Minerva Market View for Nov 13, 2023

We had our most profitable day of the year on Friday. Here's how we're positioning for the week ahead...

Good evening. We had our strongest daily performance this year on Friday! Will the rally continue this week? Let’s jump in…

Positioning and Market View

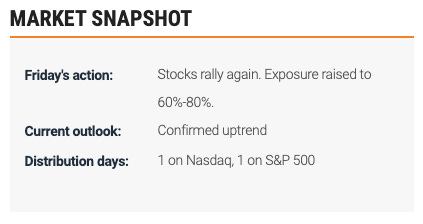

Several leading technical indicators are now decidedly bullish. These include the MarketSmith market snapshot, which is recommending increasing exposure to a range of 60%-80%:

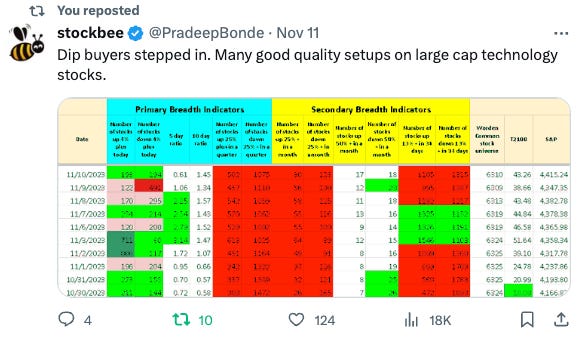

The Stockbee Market Monitor is also pointing neutral to green:

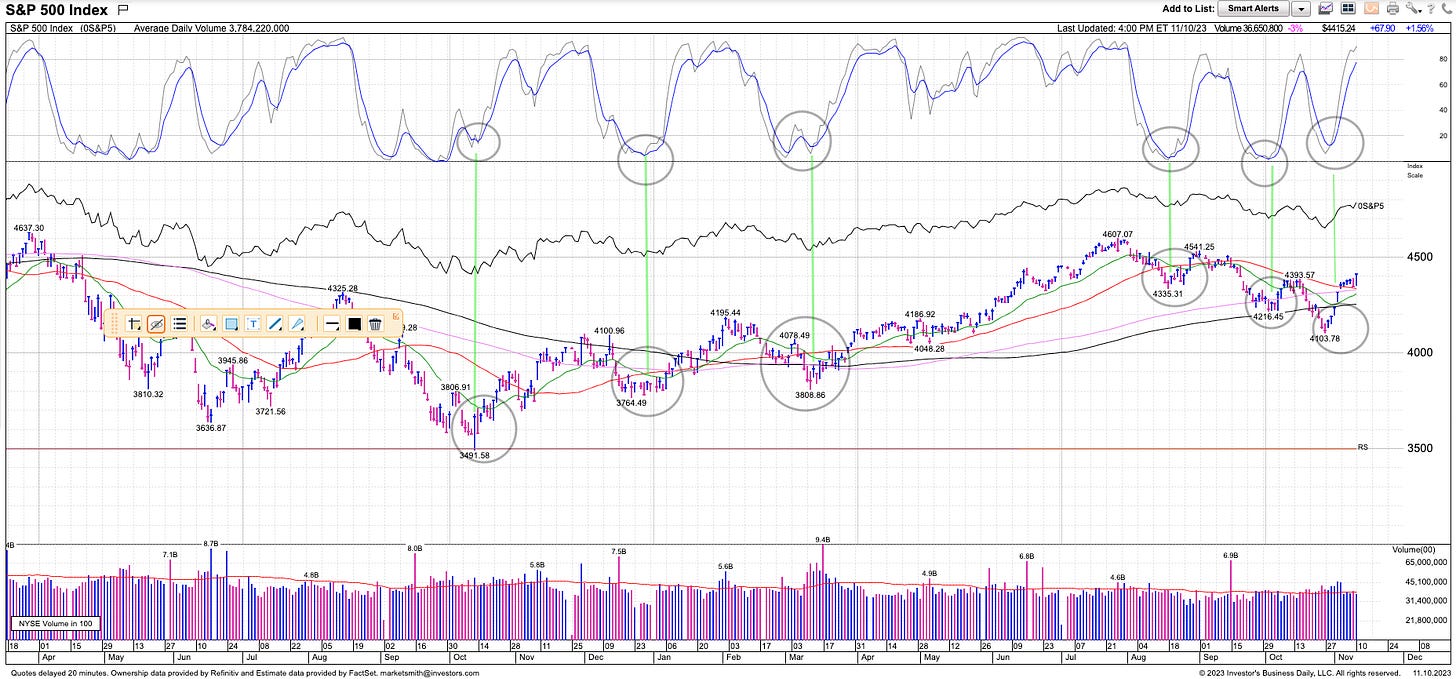

VGT 0.00%↑ which is a proxy for the Nasdaq / Megacap Tech stocks has clearly broken out of its downward trend:

The S&P 500 also closed above the important technical level of 4400:

At the same time, the volume on Friday was lower than the volume on Thursday’s decline. That warrants caution.

We will also get the CPI/PPI reports on Tuesday/Wednesday, which will add to the volatility, especially if they come in much hotter than expected, and increase the chances of further Fed hikes.

Portfolio and Performance

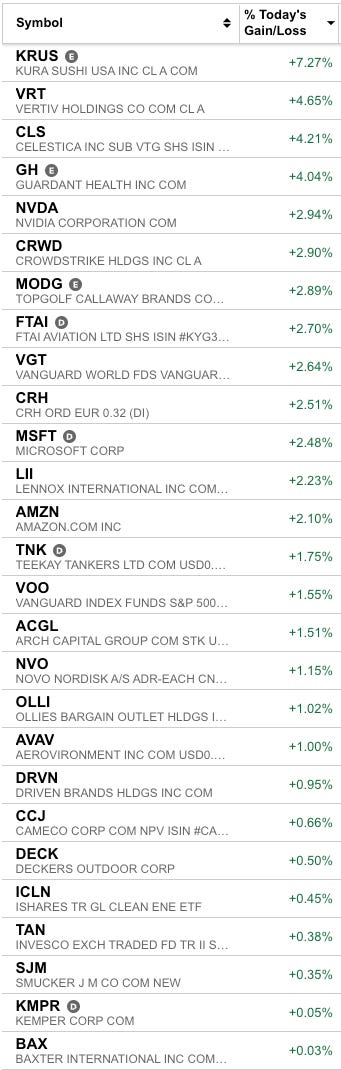

We had several strong performers in our alpha book (both longs and shorts) and the beta book provided further gains on Friday.

Several stocks returned more than 4% such as KRUS 0.00%↑ VRT 0.00%↑ CLS 0.00%↑ and GH 0.00%↑:

They more than covered for the losses on stocks such as ELF 0.00%↑ SHLS 0.00%↑ SONO 0.00%↑ etc:

Our overall long exposure is 46% right now, and we will look to add more longs and shorts depending on the market action this week.

Watchlist

Here’s what we’re watching for tomorrow:

