Minerva Market View for Nov 17, 2023

Today was a risk-off day with long-term bonds and large caps performing better. Will that develop into a broader sell-off in risk assets?

Good evening! We had some big winners in our portfolio today, both on the long side: INTC 0.00%↑ and short: MPC 0.00%↑ VLO 0.00%↑ HR 0.00%↑ GM 0.00%↑.

Today the rotation into more speculative and broad-based stuff reversed with ARKK 0.00%↑ RSP 0.00%↑ VB 0.00%↑ all correcting. Will this spiral into a more severe pullback across risk assets?

Positioning and Market View

We’re coming closer to the much-anticipated pullback, and the riskier asset classes may take a stronger beating if that does transpire.

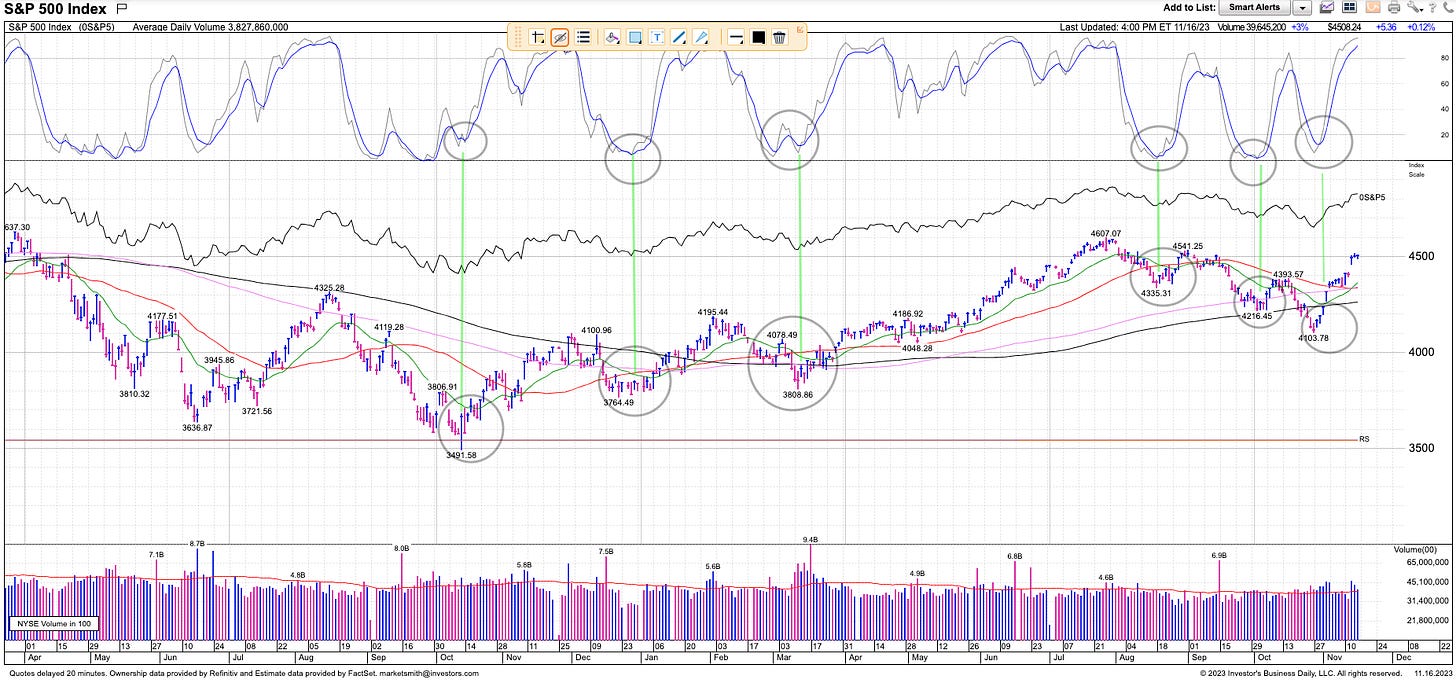

The S&P 500 / SPY 0.00%↑ / VOO 0.00%↑ still looks constructive and posted small gains on stronger-than-average volume today. This looks like the safest house on the block if a sell-off / consolidation were to happen:

As represented by VGT 0.00%↑ the Nasdaq posted even stronger gains than the S&P today, but these have been on lower volumes. It is still in a buy zone:

As posted by MarketSmith today, the QQQ 0.00%↑ can remain overbought for a long time (oversold is a typo in the image below):

All the more speculative / broad-based stuff sold off today, shown here ranked from safest to riskiest asset classes:

Ryan Detrick who has been awesome all year with his calls posted this chart of seasonality, which also indicates that we might be in for a breather here in the second half of November, as shown in the orange line dipping briefly before resuming the rally. Of course, these things don’t play out exactly, but it might be a reason to be cautious here:

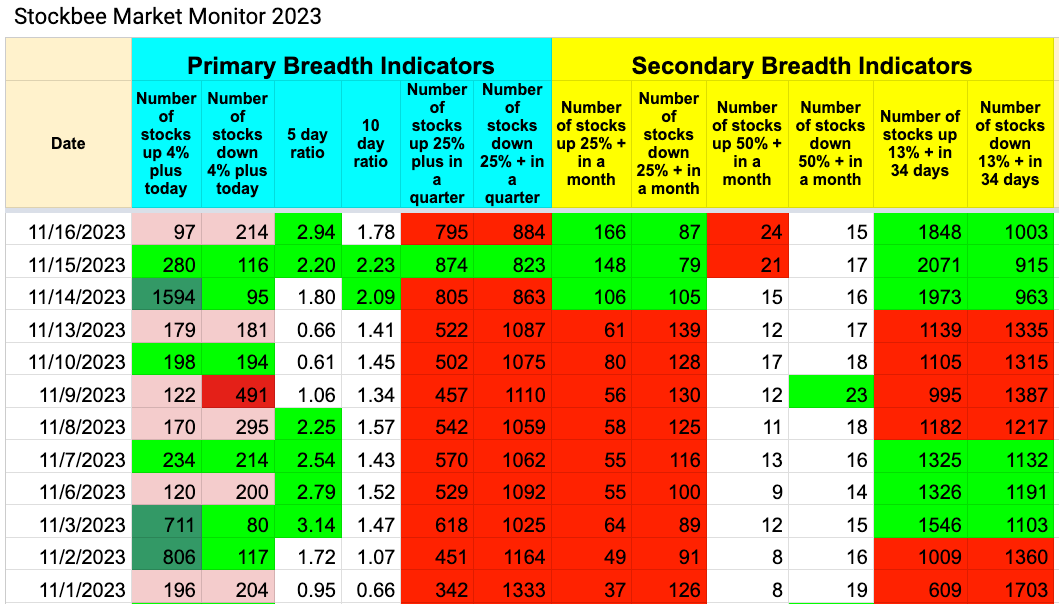

The Stockbee Market Monitor deteriorated in some areas today:

All told we shouldn’t be surprised if we get a small pullback in the next few days. This will be the time to load up on strong stocks for the rally that might follow.

Portfolio and Performance

We had several strong gainers today. We booked gains on FTAI 0.00%↑ and VB 0.00%↑ today based on the price action. We also booked our gains on CRWD 0.00%↑ after-hours yesterday after the bad results from PANW 0.00%↑ and CSCO 0.00%↑.

Our long/short book in the trading account delivered gains on balance today and the beta book composed of VOO 0.00%↑ and VGT 0.00%↑ also scraped some small gains. Losers that we’re on watch to get rid of include OLLI 0.00%↑ and DECK 0.00%↑ which took a beating with the broader retail sector after the WMT 0.00%↑ earnings today.

Watchlist

We didn’t end up adding anything today. For tomorrow as well, we have a small watchlist and may exit even more positions based on price action, both to limit our losses and protect our gains.

The best place to park cash is SGOV 0.00%↑ — they have the best yields on short-term treasuries, are state tax-free, and have the lowest expense fee in the class.

Long:

TLT 0.00%↑ / long-term bonds are looking constructive and can be a safe recourse for sell-offs although lately they have been positively correlated with stocks, so we will have to monitor price action.

TM 0.00%↑ (Toyota) and LMB 0.00%↑ (Limbach) are both looking constructive.

