Minerva Market View for Dec 21, 2023

Yesterday's dip doesn't seem to signal the end of the rally for now, as we covered here previously. Here's how we're positioned for the rest of the year...

Good evening! As we expected, the dip seems to have been a one-off and the rally resumed today. This is also likely our last update for the year as we head into the winter break and activity and trading volumes are likely to subside.

Here’s an interesting historical perspective on dips like yesterday’s:

We see the rally continuing slowly and steadily into the year-end close to our target of 4800 on the SPY 0.00%↑.

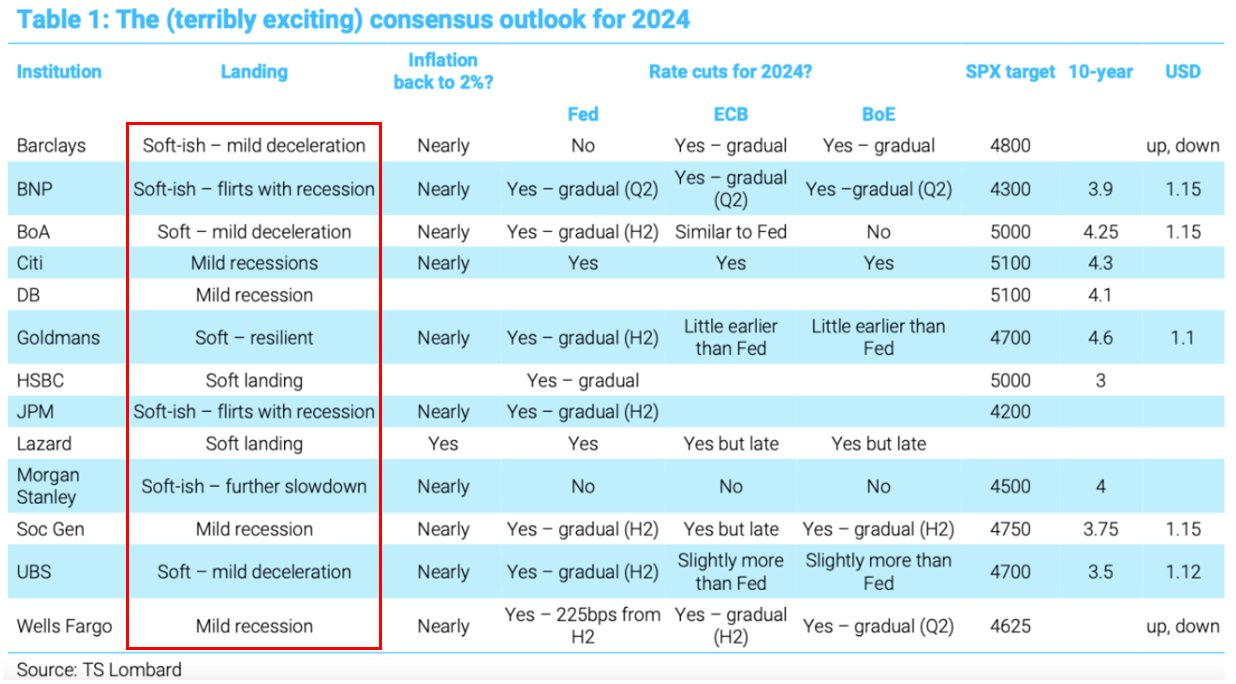

As for 2024, a slowdown seems to be the consensus on the street (except for Goldman Sachs, who were incidentally the only major bank to get this year’s forecast right):

As we saw this year, the majority consensus rarely comes to bear, especially considering next year is an election year with an incumbent president. So we maintain a bullish tilt for now.

One of the most interesting 2024 outlooks came out today from Tom Lee of Fundstrat, who again is one of those forecasters to get this year mostly right. The whole video is worth watching, but here are my key takeaways:

First, why you should listen to Tom: his #1 recommended sector this year was FANG which is up 99%.

FS Insight's stock selections have consistently beaten the SPY 0.00%↑ over the last several years.

His macro insight for this year was that inflation was mainly cars and housing and temporary supply chain shocks vs. oil shocks in the 70s.

Periods of high volatility are followed by periods of low volatility i.e. for stocks to rise, people just need people to stop selling

For 2024 he favors small caps over the S&P.

In terms of sectors, he likes financials (regional banks + large banks), industrials, and tech in that order (broad tech, not just the FANGs).

Single-stock names offered were JPM, Blackrock, and Blackstone.

