Minerva Market View for Feb 7, 2024

Here are the key themes we are observing in the markets...

Good evening! Here are the 3 key themes we are observing in the market currently:

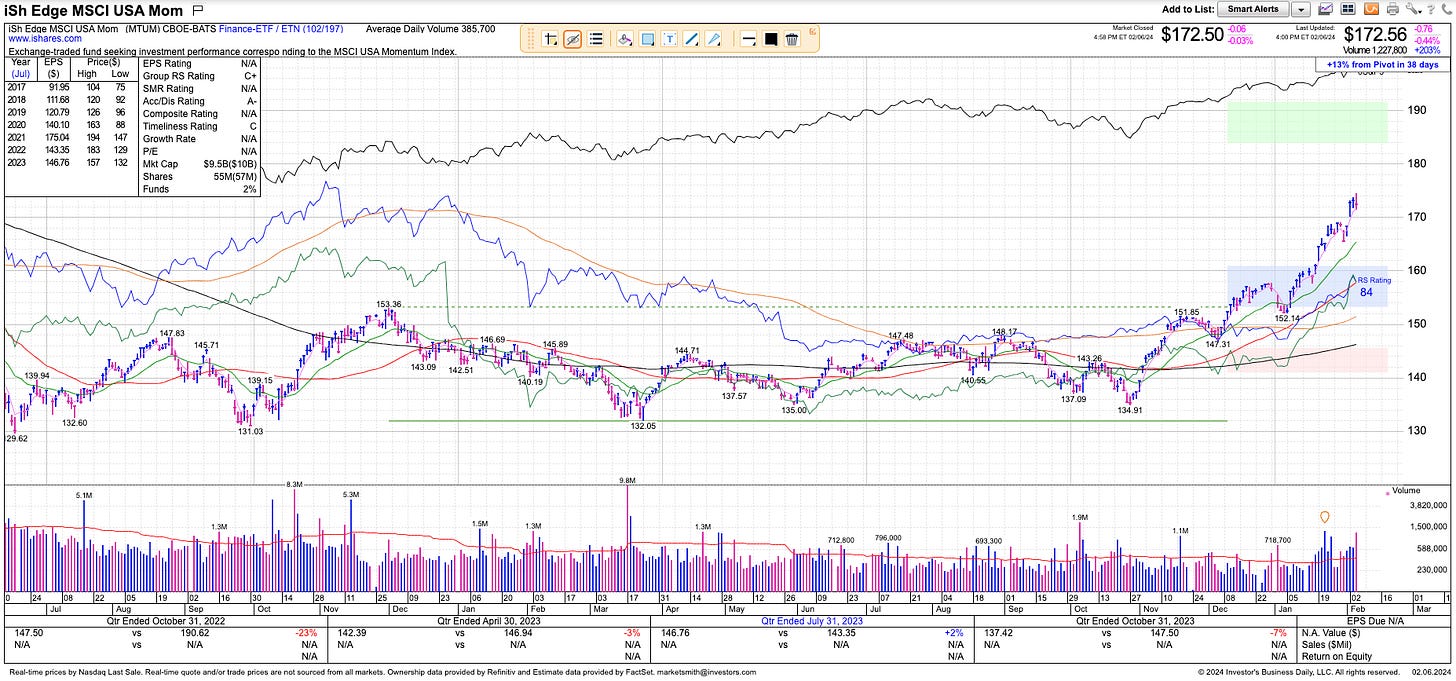

Has Momentum started stalling?

Momentum has been one of the key factors driving relative performance since the October bottom, as seen in this chart of the MTUM 0.00%↑ ETF:

Today we saw a reversal in several key names that have been momentum-driven. It’s still too early to call it a top, but this will be interesting to watch.

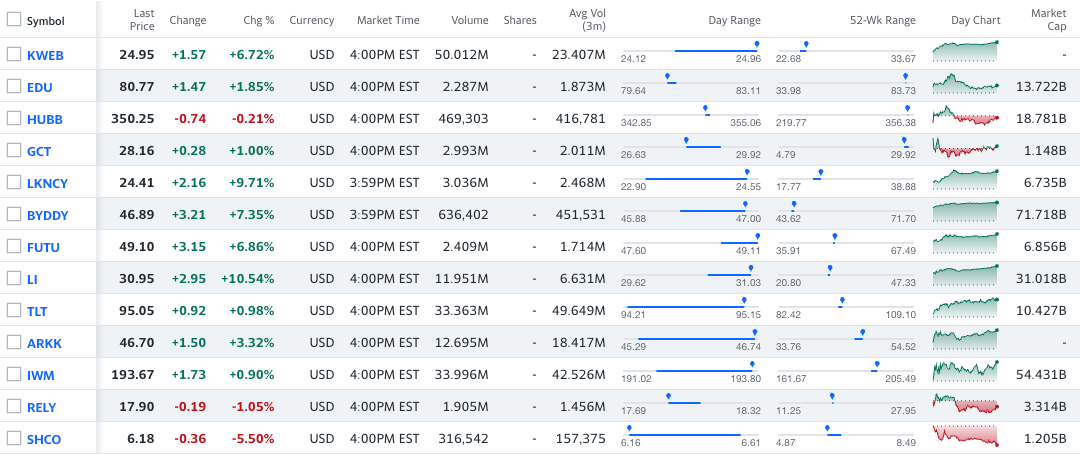

Is Breadth broadening out?

Along with that, we saw breadth broadening out with instruments like RSP 0.00%↑ IWM 0.00%↑ ARKK 0.00%↑, etc. rising along with TLT 0.00%↑ (long-term bonds). It remains to be seen whether it was just a short squeeze or an unwinding of long-short positioning since we saw many heavily shorted names shoot up as well. Again, something to keep an eye on.

Has China bottomed?

We’ve been waiting for a follow-through day to get back into Chinese equities, with a huge rise on heavy volume and it looks like we may finally have gotten one today. We’ve started to dip our toes into the water here. Earlier, the authorities seemed to be openly hostile to shareholders but now it looks like their tone has changed. There’s an excellent thread from @ShanghaiMacro going into the reasons (I’ve included it below). If this is indeed the bottom, there are several Chinese equities and broad index ETFs that offer tremendous value. We’ve covered them in the portfolio and watchlist below.

Portfolio and Performance

It has been a struggle to decipher the market’s moves over the last few days and performance has lagged behind the S&P. Here are the big movers in our portfolio for today:

And here’s the trading portfolio:

Watchlist

Here are the names we’re watching to enter based on price action. Most of these are either China-linked or bets on falling rates:

Long: KWEB 0.00%↑ EDU 0.00%↑ HUBB 0.00%↑ GCT 0.00%↑ $LKNCY $BYDDY FUTU 0.00%↑ LI 0.00%↑ TLT 0.00%↑ ARKK 0.00%↑ IWM 0.00%↑

Short: RELY 0.00%↑ SHCO 0.00%↑

Worth checking out

The rationale behind why China needs its public markets to recover:

That’s all for now. Happy Trading! Make sure to follow @MinervaCap on Twitter for real-time updates.