Minerva Market View for Dec 20, 2023

Did the bears just pop out of hibernation? Here's how we're positioning...

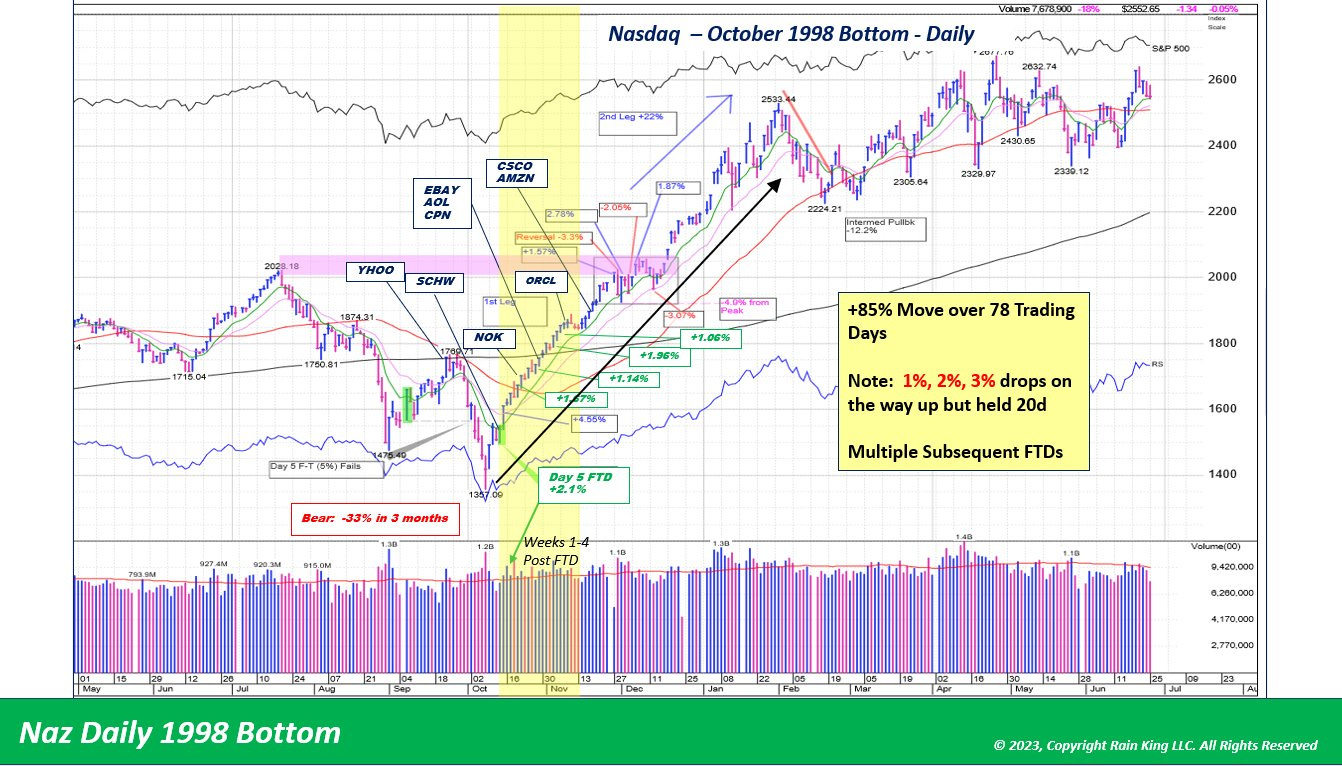

Good evening! Today was a brutal day in the markets, and we were not spared in our portfolio either. But to put today’s trading day in the context of the bigger picture, it is not uncommon to have sharp daily pullbacks of even 3% during bull markets. Here are some examples from past powerful rallies:

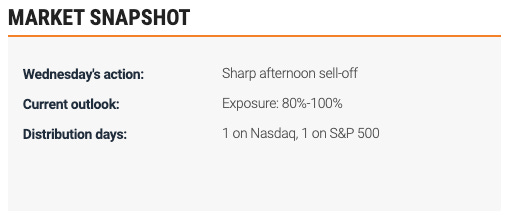

In any case, we are not fixated on any one view and will follow the price action as we did when we went short in September and October, and when we flipped long in November. The important indicator that we’re tracking is the number of “distribution days” when the major indices fall on heavier volumes than the prior day. When those exceed 5 days within the last 5 weeks, that’s a sign that a near-term top may be in and that we need to get defensive. This is as per extensive research done by William O’Neil and team at Investors Business Daily.

So far, the tracker does not show too many signs of concern, indicating that this might be just a healthy pullback:

Portfolio and Performance

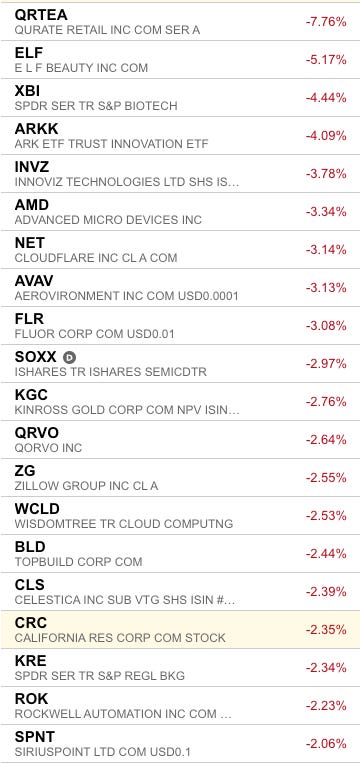

Almost all our holdings were down (except for some oil- & gas-related stocks), and some tripped their stops, so we’re down to 96% net long. If the rally resumes, we will be looking at adding back exposure. We’ve been examining our holdings closely and raising stops along the way, so we’re fine with whatever direction the market decides to take.