Short: KMX 0.00%↑ (Carmax) and AAP 0.00%↑ (Advance Auto Parts) are both looking like good shorts.

Worth checking out

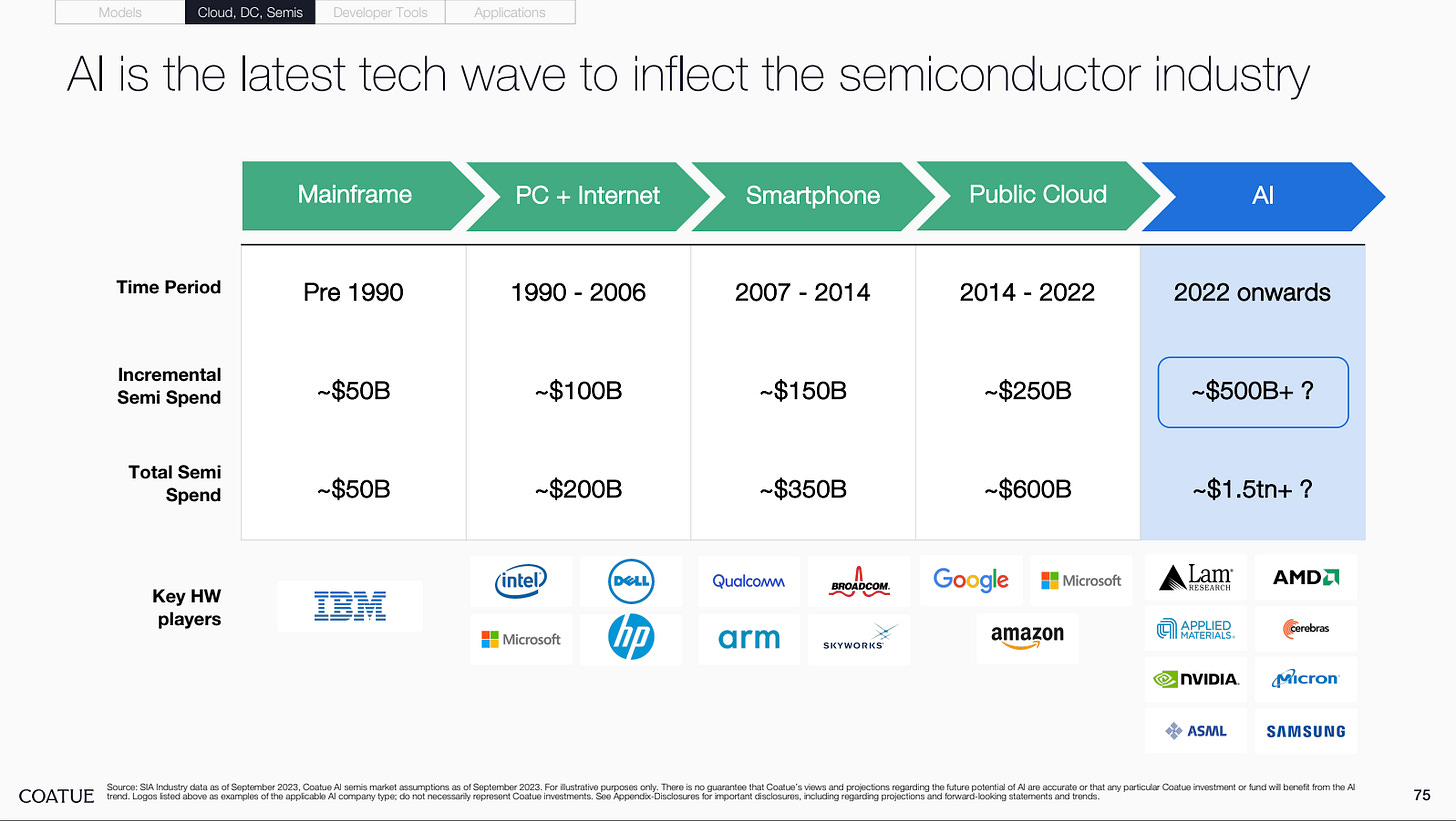

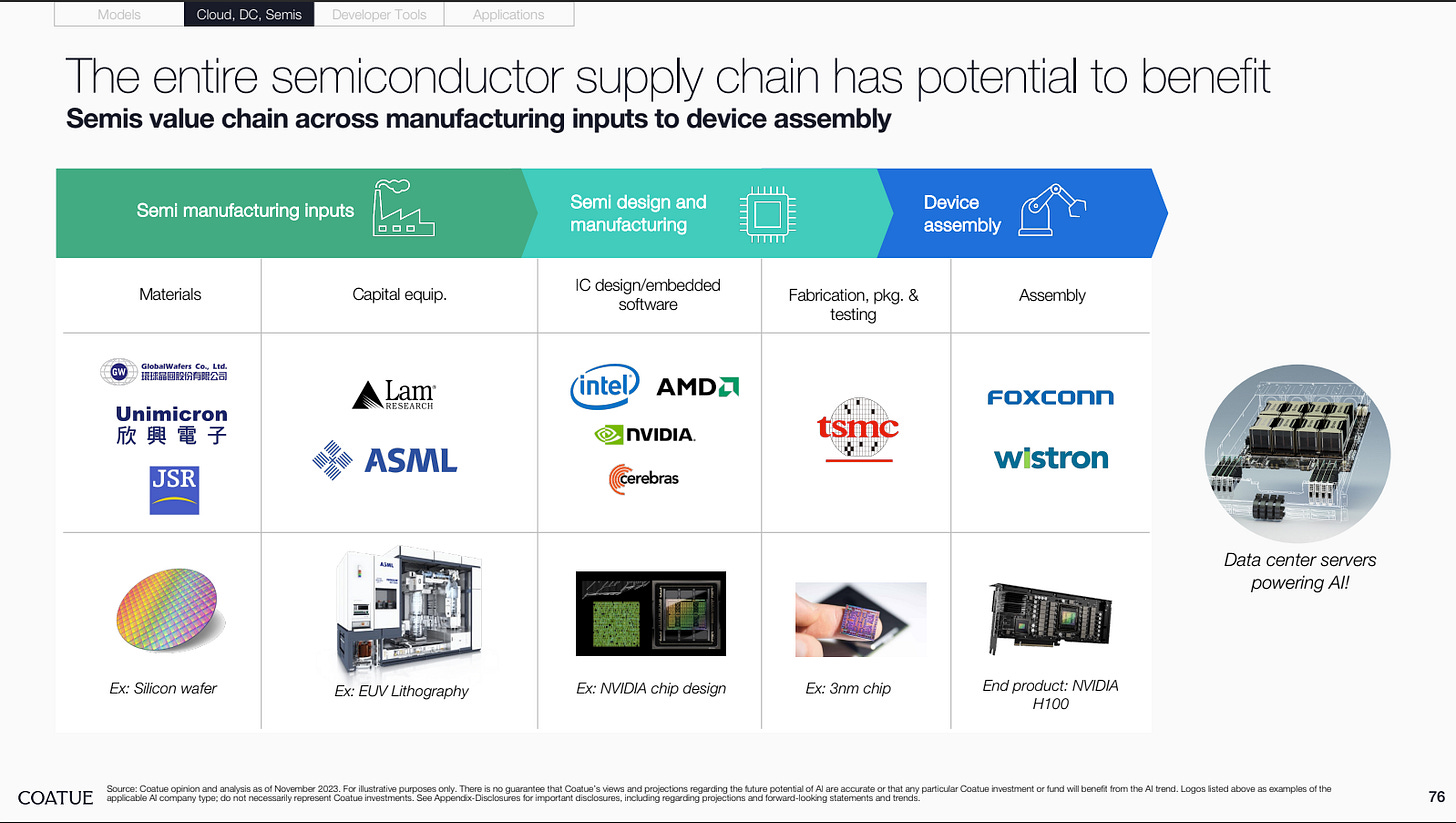

Great Coatue Perspective on AI: The Coming Revolution. Some select slides below:

We have positions in INTC 0.00%↑ NVDA 0.00%↑ MSFT 0.00%↑ and AMZN 0.00%↑.

That’s all for now! If you like our work, please share it with your network. We believe in sharing actionable trade ideas in liquid US-listed stocks/ETFs that all investors, big or small, can execute.

I’d love to hear your feedback - Happy Trading!