Minerva Market View for Nov 16, 2023

The rotation from mega-caps and safe names to more aggressive and broader-based names continues. This could build a stronger foundation for the rally to continue.

Good evening! Today was a mixed day with rotation continuing: several of the names considered “safe” until now slowing or reversing and passing the baton on to the more aggressive / “weaker” names. PPI numbers also came in cold, further strengthening the case for the Fed to stay on hold, and increasing the odds for a cut in rates sooner rather than later.

Positioning and Market View

All the technicals still point to the rally continuing, even if it consolidates here for a bit. Remember that consolidations can happen in price or in time i.e. by the indices going lower a bit from here, or just chopping around in a range for some time. Here are our usual charts:

The S&P / SPY 0.00%↑ continued its advance and is in overbought territory now. It cleared and closed above the psychologically important level of 4500. Indices can stay overbought for long, so this is not necessarily a sell signal yet.

The Nasdaq as represented by our preferred ETF VGT 0.00%↑ is now in the buy zone of a double-bottom base as per this MarketSmith chart. However, this might not be the best time to chase it considering the mega-caps are already quite stretched.

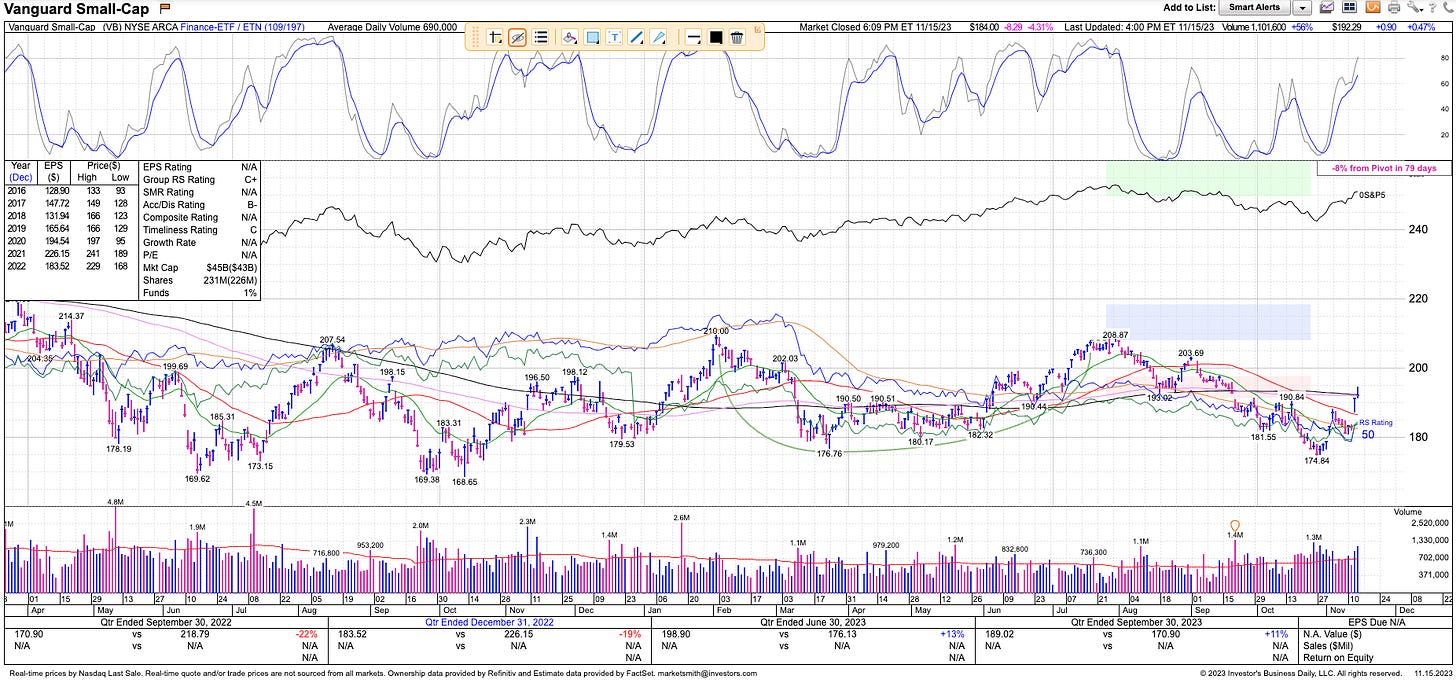

Small caps as represented by VB 0.00%↑ had another day of strong relative performance vs the above large cap indices.

