Minerva Market View for Dec 19, 2023

Small and mid caps rallied today as we expected. Their relative outperformance is likely to continue.

Good evening! As we anticipated, small- and mid-caps rallied today. They are likely to continue outperforming due to several reasons.

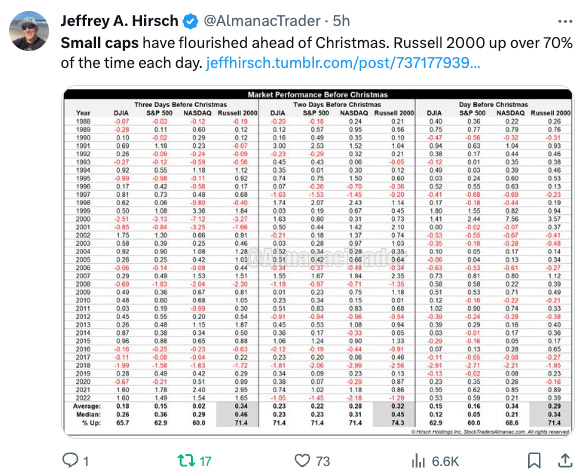

First, we’re entering a seasonally favorable period for them vs. the other major indices historically:

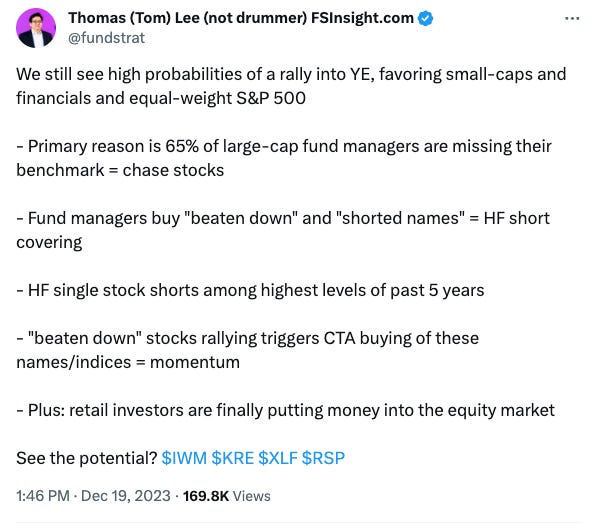

Looking into year-end the story is much the same:

And longer-term, their recent strength indicates a likelihood of more to come:

Again, these are small sample sizes, but even if you just focus on the macro, considering the economy is improving better than most expected and the Fed is likely to cut rates starting Q1, all the factors that have kept small caps beaten down for so long are reversing sharply.

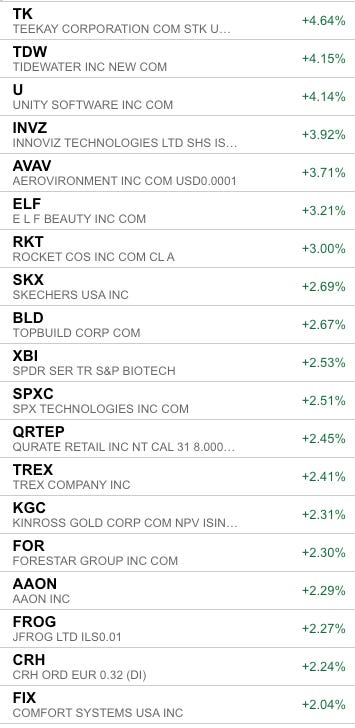

Portfolio and Performance

We had a solid day today and we expect such days to repeat. Several of our holdings outperformed even the strong showing of the Russell 2000:

Oil and gas-related tickers had the strongest showing today, again as we’d projected yesterday.

We see the small-cap rally continuing with maybe a small dip here or there. Small caps tend to consolidate for a couple of days and then jump higher as we saw over the last couple of days.

The risk is of a 5% dip and the reward is an almost 100% gain from here, so the risk/reward is tilted as much to the upside as we can hope for. We’re fully invested in both our trading and long-term portfolios.

Watchlist

For tomorrow, we have just a couple of names as our plate is already full, and adding any new positions means rebalancing:

Long: PLUS 0.00%↑ MDXG 0.00%↑ PAY 0.00%↑ ACM 0.00%↑ CRC 0.00%↑

Worth checking out

That’s all for now. Happy Trading!