As reported on Twitter, we added GOOGL 0.00%↑ and CRC 0.00%↑ on breakouts today.

Watchlist

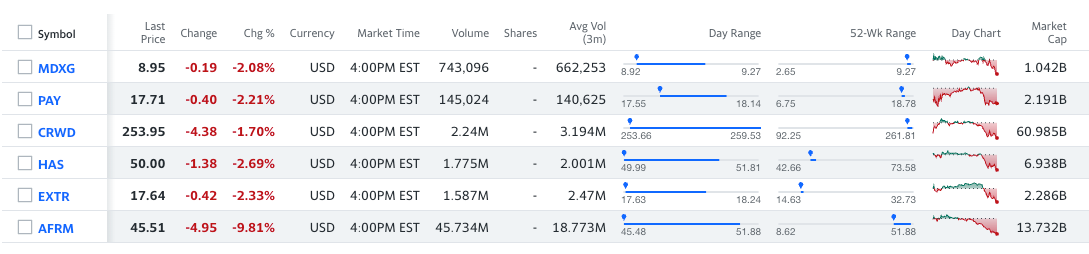

For tomorrow, we have just a couple of names that we will look at adding based on price action:

Long: MDXG 0.00%↑ PAY 0.00%↑

Short: CRWD 0.00%↑ HAS 0.00%↑ EXTR 0.00%↑ AFRM 0.00%↑

Worth checking out

These were two well-balanced 2024 outlooks:

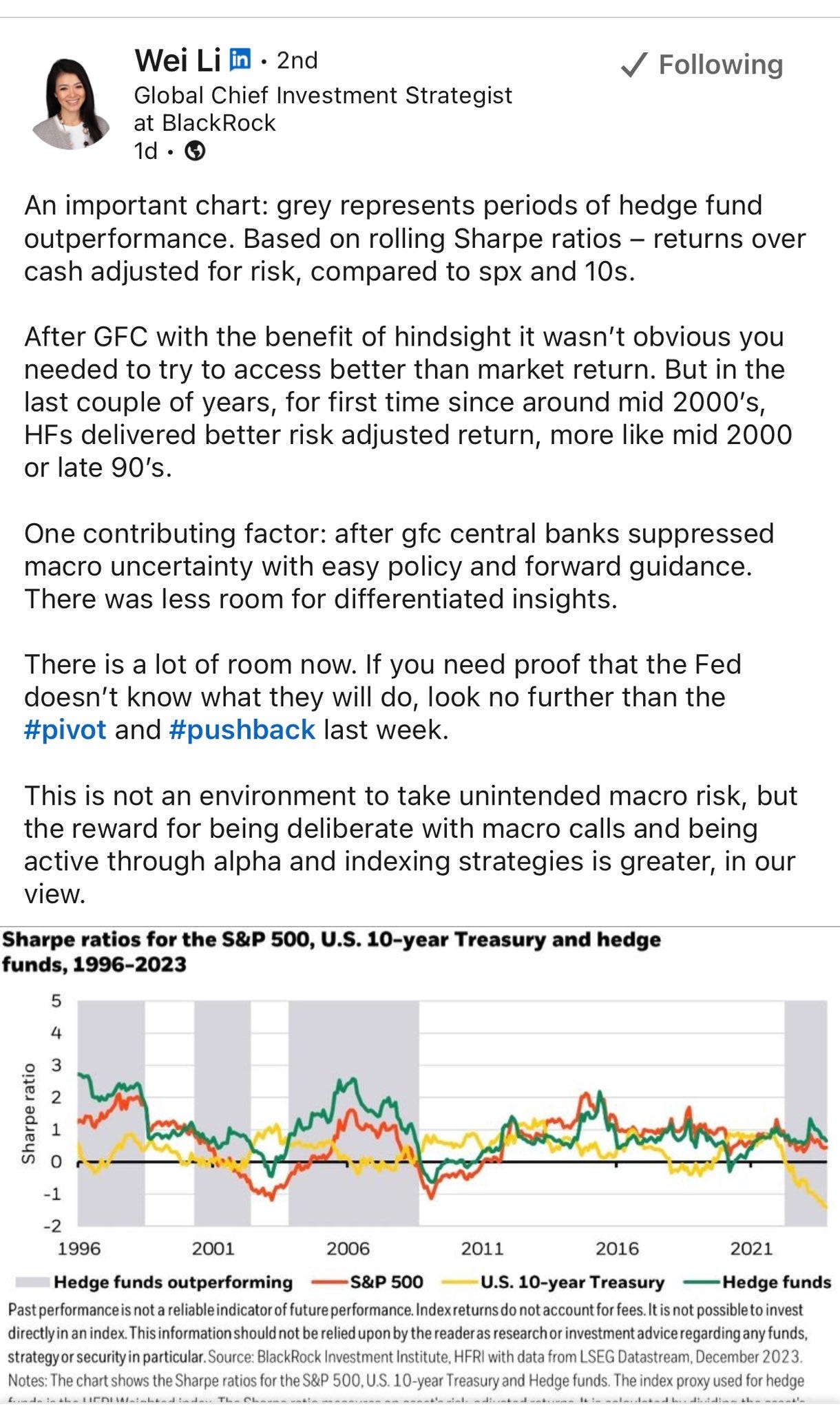

And here’s something to think about:

That’s all for now. Happy Trading!