Another way to look at it is with RSP 0.00%↑ - the equal weight S&P 500 ETF, which is also showing stronger relative strength recently as compared to its market cap-weighted counterpart. This shows a further broadening of the rally which is required if it is to sustain.

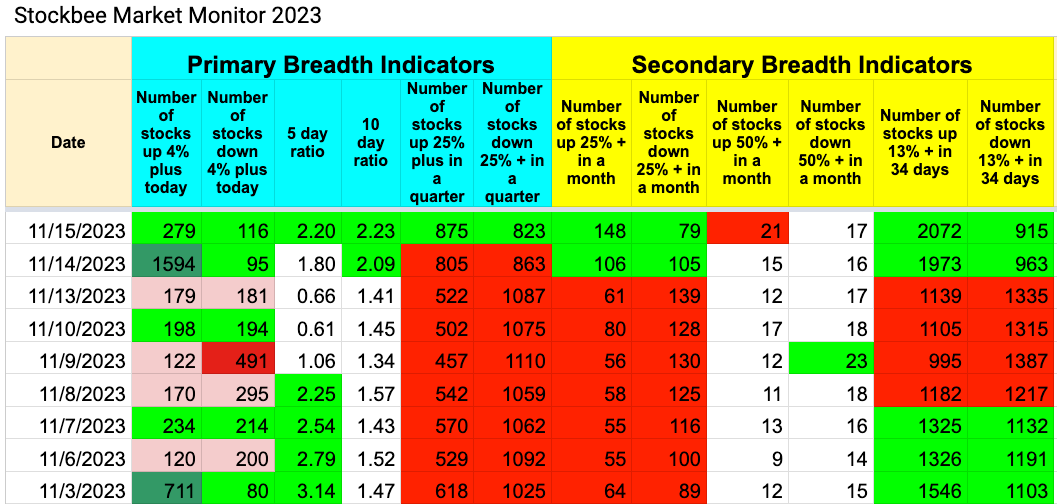

And that brings us to the Stockbee Market Monitor breadth indicators, which all show strength across the board. The 10-day ratio turning green after a bearish phase is considered bullish. The only red flag in the top row is the “number of stocks up 50%+ in a month” showing overbought/extreme bullishness. It can cool off with some consolidation here.

