Minerva Market View for Jan 22, 2024

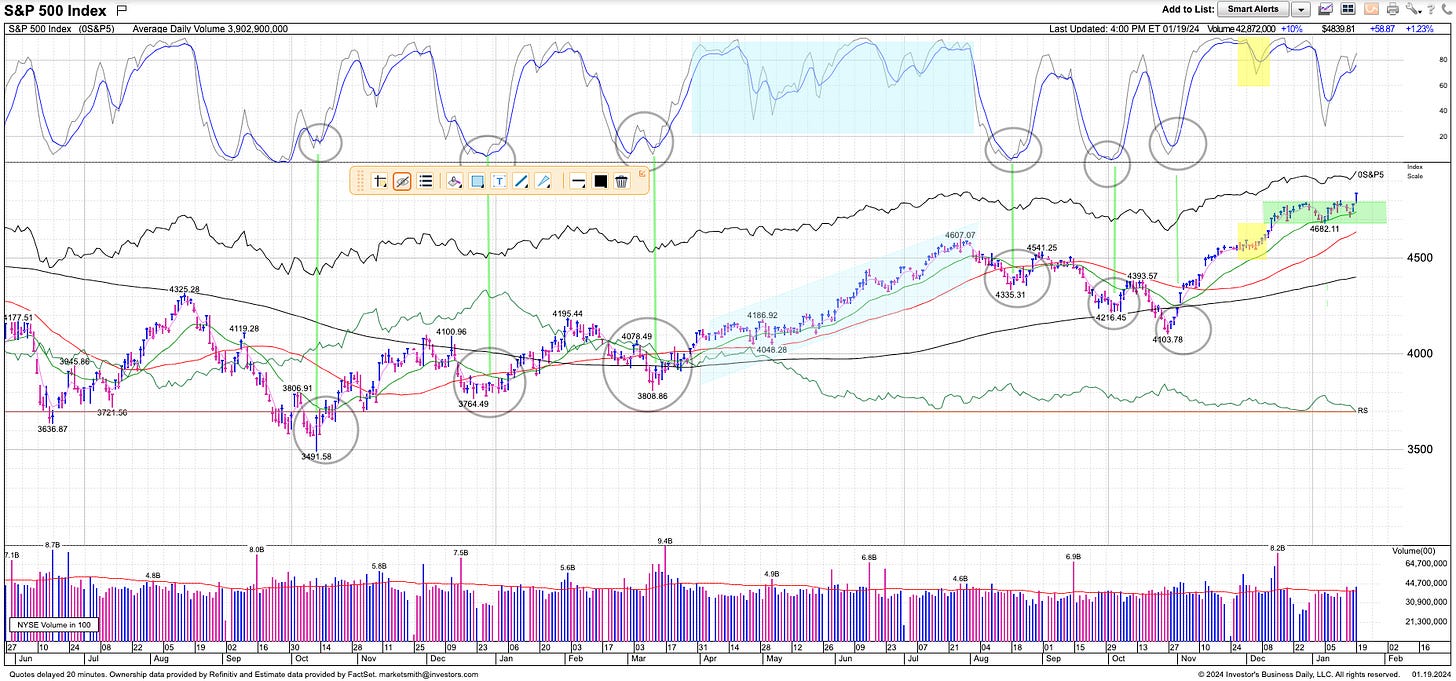

A quick update to note that we're turning cautiously optimistic and looking at scaling up our exposure along with some caveats.

The Nasdaq / QQQ 0.00%↑ popping up >1.5% on high volume on Friday gave us the bullish indicator we were looking for. With this, we're cautiously optimistic and looking at scaling up our exposure, especially on Tech and AI stocks.

The caution stems from various internals not yet confirming this bullish move and macro data releases this week that might lead to choppiness.

A decisive break below the recent range would make us cut our exposure. For now, the risk/reward favors a continuation of the bull run and we will look at puts and trailing stops to hedge.

Portfolio and Performance

Several of our holdings posted >3% gains on Friday (primarily AI-related stocks and some preferred shares) and there were no major losers.

