Minerva Market View for Dec 17, 2023

We see the rally continuing with the pendulum swinging between risk-off (Nasdaq / Megacaps) and risk-on (Small- and mid-caps).

Good evening! We see more of the same market action continuing as we get into the final 2 weeks of the year, with markets swinging between risk-on days (when small- and mid-caps / IWM 0.00%↑ / VO 0.00%↑ go up) and risk-off days (when the QQQ 0.00%↑ / mega-caps go up).

One of the beaten-down sectors has been crude oil and related oil stocks / XLE 0.00%↑. We see many of them trying to stage a recovery. There are other stocks also setting up nicely which we will cover below.

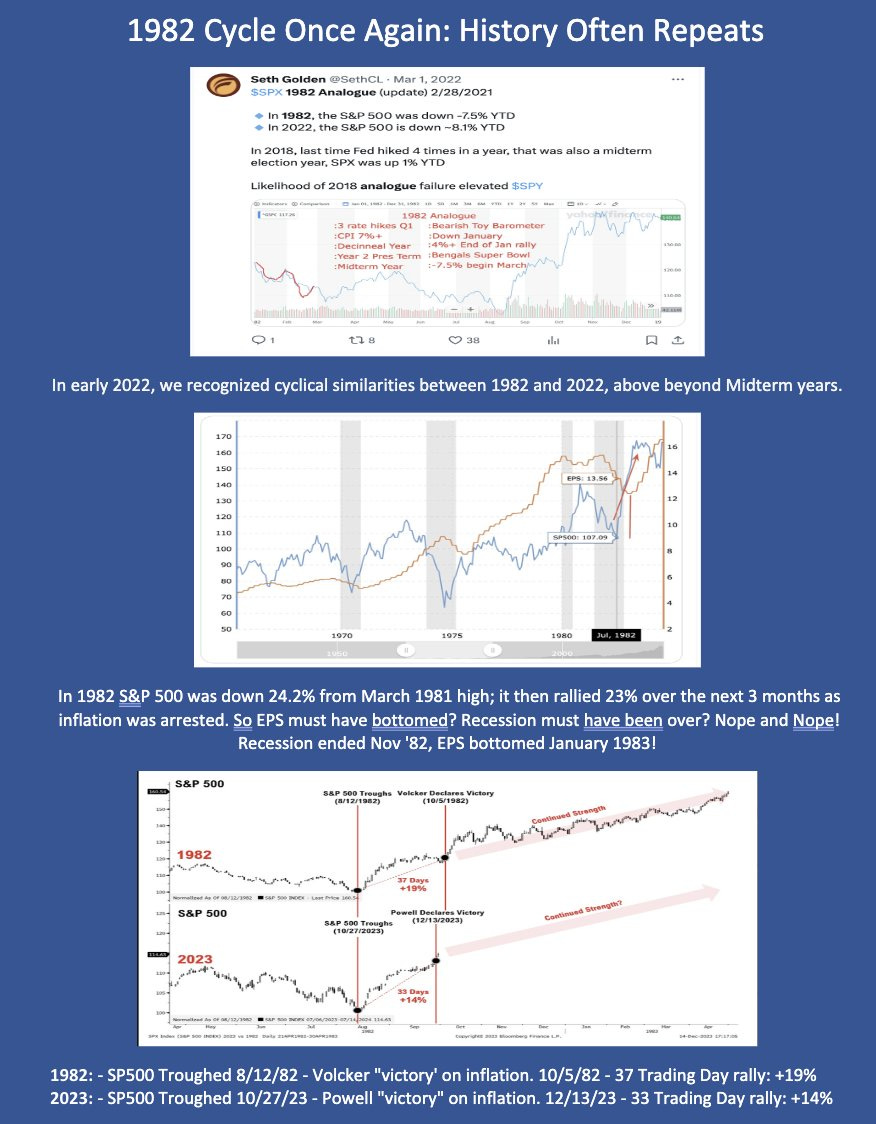

Of the analysis that crossed our screens over the weekend, these two were interesting:

Portfolio and Performance

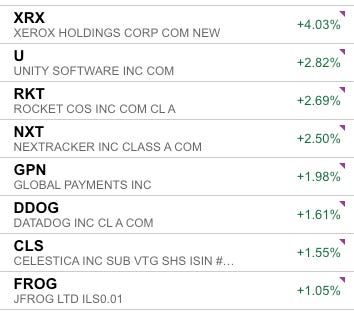

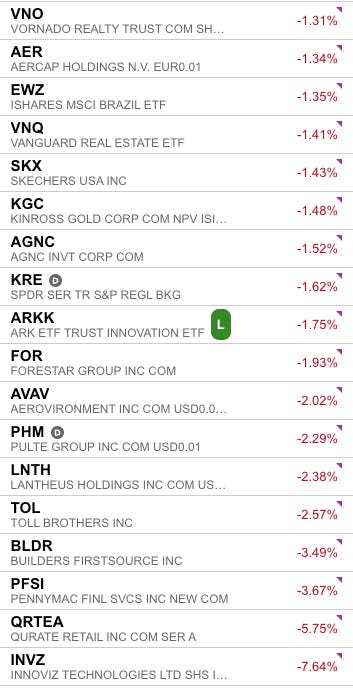

We have been heavily tilted towards small caps and risk-on tickers so Friday was a down day for us. Some of the volatility was expected as well, it being the monthly options expiry for December. We did manage to see some winners although they were outweighed by the losers:

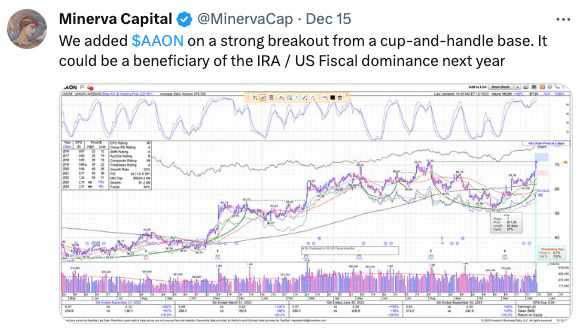

We have a huge buffer of gains from the November bottom when we started to scale in, so we don’t mind some chop and volatility. On Friday, we bought GEO 0.00%↑ and AAON 0.00%↑ as reported on Twitter:

Watchlist

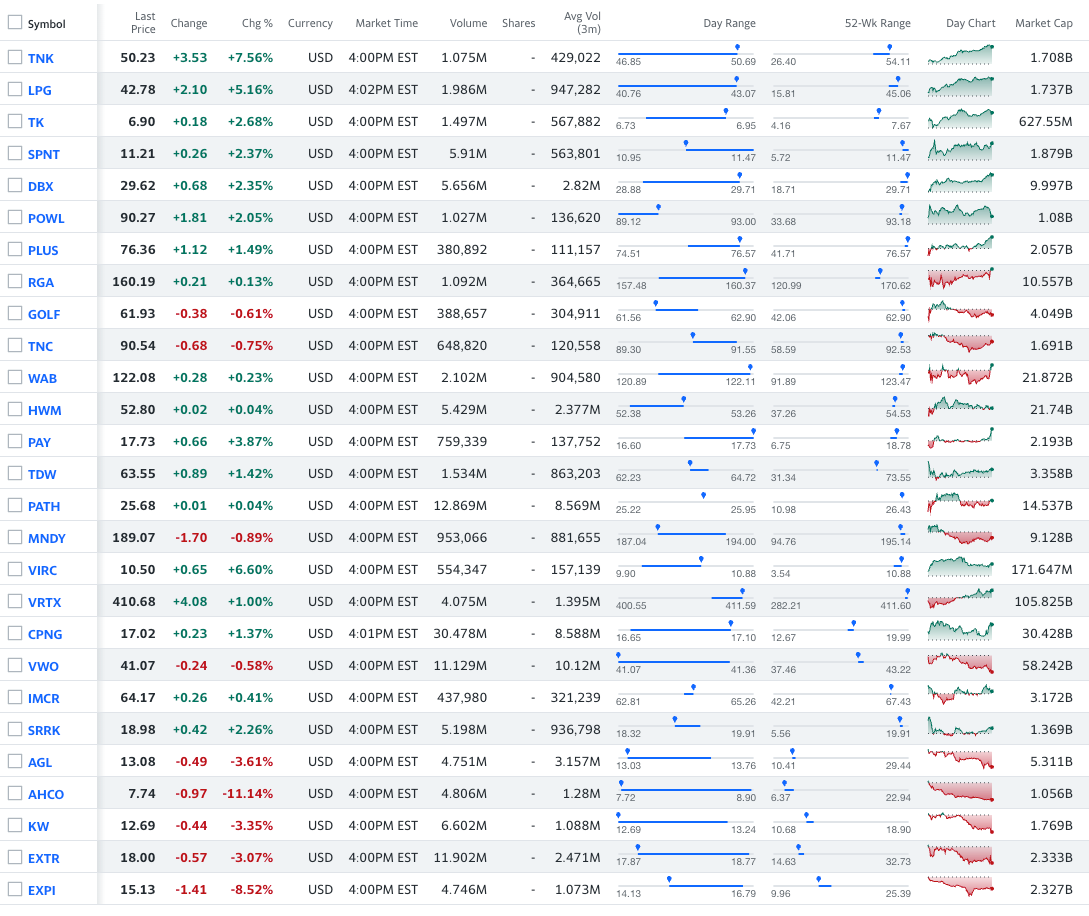

For tomorrow, we will be looking at these tickers and adding them based on price/volume action:

Long: TNK 0.00%↑ LPG 0.00%↑ TK 0.00%↑ SPNT 0.00%↑ DBX 0.00%↑ POWL 0.00%↑ PLUS 0.00%↑ RGA 0.00%↑ GOLF 0.00%↑ TNC 0.00%↑ WAB 0.00%↑ HWM 0.00%↑ PAY 0.00%↑ TDW 0.00%↑ PATH 0.00%↑ MNDY 0.00%↑ VIRC 0.00%↑ VRTX 0.00%↑ CPNG 0.00%↑ VWO 0.00%↑ IMCR 0.00%↑ SRRK 0.00%↑

Short: AGL 0.00%↑ AHCO 0.00%↑ KW 0.00%↑ EXTR 0.00%↑ EXPI 0.00%↑

Worth checking out

Larry Williams 2024 Market Outlook:

That’s all for now. Happy Trading!