Minerva Market View for Nov 20, 2023

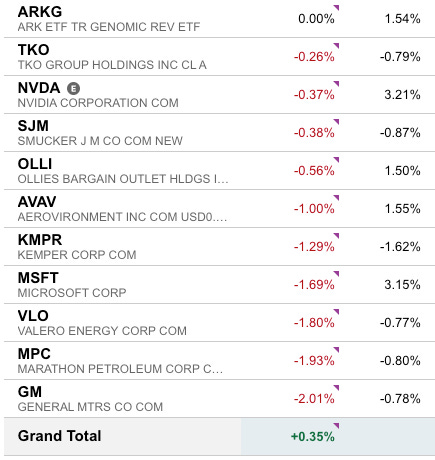

We had another great day on Friday with 2x the S&P return while being less than 80% net long. Long and shorts both did well, pointing to good alpha/stock picking.

Good evening! We had a great day on Friday with our portfolio returning 2x the S&P return, while being 78% net long. Here’s how we are positioned going forward.

Positioning and Market View

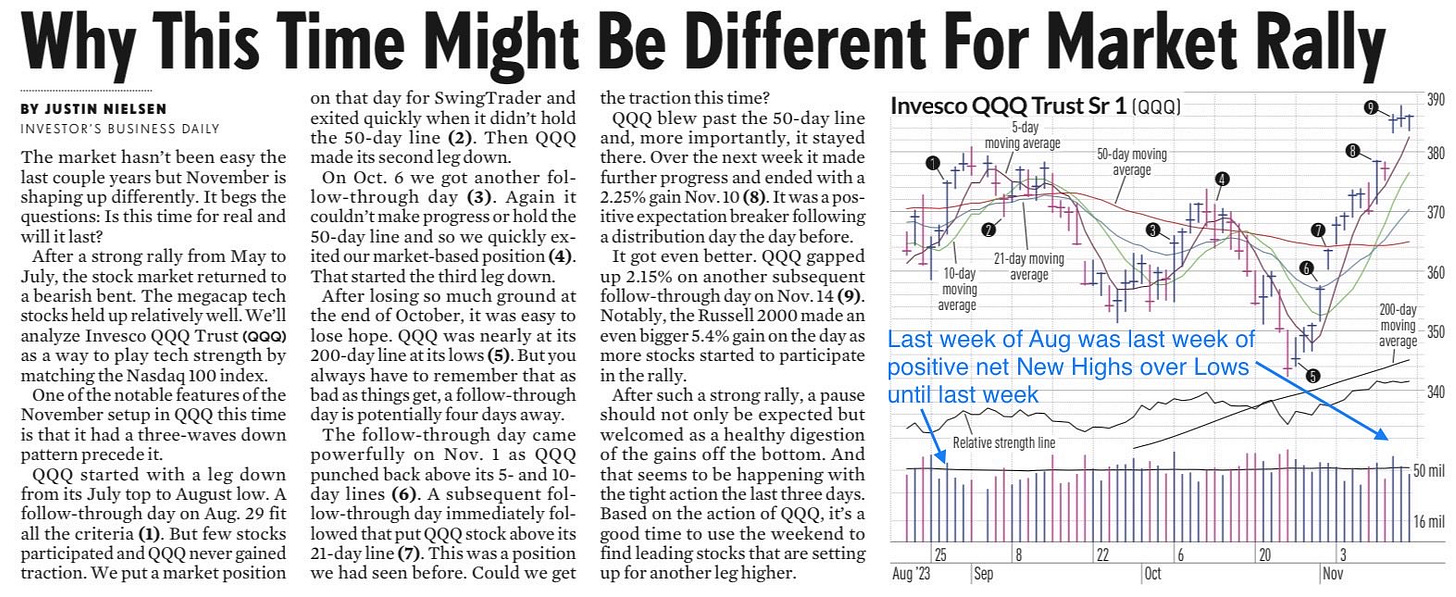

The bull case is now catching more support and we’re not even getting a brief pullback. The SPY 0.00%↑ / S&P total return is now just 2% away from all-time highs. And the Nasdaq could clear that hurdle tomorrow.