Watchlist

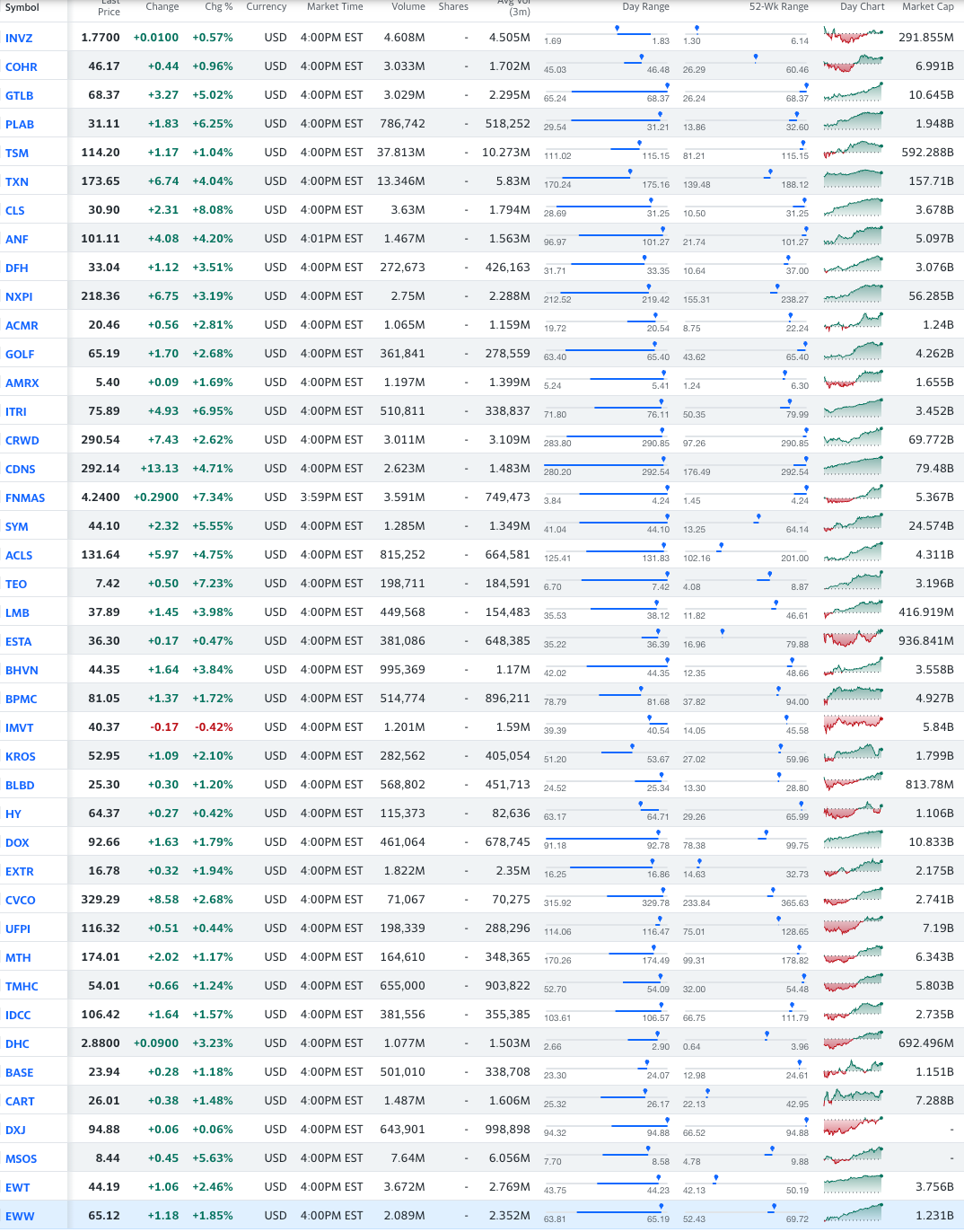

Several stocks and ETFs on the watchlist for tomorrow:

Stocks: INVZ 0.00%↑ COHR 0.00%↑ GTLB 0.00%↑ PLAB 0.00%↑ TSM 0.00%↑ TXN 0.00%↑ CLS 0.00%↑ ANF 0.00%↑ DFH 0.00%↑ NXPI 0.00%↑ ACMR 0.00%↑ GOLF 0.00%↑ AMRX 0.00%↑ ITRI 0.00%↑ CRWD 0.00%↑ CDNS 0.00%↑ $FNMAS SYM 0.00%↑ ACLS 0.00%↑ TEO 0.00%↑ LMB 0.00%↑ ESTA 0.00%↑ BHVN 0.00%↑ BPMC 0.00%↑ IMVT 0.00%↑ KROS 0.00%↑ BLBD 0.00%↑ HY 0.00%↑ DOX 0.00%↑ EXTR 0.00%↑ CVCO 0.00%↑ UFPI 0.00%↑ MTH 0.00%↑ TMHC 0.00%↑ IDCC 0.00%↑ DHC 0.00%↑ BASE 0.00%↑ CART 0.00%↑

ETFs: DXJ 0.00%↑ MSOS 0.00%↑ EWT 0.00%↑ EWW 0.00%↑

That’s all for now - happy trading!