Minerva Market View for Jan 22, 2024

Are we getting into the giddy bubble days of 2020-21? And some other themes for the year...

Good evening! Today we examine if seeing early signs of a 2020-21 asset bubble starting in assets. To wit, these tweets from noted short-sellers Jim Chanos and Nate Anderson (of Hindenburg):

Astute observers also commented about the rise of shitcoins, NFTs, and stocks of companies with no fundamentals. Now, as traders, our first impulse when we see a new bubble just forming is not to run away but rather towards it. Let us see how these things play out over the next few days and weeks, but this is something we will be watching closely.

Here are some other themes that we’re observing playing out so far:

Long-duration interest rates zig-zagging: it looks like 10-year rates are falling again. This will likely give support to risk assets such as ARKK 0.00%↑ IWM 0.00%↑(small caps), XBI 0.00%↑ (biotech), KRE 0.00%↑ regional banks and homebuilders and pretty much any rate-sensitive sector. If and when rates were to climb again, these would reverse. We will cover some stock plays below.

Election outcomes: we have no political affiliations and neither do we let politics get in the way of making money. That said, as Trump’s chances have improved, stocks such as $FNMA $FNMAS $FMCC DWAC 0.00%↑ RUM 0.00%↑ etc. have shot up and many of them could still have a long way to go (remember this can work in reverse as well).

Portfolio and Performance

We had a great day today, with several stocks and ETFs popping:

Losers were limited to just a couple of stocks:

We added several stocks from yesterday’s watchlist and are now ~65% net-long.

Watchlist

Here’s what we’re watching for tomorrow:

Long: KRE 0.00%↑ ARKK 0.00%↑ AZEK 0.00%↑ AMRX 0.00%↑ CLBT 0.00%↑ LMB 0.00%↑ ITRI 0.00%↑ PATH 0.00%↑ ELF 0.00%↑ GCT 0.00%↑ ELTK 0.00%↑ REAX 0.00%↑ DBRG 0.00%↑ GTN 0.00%↑ HOUS 0.00%↑ PATH 0.00%↑ RDFN 0.00%↑ OPEN 0.00%↑ APP 0.00%↑ RUM 0.00%↑ GRFS 0.00%↑ DCGO 0.00%↑ UPST 0.00%↑ CVNA 0.00%↑ AFRM 0.00%↑ BLBD 0.00%↑ CIEN 0.00%↑ MU 0.00%↑ QCOM 0.00%↑ ANET 0.00%↑ CRDO 0.00%↑ DOCN 0.00%↑ NICE 0.00%↑

Short: ABR 0.00%↑ COCO 0.00%↑

Worth checking out

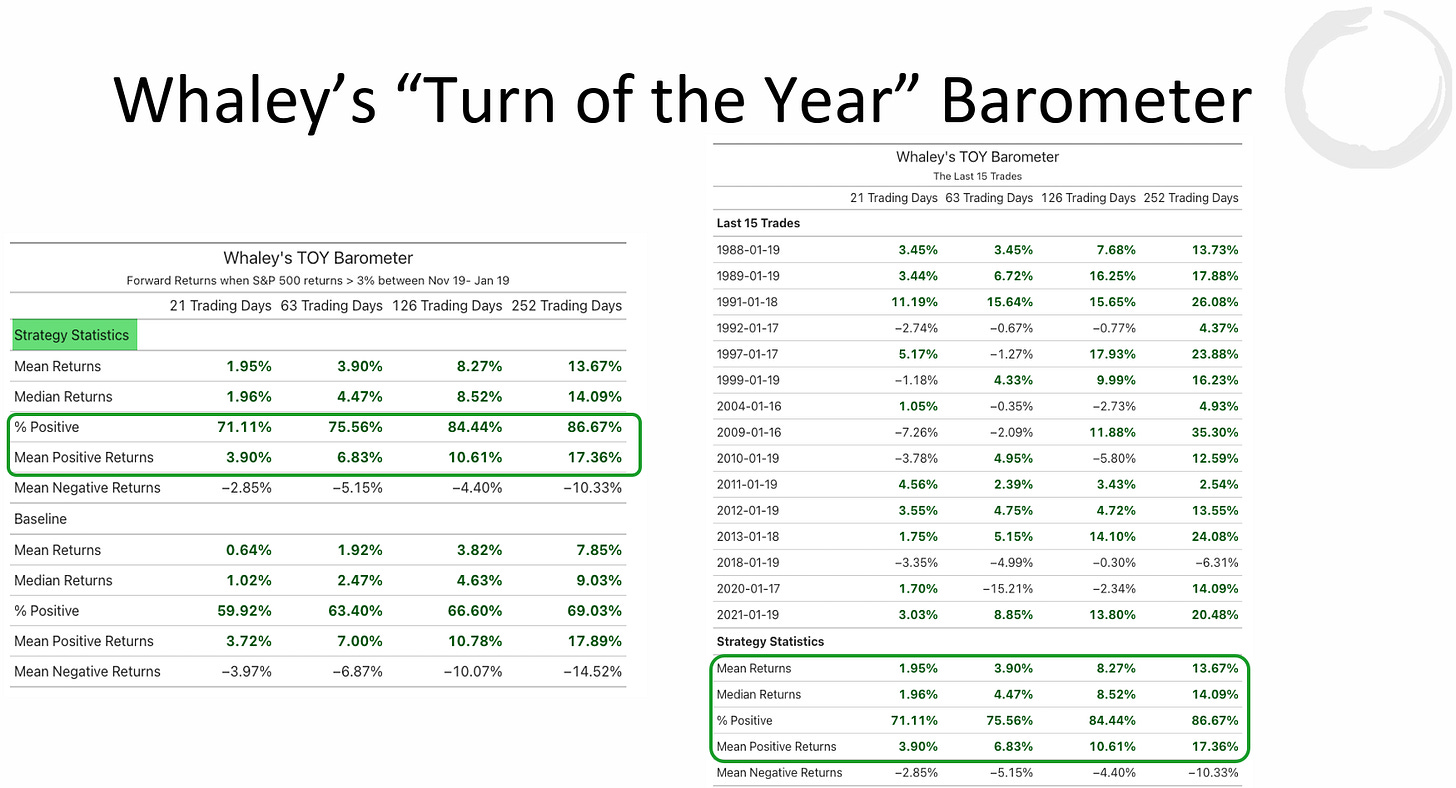

Some of the impressive price action we’ve been seeing despite the weak underlying technicals is due to several breadth thrusts that have been triggered recently. This whitepaper from Wayne Whaley covers several of them:

Wayne Whaley is a legendary quant who once remarked that if he were limited to using only one indicator for betting on trend direction for the year, it’d be his TOY (Turn Of Year) Barometer. There’s a good reason for this. A bullish TOY signal has a very high win rate. You can find more on how the TOY Barometer is constructed here. This barometer fired a bullish signal this past week.

Neil Dutta is one of the few economists who got 2023 right. In this podcast, he shares how his outlook differed from those of other mainstream economists and what he sees for 2024:

That’s all for now. Happy Trading!

Disclaimer: This post is for professional investors only and is shared with other like-minded investors for the exchange of views and informational purposes only. Please see the disclosures and disclaimers for more details and always note, we may be entirely wrong and/or may change our mind at any time. This is NOT investment advice, please do your own due diligence.

Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.