Minerva Market View for Nov 15, 2023

Bulls are fully in control of the rally now. We had another record day of profits in our portfolio. Here's how we're positioning going forward.

Good evening! We have been getting progressively bullish since the recent bottom and today we posted another record day of profits for the year. Here’s how we’re positioning as we advance.

Positioning and Market View

Strong rallies throughout on volume and greatly improved signs of market breadth:

The SPY 0.00%↑ gapped up right on the open and there was no stopping it throughout the day. It has cleared all the nearby resistance levels and is now poised to go to all-time highs by year-end.

The Nasdaq / Tech Sector (represented here by VGT 0.00%↑ ) had broken out of its downward channel as we covered recently. Now it is well out of the channel on strong volume and there seems to be no stopping it either.

Since Jan 31, the S&P rallied 500+ points (more than 10%) to the high in July.

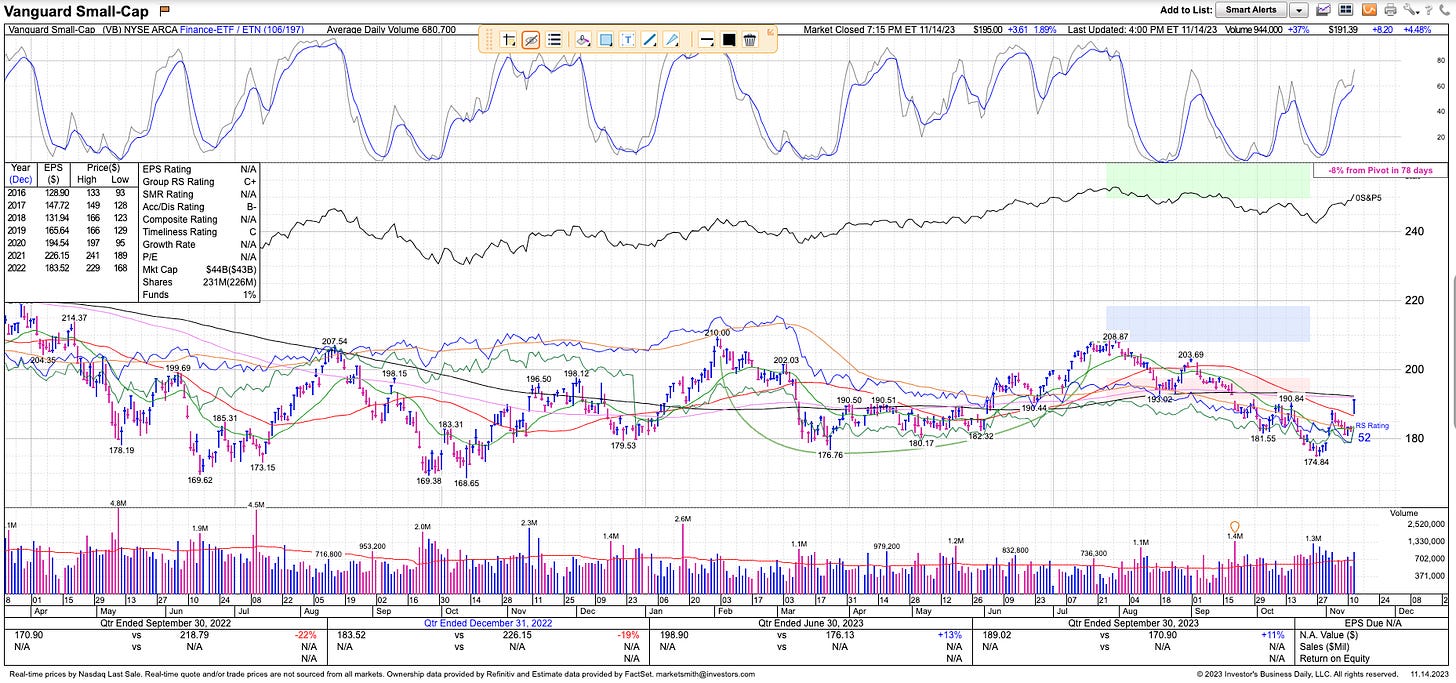

Most importantly, today saw a character change with small-caps / VB 0.00%↑ posting a vigorous up day on volume. A lot of this was short-covering since the most speculative stuff like ARKK 0.00%↑ rallied a lot, but there is also a rotation happening from the defensive sectors like large caps, healthcare, insurance, etc. to the beaten-down sectors like small-caps, solar, mortgage, homebuilders, regional banks etc.

We closed out a lot of our shorts and have moved to a 95% gross book with 5% shorts remaining for a net-long exposure of 85%.

Portfolio and Performance

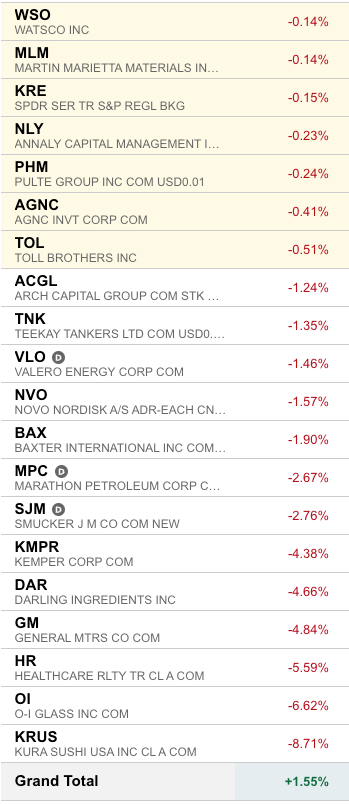

Several of our stocks posted strong gains today, along with our outsized beta weighting where we added VB 0.00%↑ (small caps) to VOO 0.00%↑ (large caps) and VGT 0.00%↑ (tech).