2024 projections: $SPY flat or down 5% in the first half due to correction/consolidation of the parabolic rally, growth scare, AI not living up to hype. But small-caps continue to outperform.

$SPX could go down to 4300-4400 in the first half followed by a strong second half where it rises to close 2024 at 5200.

Small caps / $RTY / $IWM remain fine through the year and end 50% up.

These are my notes, so any errors are mine but I strongly urge you to watch the full video if it's the only 2024 Outlook video you watch. I have no affiliation and am not even a paying member, I just like to learn from folks who can help me make money:

Now, I would hesitate to go against a guru like this, so I am going to be more watchful on my large VOO 0.00%↑ (S&P ETF) holding as we enter the new year, and tighten up the stops.

Portfolio and Performance

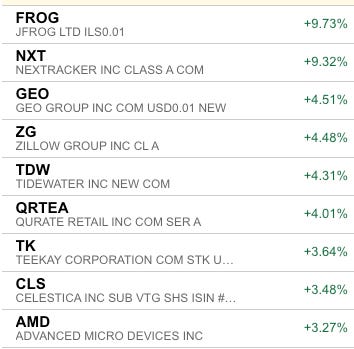

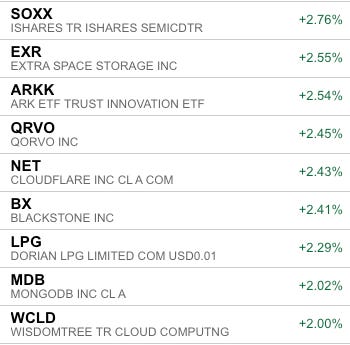

Today was a mirror image of y'day in our portfolio. Holdings that gained >2% include: FROG 0.00%↑ NXT 0.00%↑ GEO 0.00%↑ ZG 0.00%↑ TDW 0.00%↑ QRTEA 0.00%↑ TK 0.00%↑ CLS 0.00%↑ AMD 0.00%↑ SOXX 0.00%↑ EXR 0.00%↑ ARKK 0.00%↑ QRVO 0.00%↑ NET 0.00%↑ BX 0.00%↑ LPG 0.00%↑ MDB 0.00%↑ WCLD 0.00%↑

Today we bought EWT 0.00%↑ (Taiwan ETF) in our portfolio after a > 12% dip yesterday on China invasion fears. It is a risky play but it's a bet that those fears don't play out as soon or as anticipated. Most of the holdings are semiconductor/technology stocks that stand to be AI beneficiaries.

Watchlist

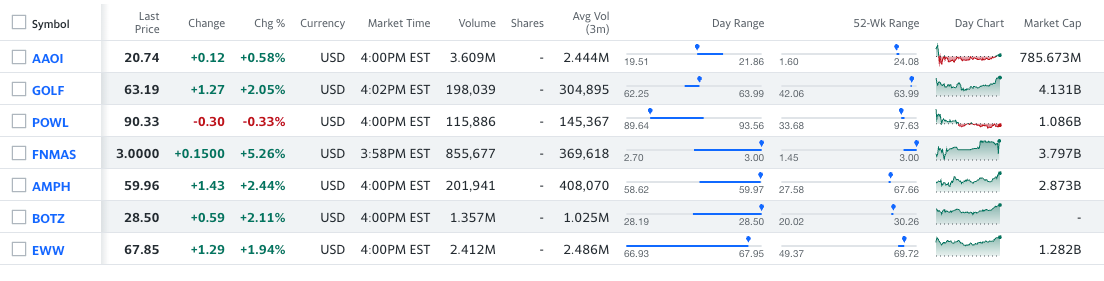

For tomorrow, we will be looking at the price/volume action on these tickers:

AAOI 0.00%↑ GOLF 0.00%↑ POWL 0.00%↑ $FNMAS AMPH 0.00%↑ BOTZ 0.00%↑ EWW 0.00%↑

Of these FNMAS is the ticker for Fannie Mae preferred S-series: it seems to be highly speculative but has been getting a lot of price and volume action lately, so I might take a small position in it. Shareholders lost the court case to bring it out of conservatorship, but there seems to be speculation that the government might take some favorable action.

Worth checking out

Bianco Research 2024 outlook with some great perspectives on bonds and their new actively-managed bond ETF WTBN 0.00%↑

Some great thoughts on Predicting vs. Trading from Market Wizard

:Wishing Happy Holidays to you and yours and a Happy New Year in advance! I won’t be regular on Substack during the winter break but will continue to post anything important/urgent on Twitter @minervacap.