Minerva Market View for Feb 2, 2024

Today we got a glimpse of the roller coaster moves we’d been anticipating. We managed to stay green throughout the day and finished strong thanks to our hedges.

Good evening! Today we got a glimpse of the roller coaster market that we’d been anticipating. Our portfolio finished the day +1.05% vs the S&P’s +1.25% while being just 25% net-long. More importantly, the equity curve stayed in the green throughout the day, with the shorts and hedges providing enough cover when the market was in the red and not holding performance back once it turned green. This is the kind of robust portfolio we believe will be needed over the next few weeks.

Tomorrow, we get the job numbers. If they’re too hot, they will raise fears of rate cuts being pushed further out. If they’re too cold, they might stoke fears of a slowdown/recession. A Goldilocks number will be needed for the market to continue rallying. Of course, AMZN 0.00%↑ and META 0.00%↑ reporting great earnings will support the mega-cap / tech indices, while AAPL 0.00%↑ will detract. Our AAPL 0.00%↑ short should help.

Portfolio and Performance

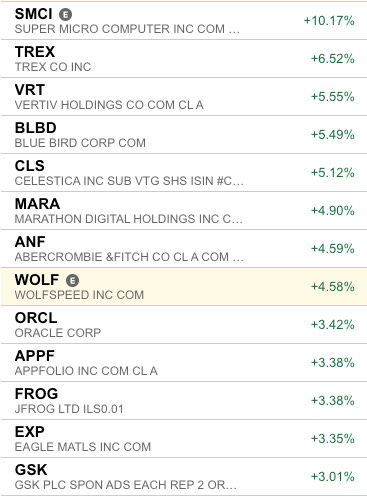

We had several winners >3% today and no losers greater than that.

We got stopped out on DOCU 0.00%↑ and IE 0.00%↑ and booked solid gains on the NYCB 0.00%↑ and VLY 0.00%↑ shorts.

We shorted MKTX 0.00%↑ OZK 0.00%↑ POWL 0.00%↑ SPR 0.00%↑ WOLF 0.00%↑.

Watchlist

Here are the names we’re watching to enter based on price action:

Long: ACM 0.00%↑ CEG 0.00%↑ ROAD 0.00%↑ HUBB 0.00%↑ UTI 0.00%↑ NVDA 0.00%↑

Short: NXT 0.00%↑ BRZE 0.00%↑ HTZ 0.00%↑

Worth checking out

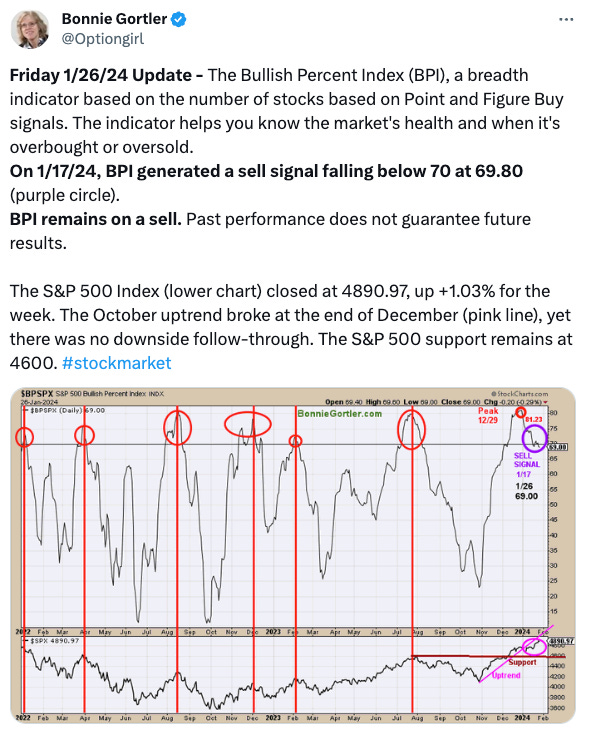

We agree with this observation shared by @ukarlewitz on X that we’re still in a long-term uptrend but with a minor dip/chop phase coming up:

Insightful interview with Marios Stamatoudis, one of the top performers at the USIC last year:

That’s all for now. Happy Trading! Make sure to follow @MinervaCap on Twitter for real-time updates.