0.00%↑ Z 0.00%↑ MKC 0.00%↑

Worth checking out

Good analysis by an expert in the semiconductor space on why Nvidia still has strong prospects going forward and there is no material competition on the horizon:

This thread from Mark Ritchie on similar sharp rallies in the past is worth checking out:

That’s all for now! Have a great Thanksgiving and see you next week. 🦃

If you like our work, please share it with your network. We believe in sharing actionable trade ideas in liquid US-listed stocks/ETFs that all investors, big or small, can execute.

I’d love to hear your feedback - Happy Trading!