Minerva Market View for Jan 30, 2024

Today we discuss how we're positioning for the QRA/FOMC and after...

Good evening! Today, the Treasury with its QRA (Quarterly Refunding Announcement) has given a taste of what to expect on Wednesday when they share the details of how the borrowing will be split between bills (short-term) and bonds (longer-duration). Most of the market watchers I respect expect the Treasury to support the markets. With inflation falling rapidly, the FOMC is also expected to be dovish – with either rate cuts starting in March, or with dovish messaging around rate cuts starting in May.

Both of these developments should be supportive of risk assets, and we saw a preview of that today with ARKK 0.00%↑ rallying close to 5%. If events do indeed play out as anticipated, we can see a repeat of Oct-Nov price action. Here are some of the candidates I have identified as potentially rate-sensitive:

Falling rates = falling dollar = rising bond prices = beneficial for anything that needs cheap capital = risk on

Long-term bonds: TLT 0.00%↑ / VGLT 0.00%↑

Biotech: XBI 0.00%↑ / ARKG 0.00%↑

Small-cap: IWM 0.00%↑ / VTWO 0.00%↑

Solar / EV: TAN 0.00%↑

M-REITs: AGNC 0.00%↑ NLY 0.00%↑

REITs: VNQ 0.00%↑

Homebuilders: XHB 0.00%↑ ITB 0.00%↑

Emerging Equities: EEM 0.00%↑ / EMXC 0.00%↑

Emerging Bonds: EMLC 0.00%↑

Innovation / Speculative: ARKK 0.00%↑ ARKF 0.00%↑

Not all of these will benefit to the same degree, so the key will be to watch the price action and build a diversified portfolio that combines the most beneficial elements.

Portfolio and Performance

Our portfolio is already exposed to a lot of these factors and we saw a nice pop today, with several of our holdings gaining more than 2% on the day:

The only notable loser was our TSLA 0.00%↑ short, which we’re still holding as we think it has more downside after it fills the gap to 195 or so.

Right now, we’re about 70% net long and looking at increasing exposure if the thesis outlined above plays out. We’re also mindful that February-March isn’t the best from a seasonal point of view. We can reconcile some of these factors if small-caps, mid-caps, and the broader market starts rallying more than the mega-caps.

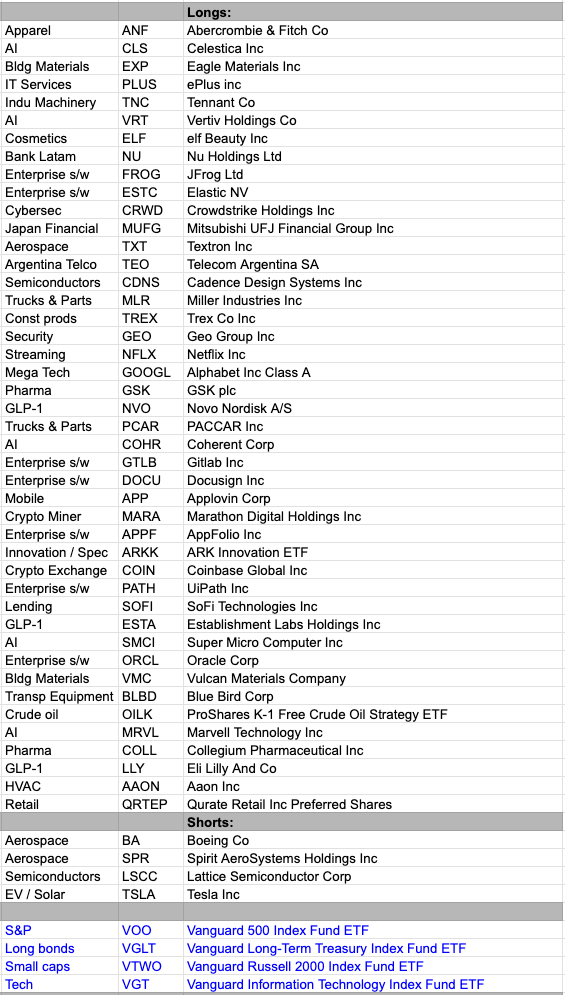

Here’s what our portfolio looks like currently:

Watchlist

Here are the names we’re watching for tomorrow:

Dividend plays: PBR 0.00%↑ $PBR-A NLY 0.00%↑ AGNC 0.00%↑

Falling rates: BLND 0.00%↑ EXR 0.00%↑ RKT 0.00%↑ LC 0.00%↑ TREE 0.00%↑

Setting up bases: FOUR 0.00%↑ REVG 0.00%↑ DFH 0.00%↑ RPD 0.00%↑

ETFs taking off: WGMI 0.00%↑ ARKG 0.00%↑ KRE 0.00%↑

Short candidates: TAL 0.00%↑

Worth checking out

To anyone who dismisses AI as a mere "toy", show them these examples from a16z and remind them that the iPhone and the PC were also dismissed as "toys" when they came out and today they're responsible for two $3T companies:

Source: The Future of Prosumer: The Rise of “AI Native” Workflows

That’s all for now. Happy Trading! Make sure to follow @MinervaCap on Twitter for real-time updates.