Minerva Market View for Nov 20, 2023

Our portfolio did great today in sync with the broader indices. Here's what we're looking for going forward.

Good evening! If you’ve been tracking our positioning, you know that today was a great day for us with several winners in AI and Biotech including VRT 0.00%↑ ARKK 0.00%↑ AVAV 0.00%↑ NVDA 0.00%↑ ARKG 0.00%↑ INTC 0.00%↑ and MSFT 0.00%↑ all up 2%+.

Positioning and Market View

As regular readers know, we flipped long since Oct 31st and now more and more voices are hesitantly dropping their guard against this advance. Of course, once everyone joins in the rally, that’s when we know it’s close to its end :) Anyway, Simon Ree posted an eloquent reasoning behind why this rally is likely to continue:

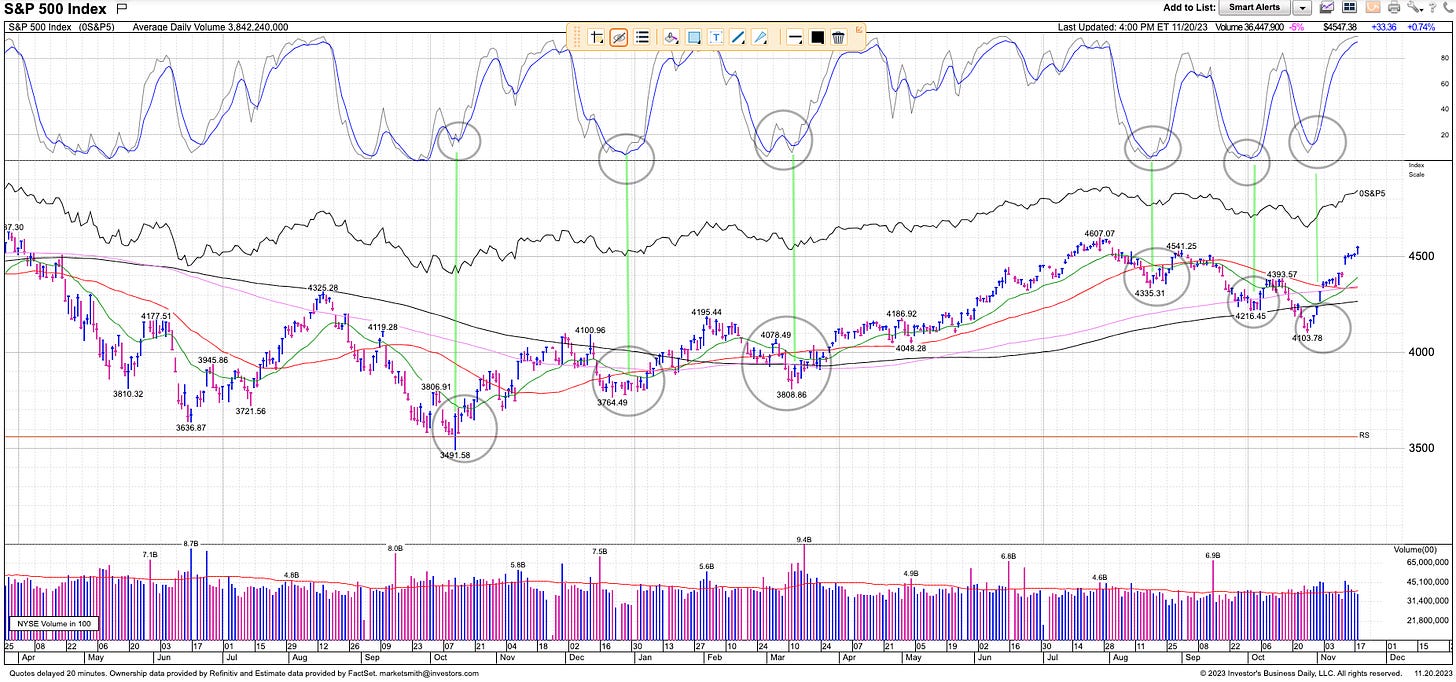

And sure enough, the major indices continue to push forward without any material dip or technical deterioration:

The Nasdaq as represented by VGT 0.00%↑ below is in a buy zone currently:

The major event everyone invested in AI and Technology is looking forward to is NVDA 0.00%↑’s earnings after tomorrow's close. We’re overweight AI and Tech in our portfolio and expect this rally to continue. Any dips will be opportunities to further deploy funds until the end of the year.

We also agree with @DanielTNiles’s bullish outlook through year-end:

Portfolio and Performance

Today, we closed our AAP 0.00%↑ short and bought CRSP 0.00%↑ to bring our net long to 80%. The Biotech space is staging a massive bounce and this thread on X is worth checking out if you want to dive deeper:

If you don’t want to research or get exposure to single stock names, XBI 0.00%↑ and ARKG 0.00%↑ are good ETFs to get broad Biotech exposure.

Here are our winners and losers for today. We performed broadly in line with the S&P while being 80% invested. Most of these names are still in a good buy range, except CLS 0.00%↑ which is stretched now, and OLLI 0.00%↑ which is not performing well.

Watchlist

For tomorrow, we have just a few names we’re looking at adding: NVO 0.00%↑ SKT 0.00%↑ LMB 0.00%↑.

Worth checking out

A great blog post by the always-fantastic Morgan Housel: The Full Reset

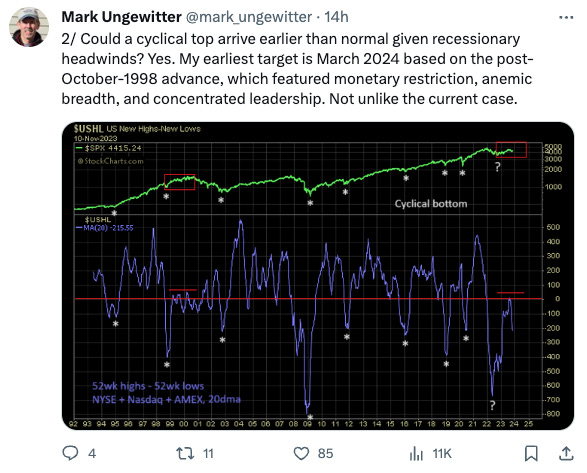

From the Macro Ops newsletter:

That’s all for now! If you like our work, please share it with your network. We believe in sharing actionable trade ideas in liquid US-listed stocks/ETFs that all investors, big or small, can execute.

I’d love to hear your feedback - Happy Trading!