Minerva Market View for Jan 2, 2024

Are we entering a correction or is it still BTFD? Let's figure out...

Good evening! We started the New Year with a dip. Now the question on everyone’s mind is whether this is a brief pause or a more serious correction in the making. Let’s see what the tape and data are telling us.

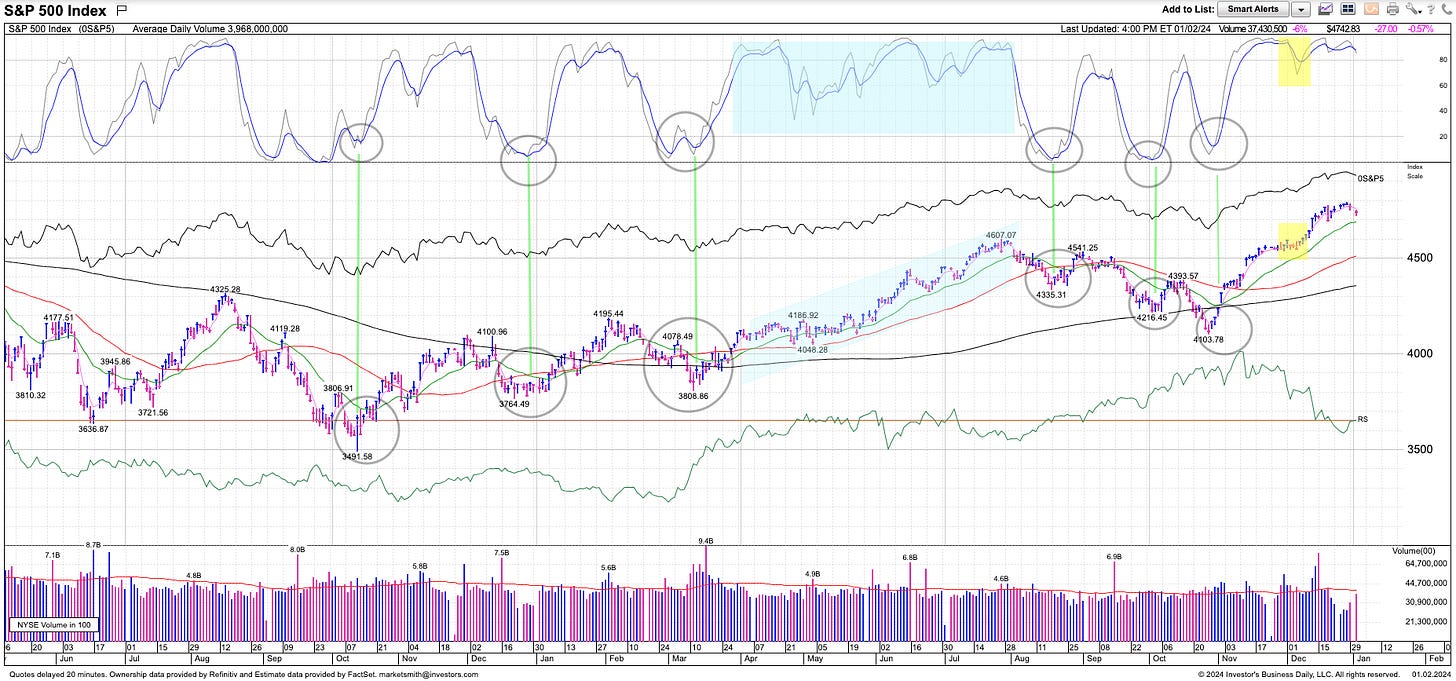

The major indices did have a distribution day today i.e. a sizeable decline on higher volume. Having said that, no alarm bells are ringing yet on the S&P chart:

Today, we got stopped out on many of our profitable tech positions that we were protecting with trailing stops. We’ve been negative on most of mega-cap tech for a while, so that helped. With today's dip, we’re now up to 3 distribution days in the recent cycle. That does warrant additional caution, as shown by this reduction in recommended exposure down to a range of 60-80% by MarketSmith:

The NYSE A/D line also took a hit, due to the weaker breadth, but is above its 10-day moving average so far. Previous corrections have generally coincided with it breaking below:

All in all, these technical indicators point to increased caution, but still within the broadly bullish theme. If two more distribution days show up soon, then we will be much more cautious.

