Minerva Market View for Jan 17, 2024

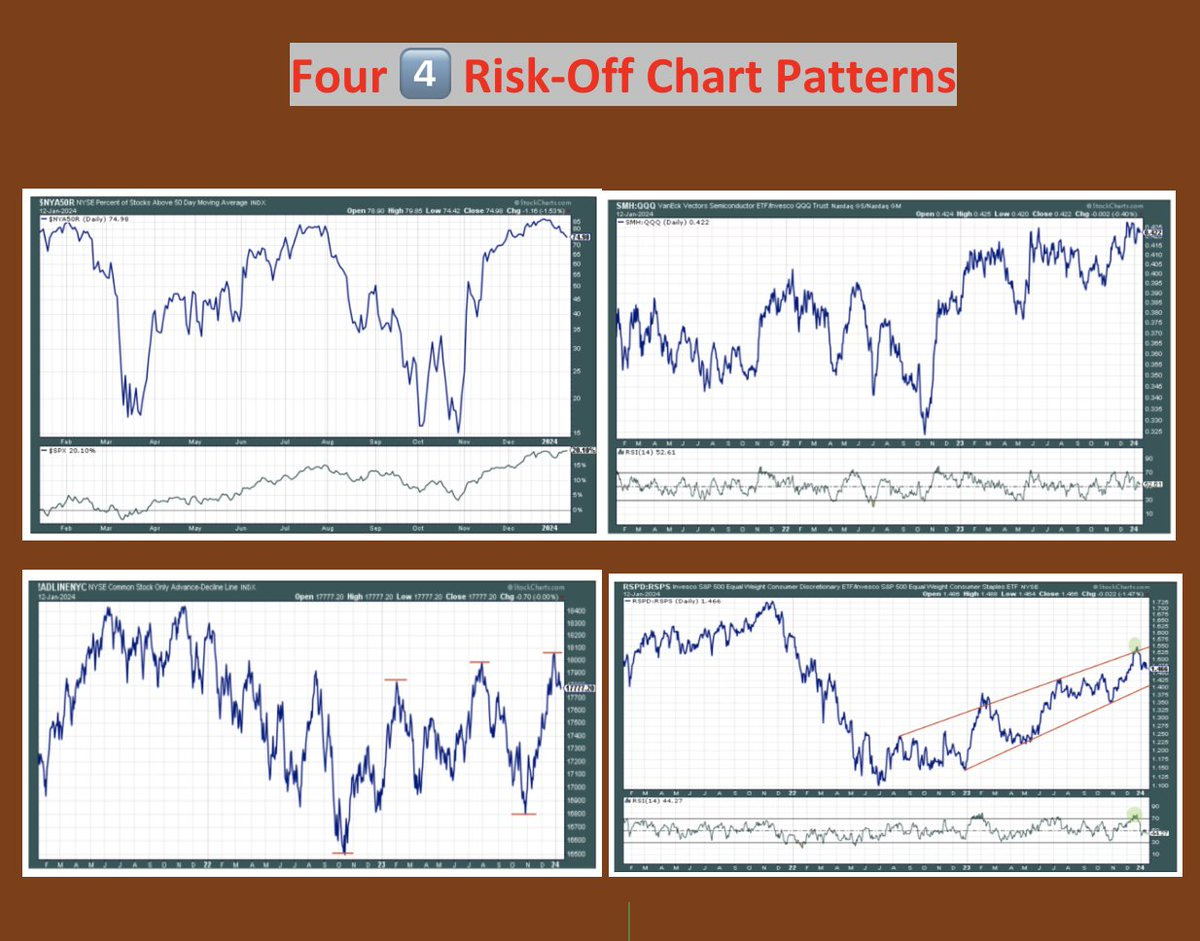

We might be in a near-term topping process. Caution is warranted.

Good evening! We are seeing several warning signs flash. We might be forming a near-term top, and defensive strategies will likely be needed for the next few weeks.