They helped us cover the losses, which mainly came from our shorts. And that was natural as we were using them as hedges:

We added several names highlighted in yellow above with the following themes:

AI beneficiaries: VRT 0.00%↑

Technicals/fundamentals: WSO 0.00%↑ MLM 0.00%↑ FIX 0.00%↑

Regional banks: KRE 0.00%↑

Mortgage REITs: AGNC 0.00%↑ NLY 0.00%↑

Homebuilders: TOL 0.00%↑ PHM 0.00%↑

The last three of these would benefit from rates coming down.

Watchlist

We don’t have too many names for tomorrow but will look to add to our current holdings that continue to perform well while trimming positions that don’t.

Long: STN 0.00%↑ AKAM 0.00%↑ AROC 0.00%↑

Short: none

The market will have some pullbacks as it consolidates all its recent gains, and those would be good times to put money to work. Right now, bears have run out of most of their supporting arguments. Many investors are still underweight equities so there can be a massive rally as everyone tries to catch up.

Worth checking out

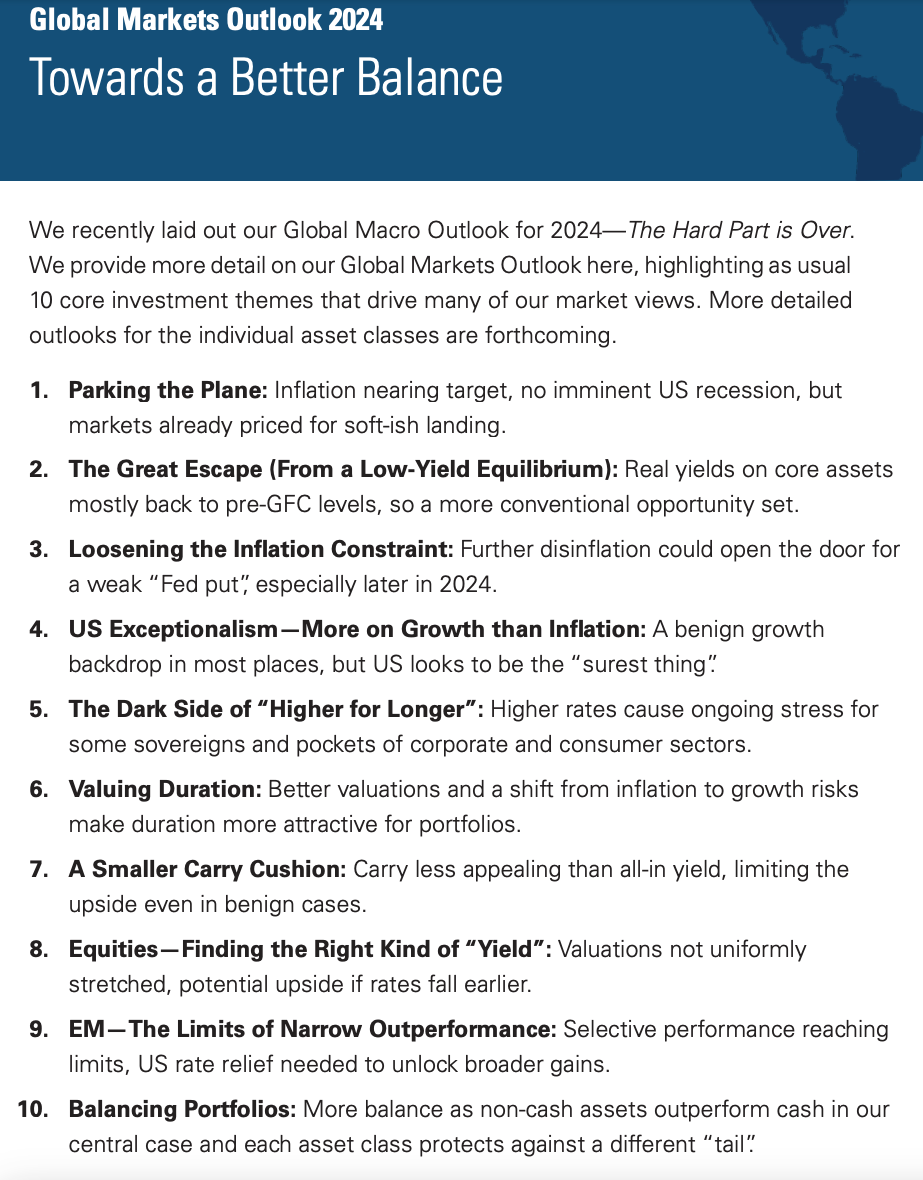

Goldman Sachs is one of the few Wall Street banks that got the 2023 macro picture mostly correct i.e. they weren’t in the recession camp. They’re now out with their 2024 outlooks and they’re all worth reading:

Global Markets Outlook 2024 Towards a Better Balance (snapshot below)

Tom Lee of Fundstrat is one of the analysts who also predicted the 2023 rally accurately. He sees continued gains for small caps, tech, and industrials:

That’s all for now! If you like our work, please share it with your network. We believe in sharing actionable trade ideas in liquid US-listed stocks/ETFs that all investors, big or small, can execute. Your friends will thank you for the added alpha 😊

Happy Trading!