Minerva Market View for Nov 1, 2023

The market is showing signs of a revival. Will it stick?

Good evening and Happy Halloween! Here’s our Market View for Wednesday, November 1st:

Positioning and Market View

The major indices all posted gains today although the price action was tentative. The S&P did show us the first sign that we were looking for yesterday in terms of stochastics confirmed by price and volume action:

Of course, as we noted, such periods in the recent past (shown in the circles on the chart above) were accompanied by volatile price action over the next few days before the indices took off.

We also have headwinds in terms of the Treasury’s QRA (Quarterly Refunding Announcement) tomorrow. The current downturn was largely attributed to the previous QRA, where the Treasury increased the supply of longer-term bonds more than expected, thus driving up long-term yields and driving down bond prices, and along with that, all asset prices.

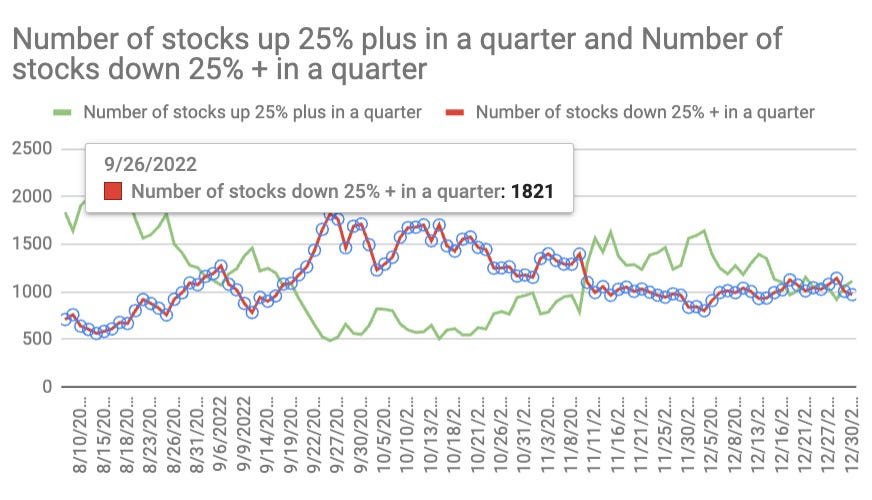

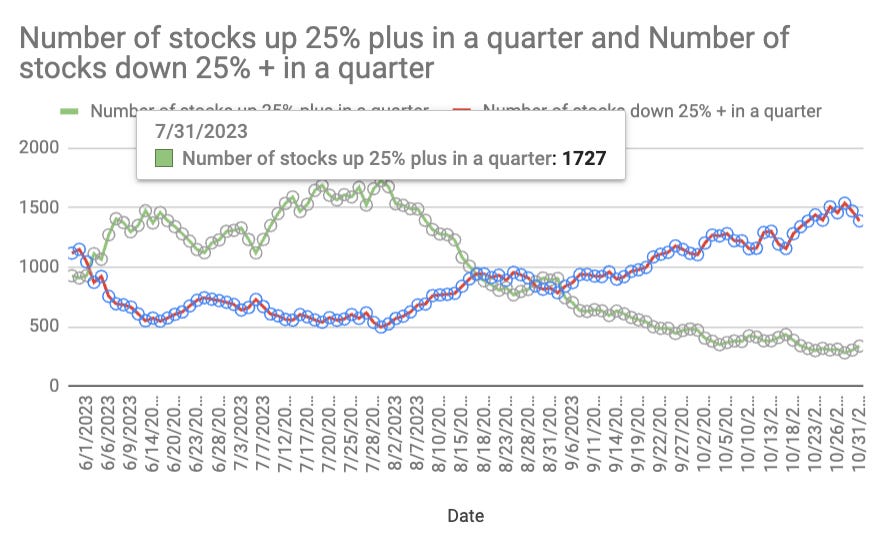

However, we are seeing some other green shoots. Today, a lot of the stocks that we track were in the green. Secondary indicators like the ones below have turned at previous market turning points like the October 2022 bottom and the July 2023 top and seem to be turning again now (time will tell):

Performance

We closed out a lot more of our shorts today, and are now 10% net long. We closed the month at -0.1% compared to the S&P’s -2.2%. This follows a strong September where we gained +1.4% compared to the S&P’s -5% loss.