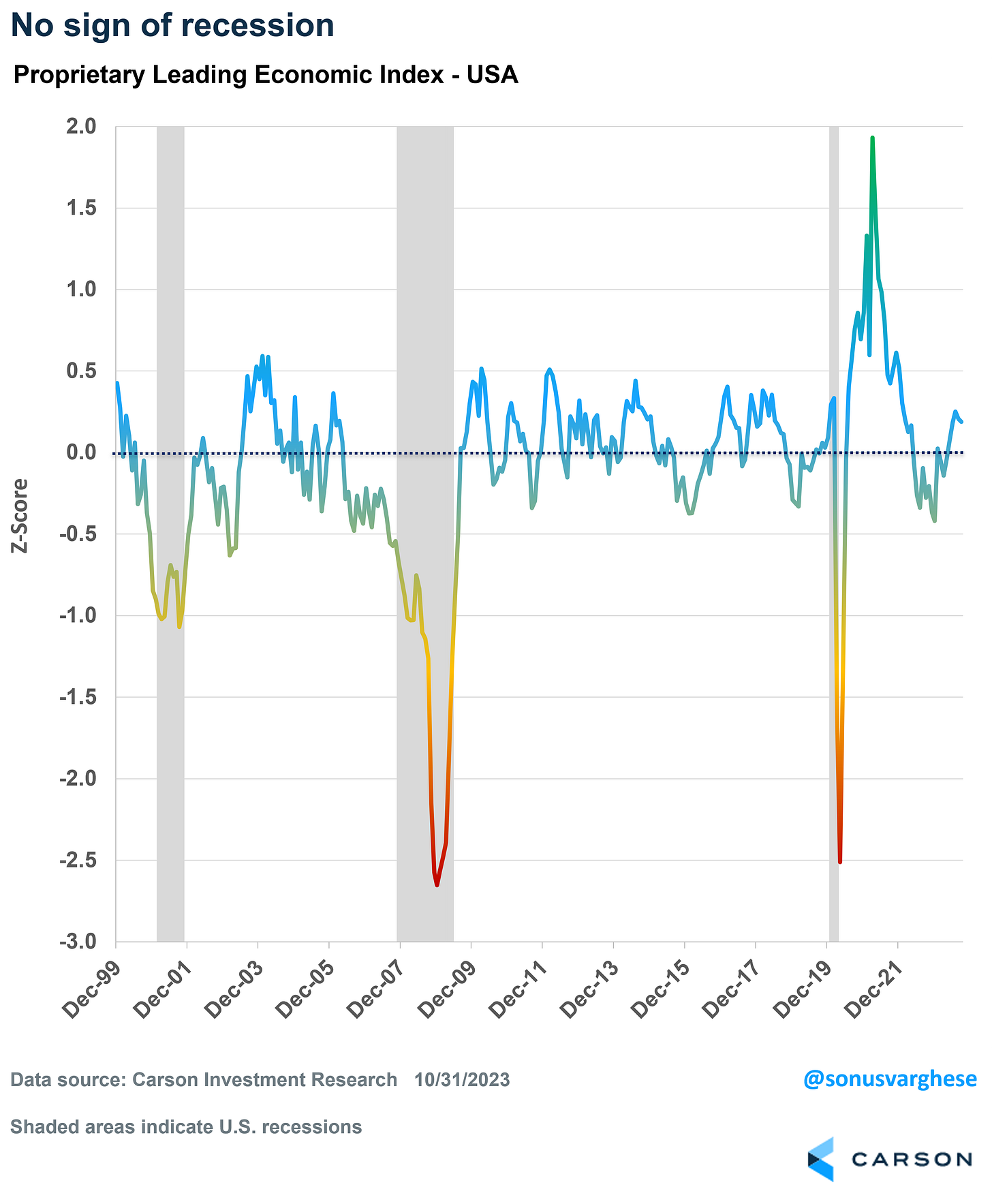

Now that we’re done with the technical indicators, here is a more fundamental/macro indicator — the Carson Group has been prescient this year in their market and economy calls. Their proprietary LEI (Leading Economic Indicator) is not showing any near-term signs of a recession yet:

There is still a lot of money on the sidelines and a lot of fund managers who will need to chase this rally, so it has all the ingredients for a rally into year-end, maybe after a brief pause/dip in the near term.

Portfolio and Performance

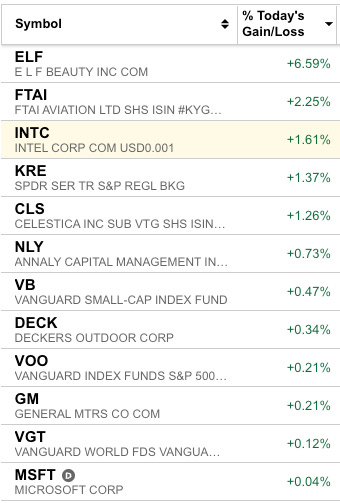

Today started strong but was a mixed day on the close for us, with the portfolio still being tilted towards the heavyweight / stronger names. Nonetheless, we saw great gains in ELF 0.00%↑ FTAI 0.00%↑ and others. We booked profits on CRWD 0.00%↑ and closed out NVO 0.00%↑ , which showed weakness from this rotation out of defensives. The largest weights in our portfolio are on the beta side: VOO 0.00%↑ VGT 0.00%↑ and VB 0.00%↑ and all saw decent upticks today.