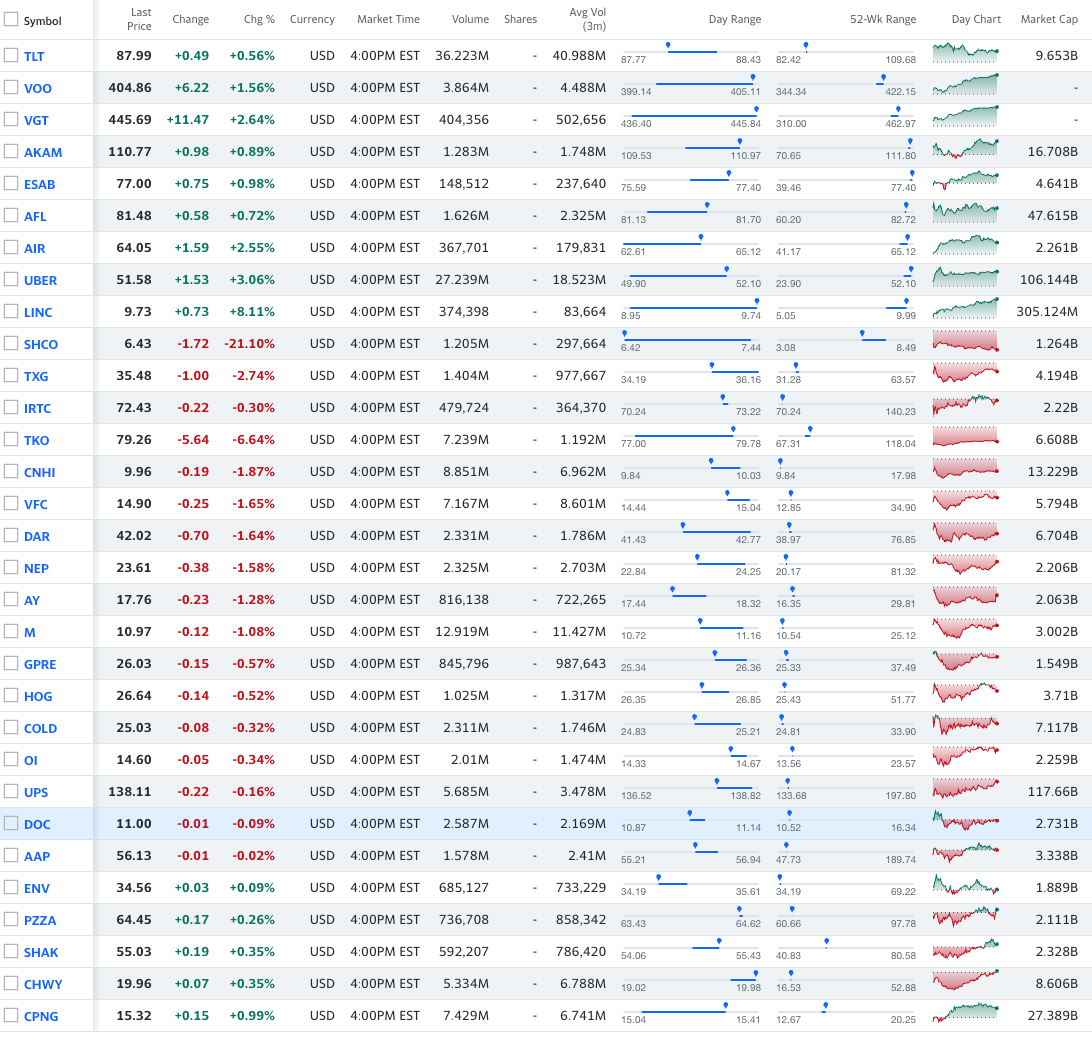

Long: VOO 0.00%↑ VGT 0.00%↑ AKAM 0.00%↑ ESAB 0.00%↑ AFL 0.00%↑ AIR 0.00%↑ UBER 0.00%↑ LINC 0.00%↑

Short: SHCO 0.00%↑ TXG 0.00%↑ IRTC 0.00%↑ TKO 0.00%↑ CNHI 0.00%↑ VFC 0.00%↑ DAR 0.00%↑ NEP 0.00%↑ AY 0.00%↑ M 0.00%↑ GPRE 0.00%↑ HOG 0.00%↑ COLD 0.00%↑ OI 0.00%↑ UPS 0.00%↑ DOC 0.00%↑ AAP 0.00%↑ ENV 0.00%↑ PZZA 0.00%↑ SHAK 0.00%↑ CHWY 0.00%↑ CPNG 0.00%↑

In short, this continues to be a market that rewards good stock selection on the long and short side. And you want some beta exposure to not miss out on the rally if it continues.

Worth checking out

That’s all for now! If you like our work, please share it with your network. We believe in sharing actionable trade ideas in liquid US-listed stocks/ETFs that all investors, big or small, can execute. Your friends will thank you for the added alpha 😊

Happy Trading!