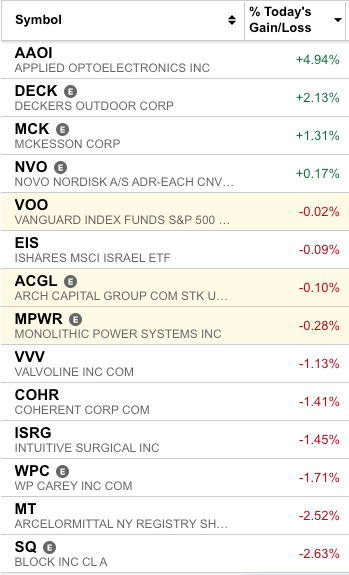

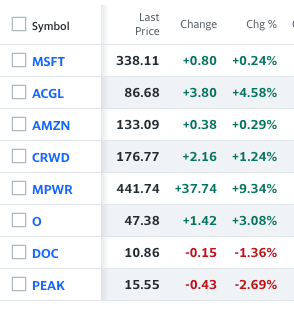

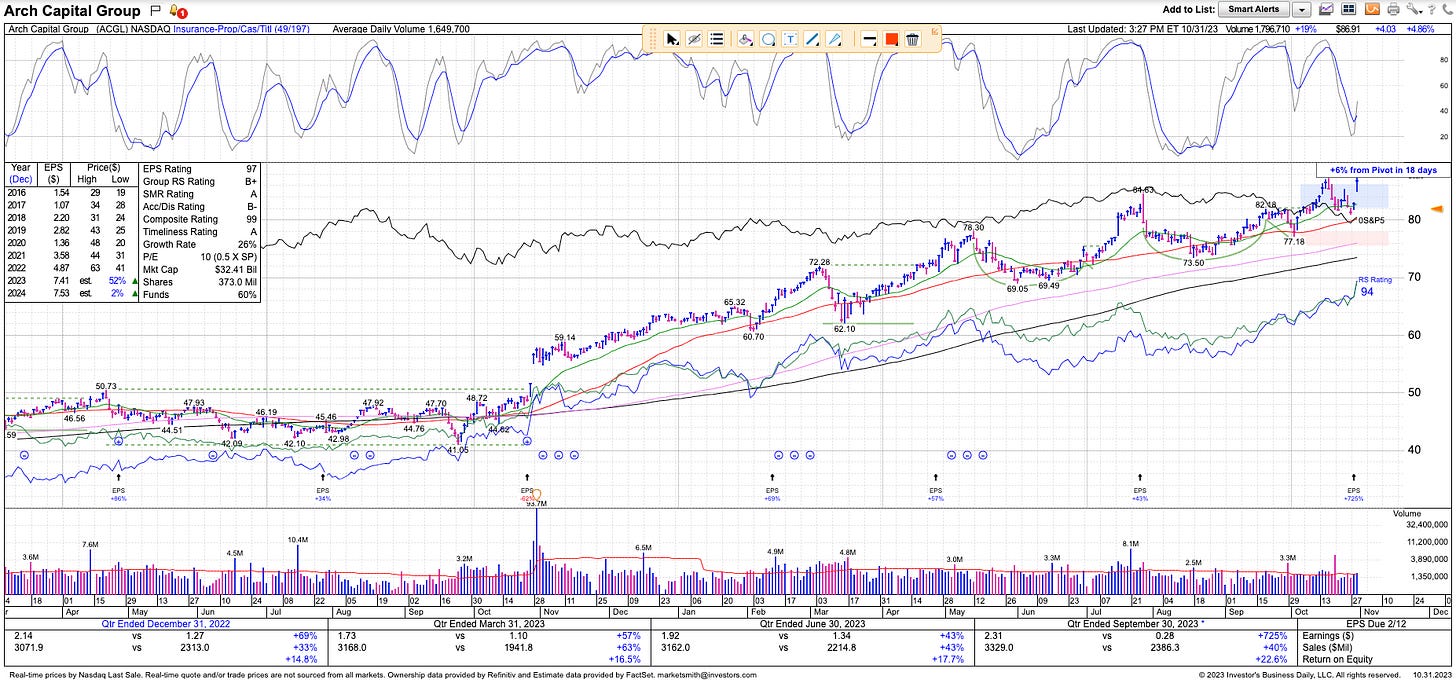

We also added some tentative longs to participate if a rally does indeed hold from these levels: ACGL 0.00%↑ MPWR 0.00%↑ and VOO 0.00%↑

Obviously, almost everything went up today, but some of the long tickers we highlighted yesterday shot up much higher. Most of the shorts were squeezed today. We closed out our O 0.00%↑ position at a profit. The other names in this space PEAK 0.00%↑ and DOC 0.00%↑ fell further today, but considering the possibility of a squeeze, we didn’t enter into those.

Here are the charts for ACGL 0.00%↑ and MPWR 0.00%↑ - they’re still good buys at this range:

Watchlist

Here’s our watchlist for tomorrow:

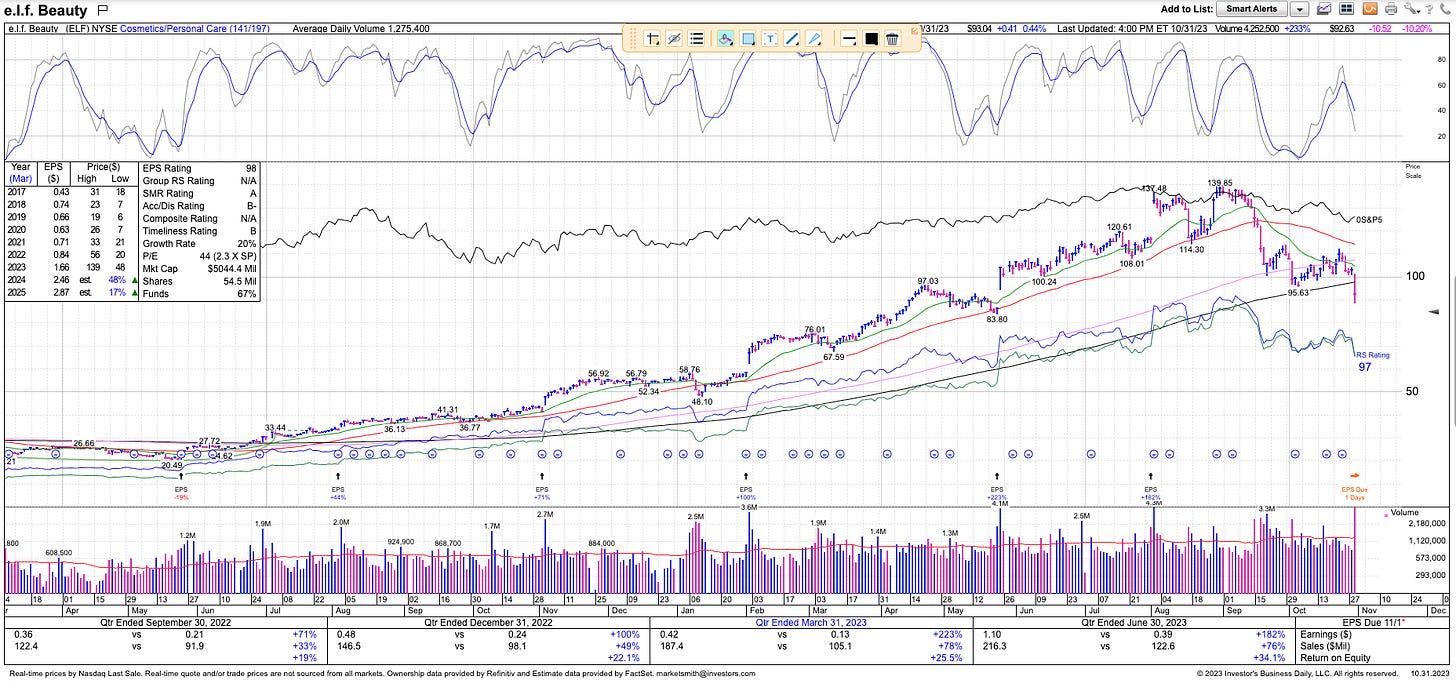

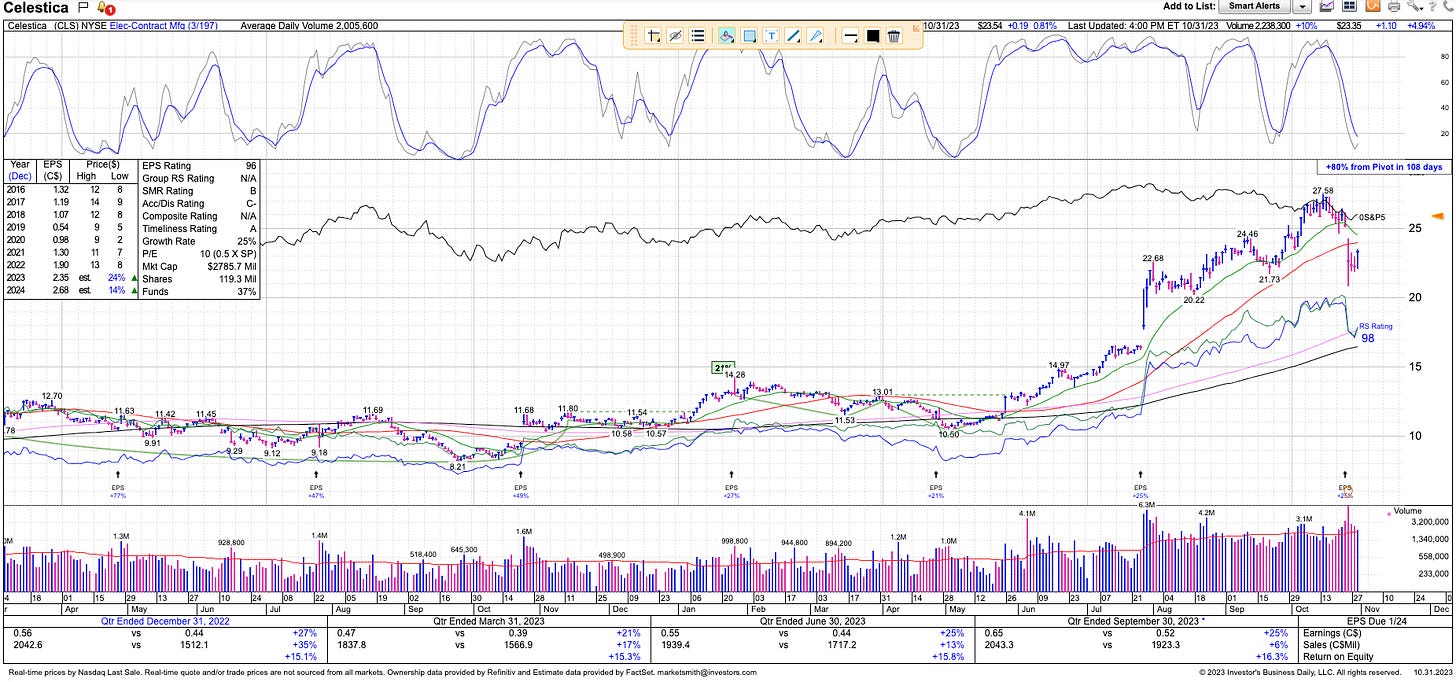

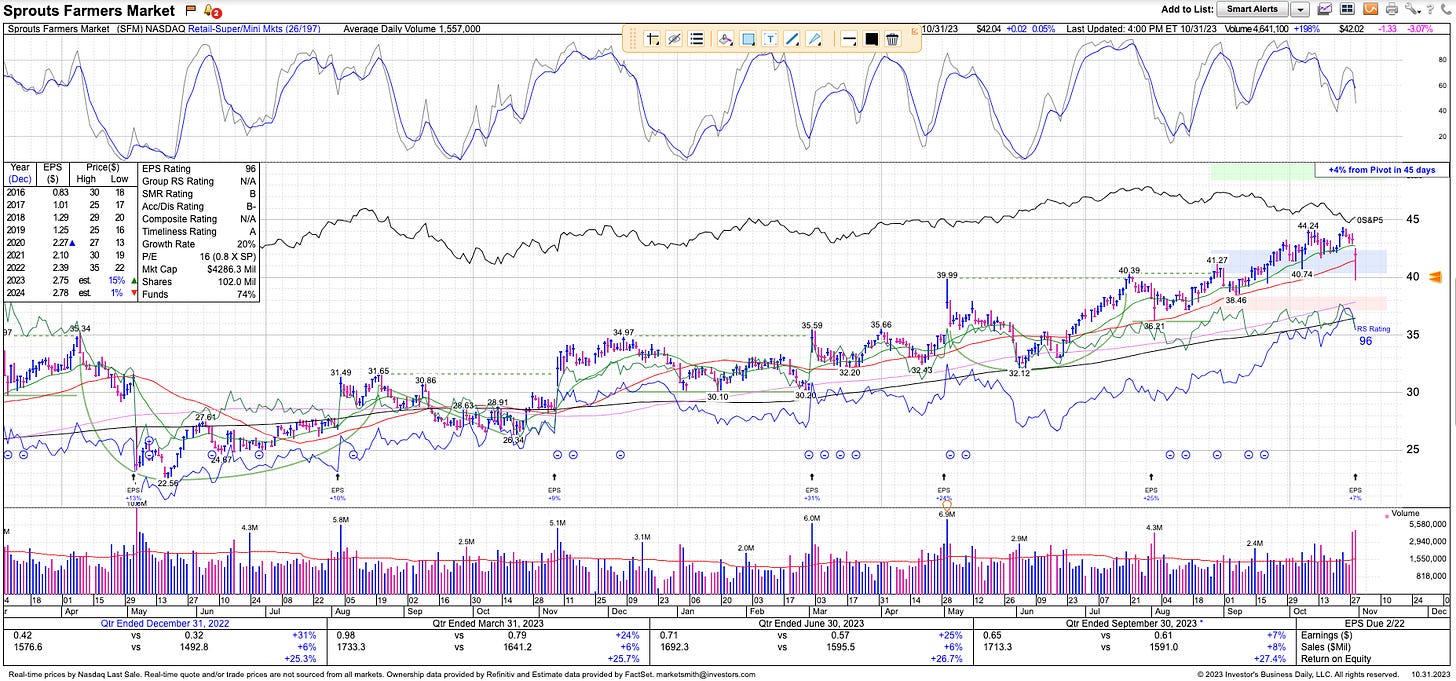

Long: ANET 0.00%↑ CLS 0.00%↑ CRWD 0.00%↑ ELF 0.00%↑ SFM 0.00%↑ TNK 0.00%↑

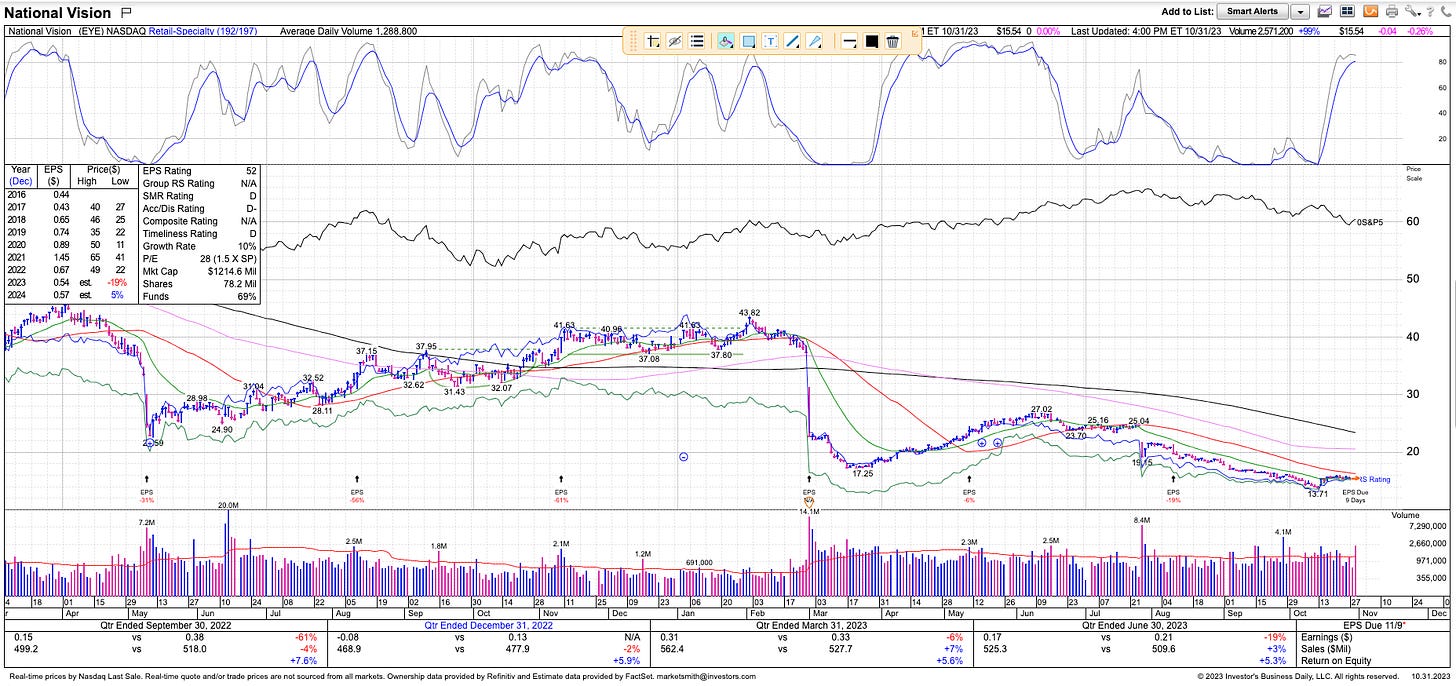

Short: EYE 0.00%↑: only one short today, because everything else looks oversold and likely to bounce.

Since there are fewer names, I will also share the charts to help understand the reasoning behind these. And if any of you have any questions, feel free to chime in in the comments section.

We got stopped out on SFM 0.00%↑ at the 40 stop-loss even though it bounced back later in the day. We will see if we can get back into it.

ICYMI

An interesting macro note from Bridgewater: “An Update from Our CIOs: Entering the Second Stage of Tightening” with my highlights and excerpt below. Their entire research section is worth checking out and subscribing to.

That’s all for now! If you like our work, please do like / share it among your network. We believe in sharing actionable trade ideas in liquid US-listed stocks that all investors, big or small, can execute. We just got started on Substack a couple of weeks back and could really use the added support!

Happy Trading! 🎃