These gains were neutralized by several small losses, both on the long and short side (we’re still carrying some shorts as hedges). Even large names like AMZN 0.00%↑ and NVDA 0.00%↑ took a beating today.

As posted on Twitter, we added to INTC 0.00%↑:

Watchlist

Due to the extended nature of the rally, we don’t have too many names on the shopping list for tomorrow. But if the rotation continues, we will look at moving funds from the larger caps into some of the following names:

Banks: BPOP 0.00%↑ FCNCA 0.00%↑ EWBC 0.00%↑ KRE 0.00%↑

Other longs at/near buy points: AROC 0.00%↑ LMB 0.00%↑

Short: NEP 0.00%↑

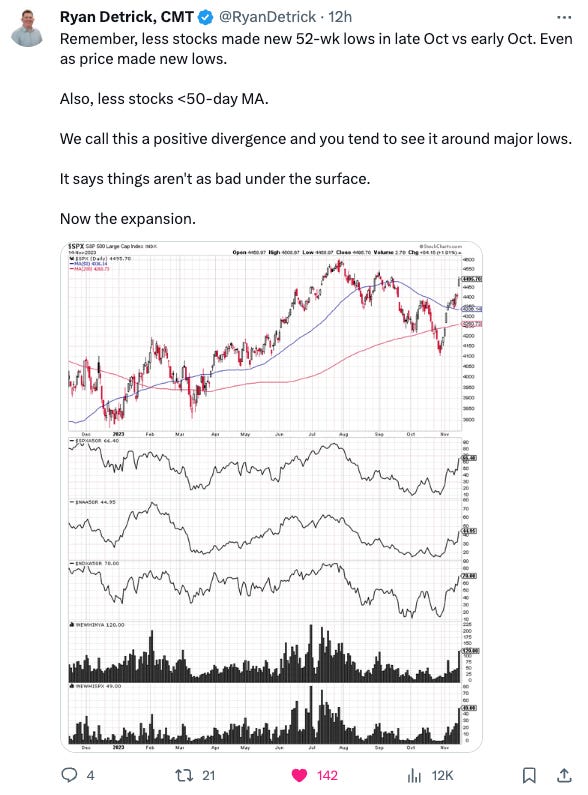

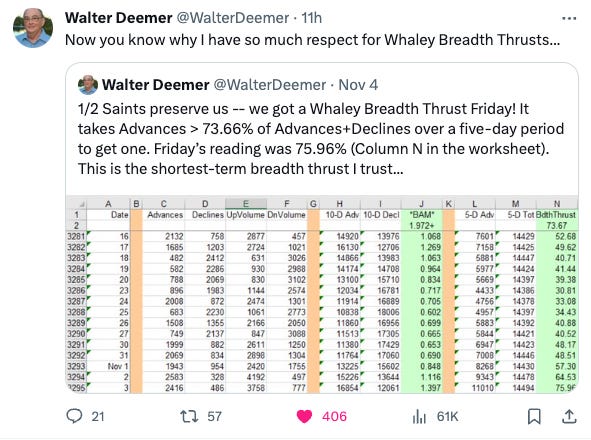

Worth checking out

That’s all for now! If you like our work, please share it with your network. We believe in sharing actionable trade ideas in liquid US-listed stocks/ETFs that all investors, big or small, can execute.

I’d love to hear your feedback - Happy Trading!

Disclaimer: This post is for professional investors only and is shared with other like-minded investors for the exchange of views and informational purposes only. Please see the disclosures and disclaimers for more details and always note, we may be entirely wrong and/or may change our mind at any time. This is NOT investment advice, please do your own due diligence.

Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.