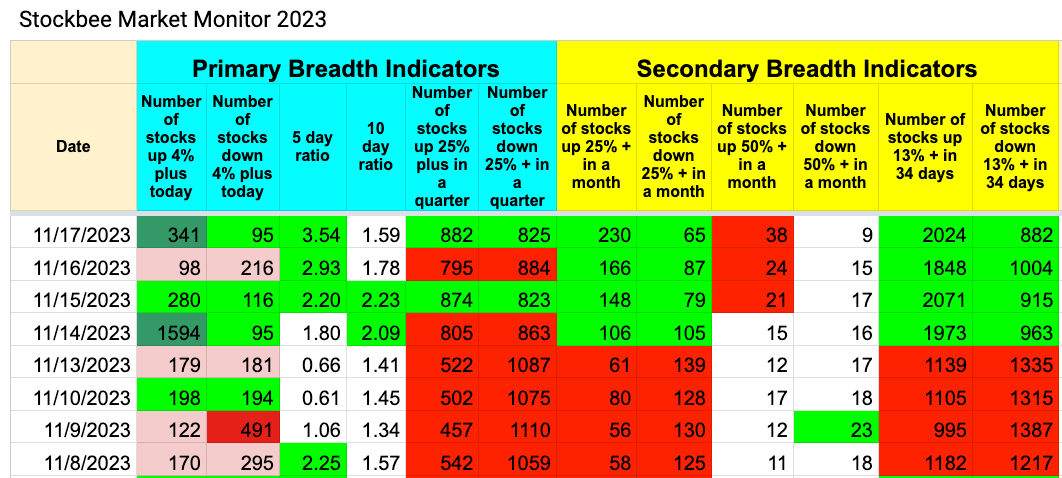

Measures of breadth are looking strong, if a bit too strong (red boxes on the top rows):

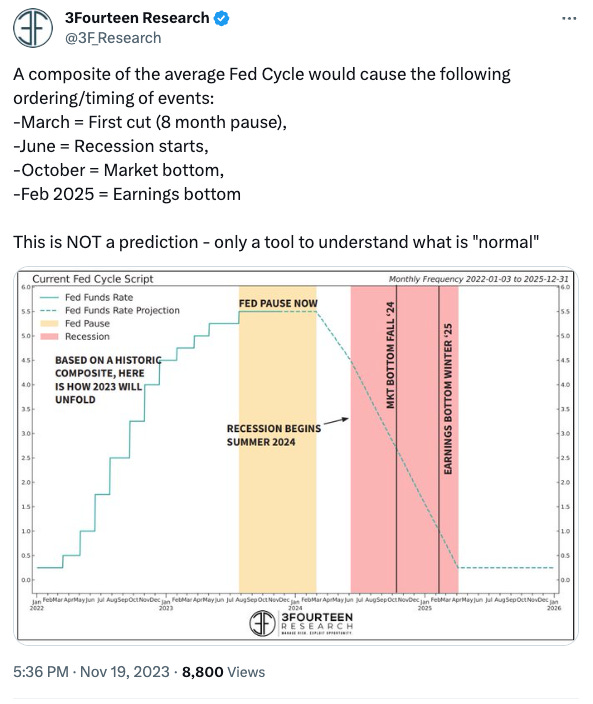

For now, it looks like the rally will continue into year-end with some small pullbacks along the way. Of course, we have not entirely dismissed the possibility of a recession / hard landing. Here is one possibility, from the folks at 3Fourteen Research:

But in the meantime, we want to participate in the rally. If a downturn does materialize, it will likely start in 2024, and that’s when we can flip short.

Portfolio and Performance

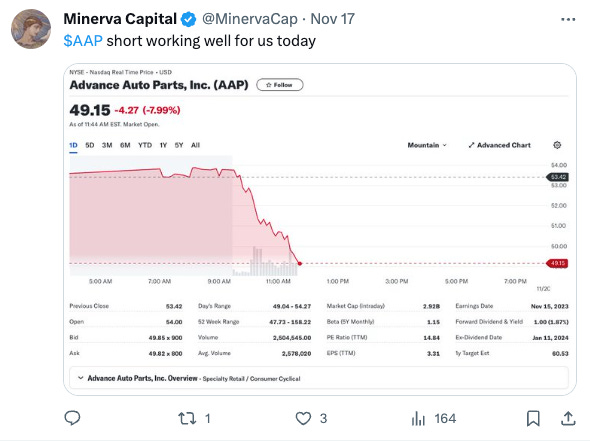

On Friday, we added Toyota TM 0.00%↑ on the long side along with a bunch of ETFs that will benefit if the risk-on rally continues: ARKK 0.00%↑ ARKG 0.00%↑ VB 0.00%↑ and XBI 0.00%↑. We also shorted AAP 0.00%↑ as reported on Twitter:

Overall it was a good day with several winners and a few losers:

Watchlist

For tomorrow, we have some names we’re looking at adding:

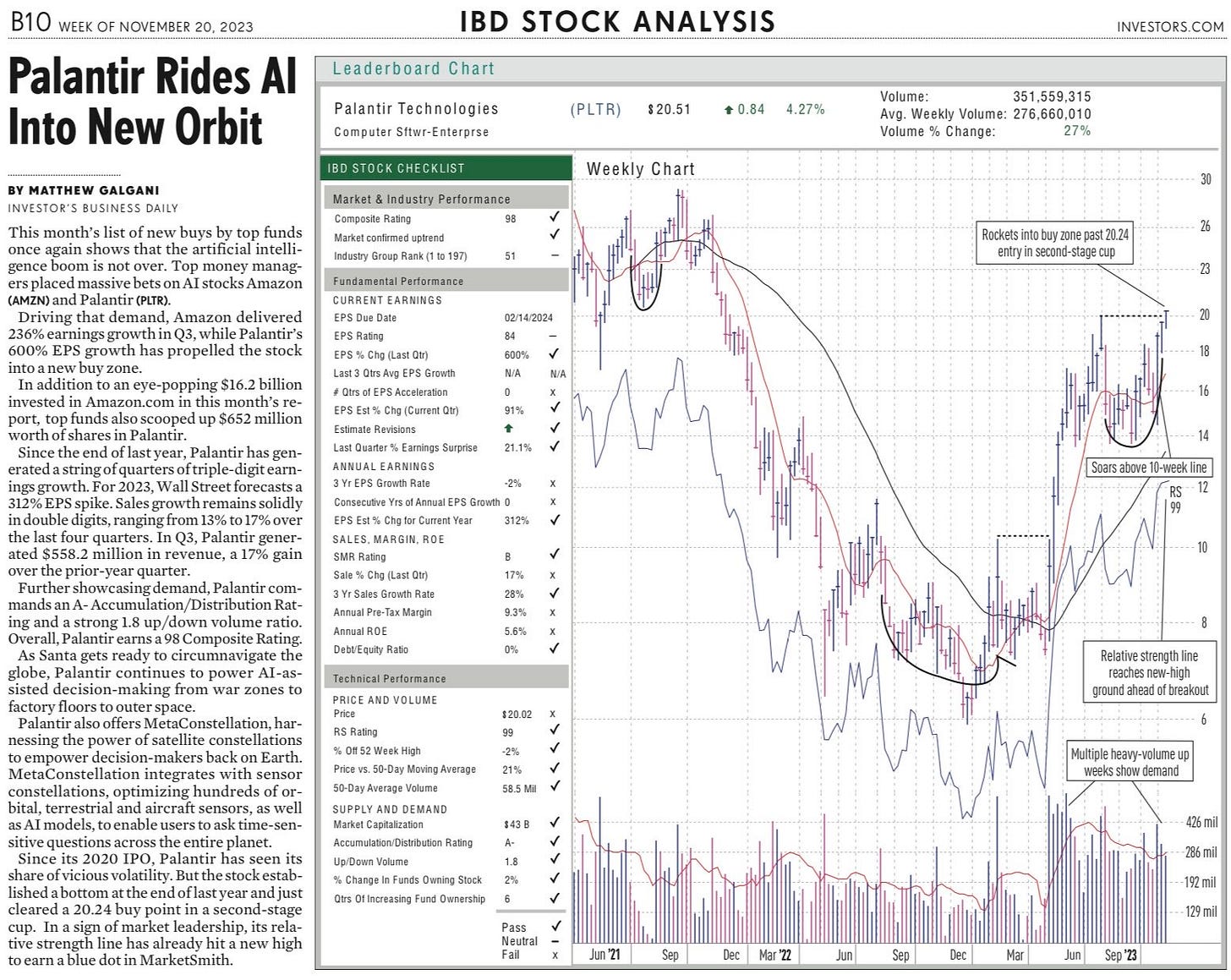

Long: TLT 0.00%↑ SKT 0.00%↑ LMB 0.00%↑ PLTR 0.00%↑

Short: KMX 0.00%↑

Worth checking out

That’s all for now! If you like our work, please share it with your network. We believe in sharing actionable trade ideas in liquid US-listed stocks/ETFs that all investors, big or small, can execute.

I’d love to hear your feedback - Happy Trading!