From a sentiment perspective, many permabears have thrown in the towel turning bullish while those who got a lot of things right are turning more cautious:

The NYSE Advance/Decline line topped towards the end of December and has been in a steady decline since, which typically coincides with downturns:

Broader momentum indicators have also been steadily deteriorating:

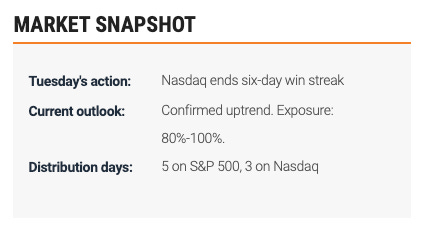

Today, we had the fifth distribution day on the S&P 500 in the last 5 weeks, another reliable indicator of a near-term top.

Portfolio and Performance

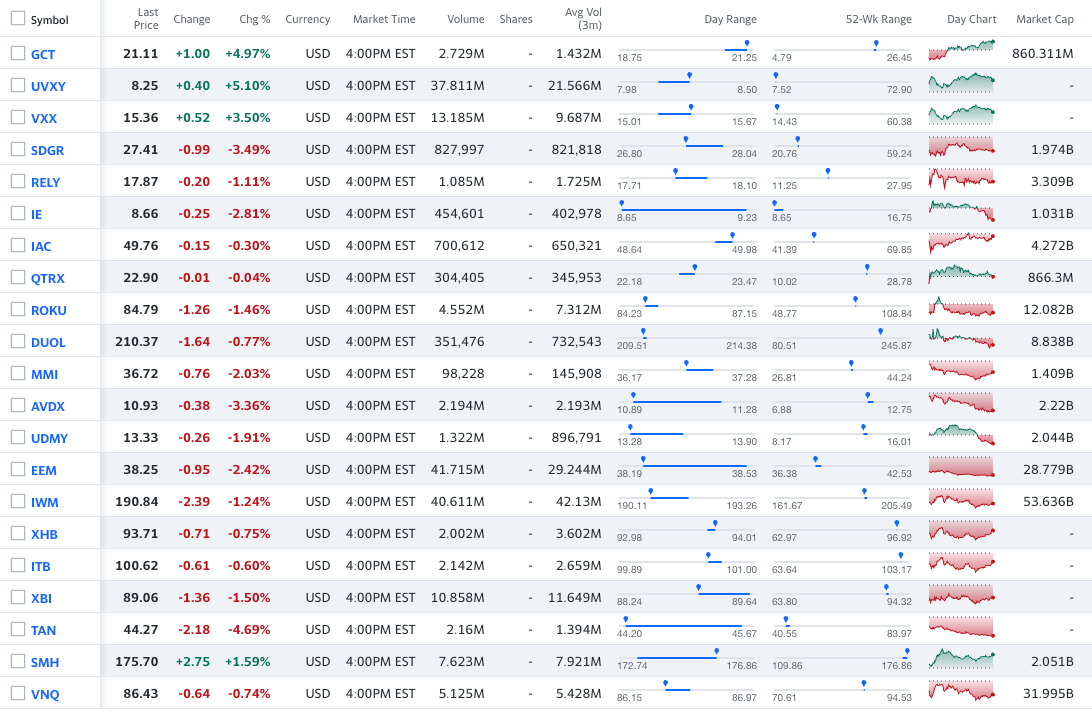

Our portfolio also dipped along with the SPY 0.00%↑ today. Here are the major movers:

We will be looking at tightening our stops and cutting stragglers. The next few days might offer some upside and a chance for us to load up on some more shorts and defensive puts.

Watchlist

For tomorrow, we have a lot of short candidates that we’re looking at. A lot of these are rate-sensitive sectors that ran up on hopes of rate cuts. If rates and the dollar start moving upward, these will be impacted the most:

Long:

Volatility ETFs: UVXY 0.00%↑ VXX 0.00%↑

Stock: GCT 0.00%↑

Short:

Rate-sensitive sectors: EEM 0.00%↑ IWM 0.00%↑ XHB 0.00%↑ ITB 0.00%↑ XBI 0.00%↑ TAN 0.00%↑ SMH 0.00%↑ VNQ 0.00%↑

Stocks: SDGR 0.00%↑ RELY 0.00%↑ IE 0.00%↑ IAC 0.00%↑ QTRX 0.00%↑ ROKU 0.00%↑ DUOL 0.00%↑ MMI 0.00%↑ AVDX 0.00%↑ UDMY 0.00%↑

Worth checking out

That’s all for now - happy trading!