Portfolio and Performance

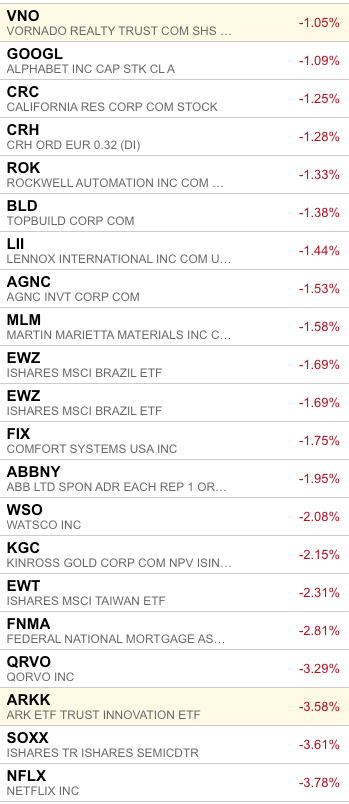

Today our portfolio took a beating along with the market. We’re now out of almost all our Tech names, except for GOOGL 0.00%↑ and NFLX 0.00%↑ which have not hit their stops yet.

Today’s theme was rotation to value and more defensive sectors. Almost everything that had gone up indiscriminately over the last two months got sold off (with the notable exception of the crypto space). We will watch to see whether that continues.

Here are our major movers from today – much more red than green:

If this is indeed a buyable dip, the stocks that go through it without falling too hard will be good ones to hold for the bounce. If not, we will be looking at trimming further exposure.

Several names from yesterday’s watchlist did well today. We added COLL 0.00%↑ LLY 0.00%↑ and VNO 0.00%↑ on the long side and AAPL 0.00%↑ APP 0.00%↑ , and OKTA 0.00%↑ on the short side.

Watchlist

Here is our watchlist for tomorrow:

Long: XLU 0.00%↑ XLV 0.00%↑ XLP 0.00%↑ DAKT 0.00%↑ HCI 0.00%↑ GOLF 0.00%↑ BLX 0.00%↑ NET 0.00%↑ TBT 0.00%↑ ARGT 0.00%↑

Short: RELY 0.00%↑ HAS 0.00%↑ FLYW 0.00%↑ ABR 0.00%↑ IOT 0.00%↑ MDB 0.00%↑ PRO 0.00%↑ MDXG 0.00%↑

Of these, BLX 0.00%↑ is interesting because it combines several themes: it’s a Latin American bank, that’s in a buy zone from a stage 2 consolidation phase after a nice uptrend and still trades at a 6 P/E:

Worth checking out

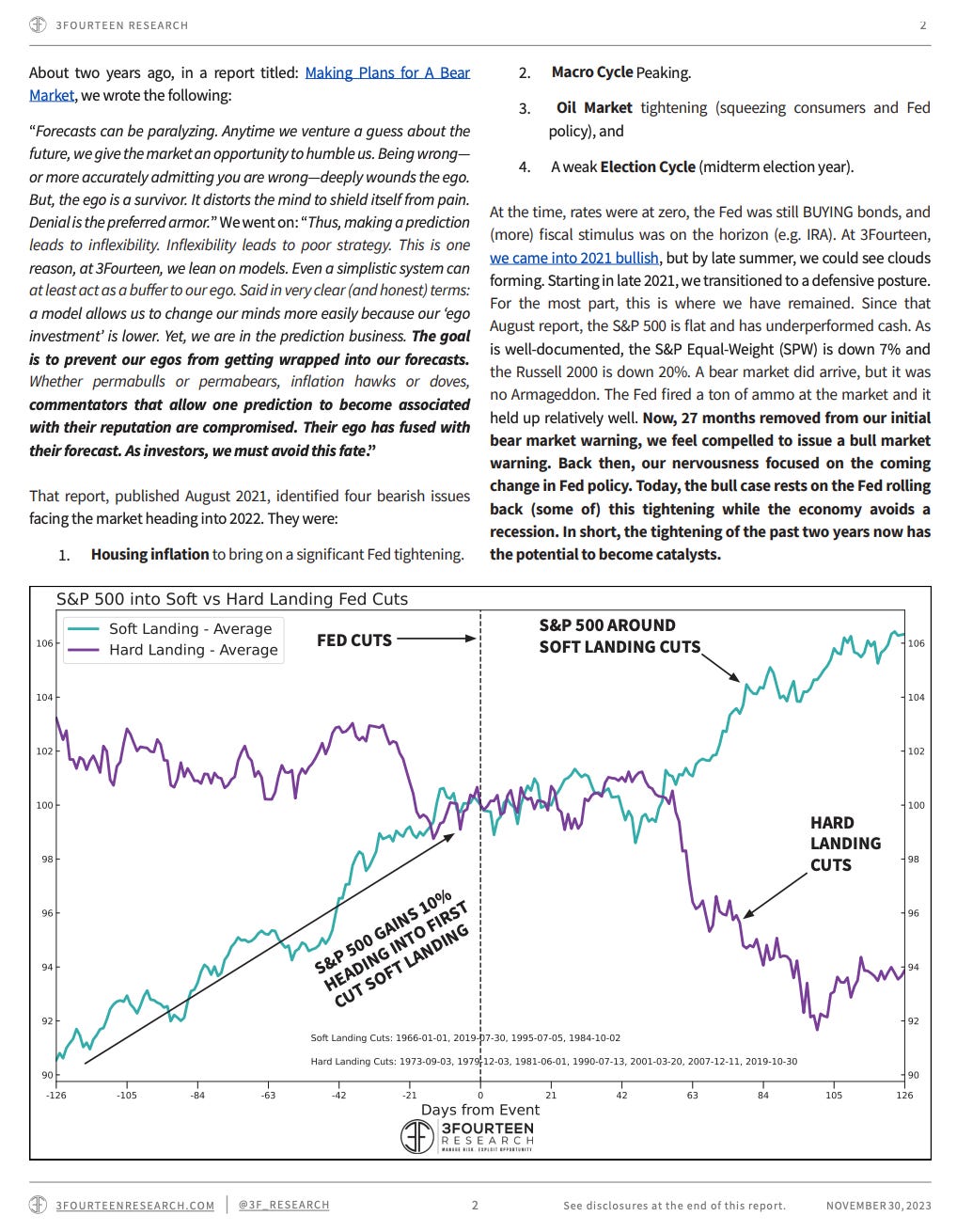

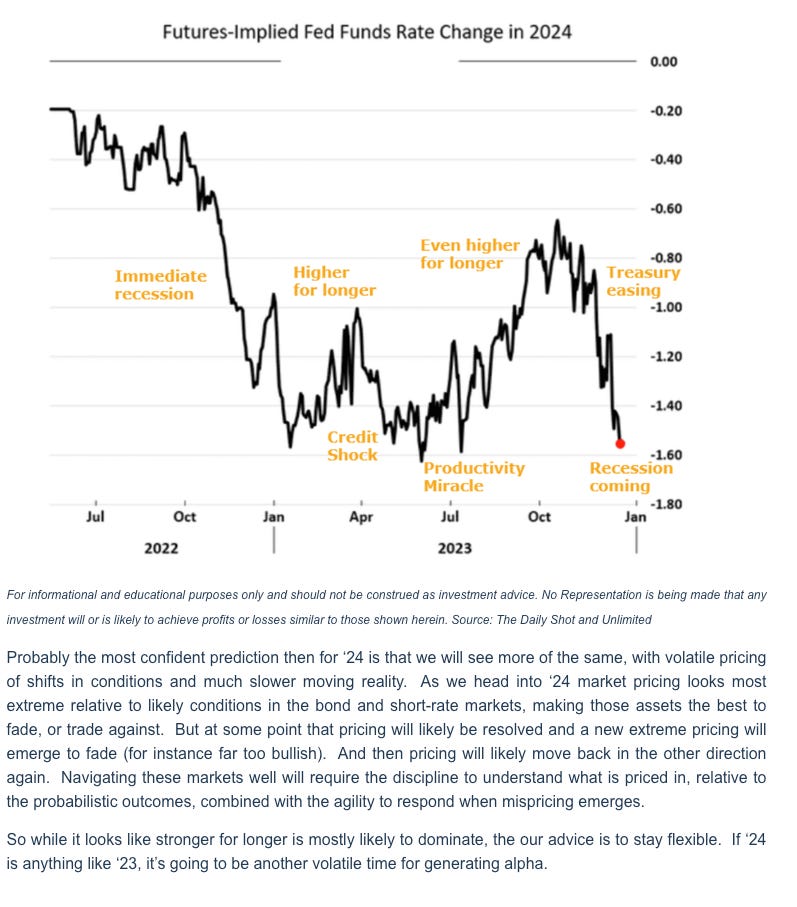

In this podcast, Darius Dale predicts a bullish three-month outlook for US stocks, bonds, and crypto and a bearish three-month outlook for the US dollar. He says these are all positive signals suggesting that the current Goldilocks regime is likely to persist for at least the next three months, perhaps longer.

That’s all for today - happy trading!