Minerva Market View for Feb 13, 2024

The rally seems to have legs but there is a rotation happening under the surface.

Good evening! Our portfolio has been doing great and outperforming the SPY 0.00%↑. We think this rally still has legs but the momentum is moving to other parts of the market. Here are the key things we’re watching:

As we noted in our previous update, the rally is rotating to small-caps IWM 0.00%↑ and other sectors (biotech, ARKK 0.00%↑, RSP 0.00%↑, etc.) of the market.

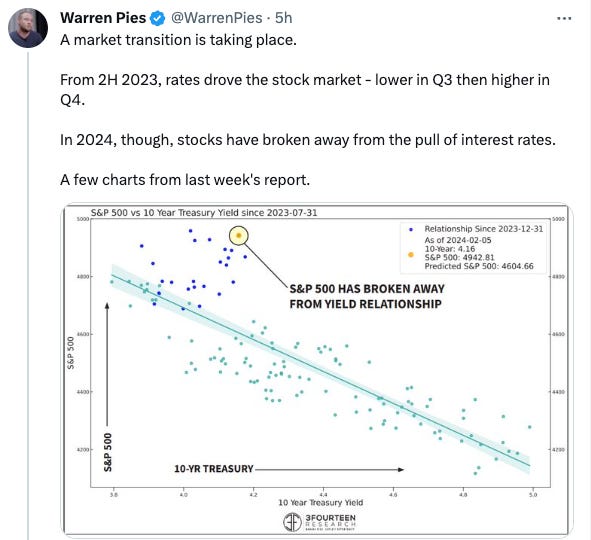

Stocks also seem to have parted ways with rates i.e. even with 10-year rates going up since the last few days, the rally has been powering on.

A lot of eyes on the CPI report coming out tomorrow. Our best guess is that it should remain conducive for the rally to continue.

This is not a market you want to be shorting (yet). Anyone managing money against a benchmark cannot afford to be too much underweight equities.

The divergences that have had a lot of us worried can also correct themselves in favor of the rally.

Breadth continues to improve:

Portfolio and Performance

Our portfolio continues to be helped by several big winners, and not too many losers. Here are the major movers for today:

Here’s what our current portfolio looks like. We’re about 75% net-long:

Watchlist

Here are the names we’re watching. We’re also planning to reallocate some of our beta from VOO 0.00%↑ to RSP 0.00%↑ (equal-weighted S&P) if breadth continues to improve.

Long: RSP 0.00%↑ GBX 0.00%↑ LMB 0.00%↑ LII 0.00%↑ ACMR 0.00%↑ YMAB 0.00%↑ CMRE 0.00%↑ MHK 0.00%↑ INGN 0.00%↑ ANET 0.00%↑ RXRX 0.00%↑

Short: OKTA 0.00%↑ PRO 0.00%↑ OSCR 0.00%↑ BMR 0.00%↑ $CRLBF $TCNNF VRSN 0.00%↑

Worth checking out

This thread from Warren Pies and the video at the end is worth going through:

That’s all for now. Happy Trading! Make sure to follow @MinervaCap on Twitter for real-time updates.