Minerva Market View for Nov 14, 2023

Quiet day in the markets today. Our alpha portfolio turned in a small profit and long/short picks are working well.

Good evening! It was a quiet day today, with our alpha long/short picks working well and more than compensating for the small losses in our beta book.

Positioning and Market View

Today seemed to be a wait-and-watch day before the CPI release tomorrow.

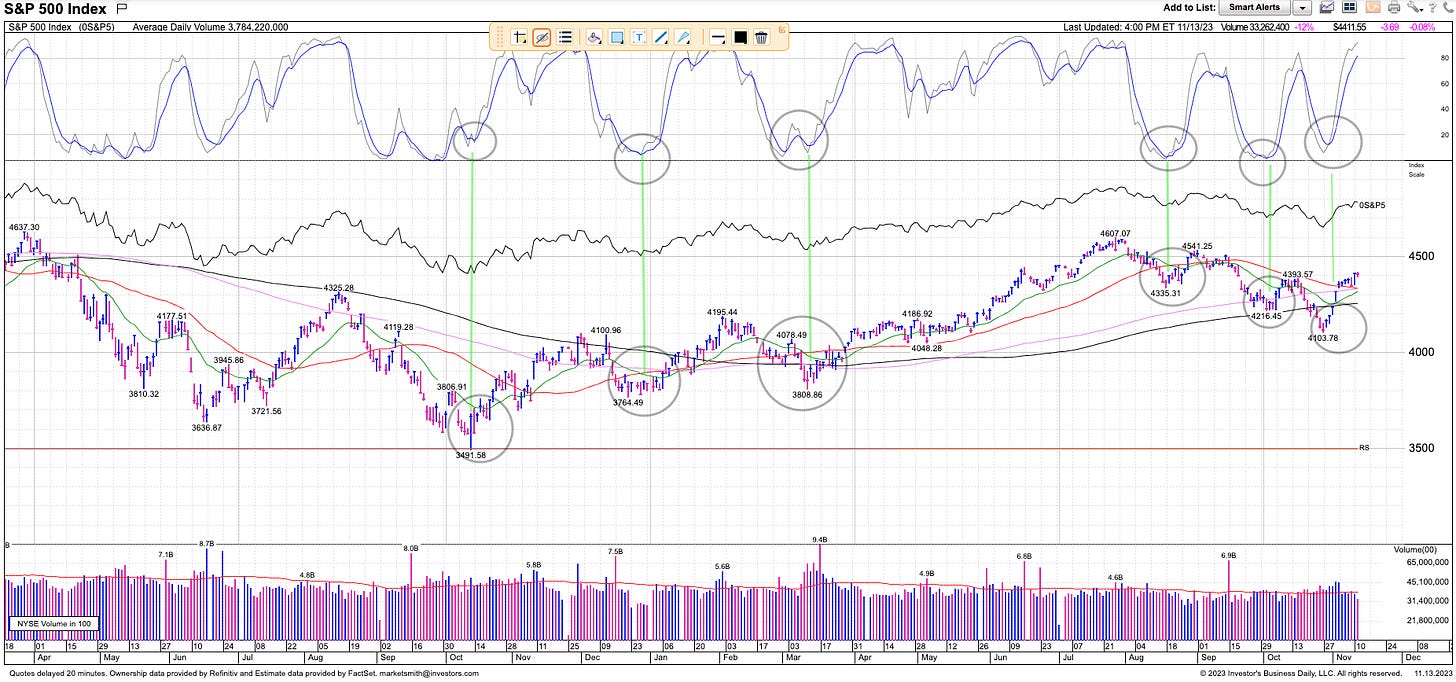

The S&P is in overbought territory but it can stay there for a long time as prior rallies have shown:

Recently, CPI days have not elicited a drastic response (up or down):

Overall, we have a gross exposure of 76% with shorts of 13% for a net-long exposure of 50%.

Portfolio and Performance

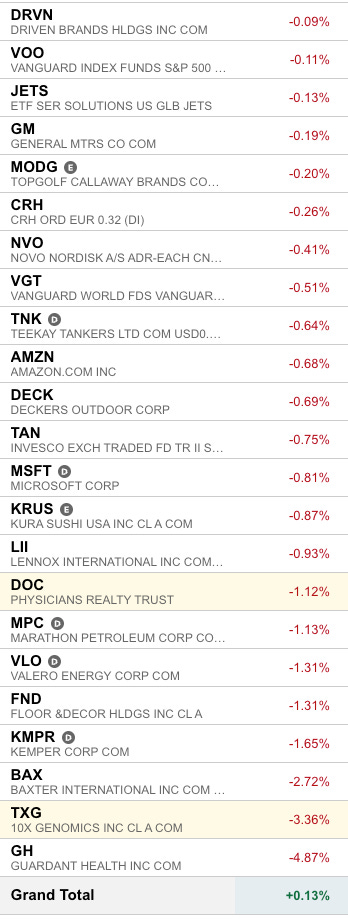

We had several gains in the alpha book today — both longs such as AVAV 0.00%↑ and shorts such as JWN 0.00%↑ (Nordstrom):

These gains helped more than compensate for the losses:

The positions marked in yellow above were new additions today. We also added to NVDA 0.00%↑ on the long side and VOO 0.00%↑ in the beta book.

Watchlist

Here’s what we’re watching for tomorrow:

Long: AKAM 0.00%↑ AIR 0.00%↑ AROC 0.00%↑ FSS 0.00%↑ CW 0.00%↑

Short: IAC 0.00%↑ IRTC 0.00%↑ W 0.00%↑ IRT 0.00%↑ CGNX 0.00%↑ NYCB 0.00%↑ Z 0.00%↑ PEAK 0.00%↑ CUZ 0.00%↑ ADNT 0.00%↑ WBA 0.00%↑ HGV 0.00%↑ UPS 0.00%↑ SHAK 0.00%↑ TKO 0.00%↑

Our long and short selections have both been providing great returns along with a solid foundation of large-cap beta in the form of VOO 0.00%↑ and VGT 0.00%↑ and we think that should continue.

Worth checking out

Great post from @mikegyulai on how most traders are of the NTJ personality type (and I can confirm that I too fall in that camp):

You can check out the complete interview here:

That’s all for now! If you like our work, please share it with your network. We believe in sharing actionable trade ideas in liquid US-listed stocks/ETFs that all investors, big or small, can execute. Your friends will thank you for the added alpha 😊

Happy Trading!