Minerva Market View for Dec 14, 2023

We are in full "risk on" mode, rotating from large-caps / "safe stocks" into the more aggressive / beaten-down sectors. This has a long way to go.

Good evening! As you would have noticed the markets are now in full risk-on mode, rotating from the mega-caps that were the winners of this year into the small- and mid-cap / equal-weight indices and beaten-down sectors such as real estate, biotech, etc.

Our portfolio continues to perform exceedingly well, logging day after day of record returns. All indications are for this rally to continue well into next year.

No one can give accurate targets, but our bets are on the S&P / SPY 0.00%↑ to touch 4800 this year and 4920 early next year. But the real action is in small-caps, where the Russell 2000 is expected to have a 50% gain within the next 12 months, per Tom Lee of Fundstrat who has had the most accurate calls on the street this year:

Portfolio and Performance

We have been fortunate to capture some excellent gains today:

We’re now at 93% net-long across our trading and long-term portfolio. On the long-term side, we rotated from VGT 0.00%↑ into RSP 0.00%↑ and ICVT 0.00%↑ today. This is in addition to a core holding of VOO 0.00%↑ VO 0.00%↑ and VTWO 0.00%↑.

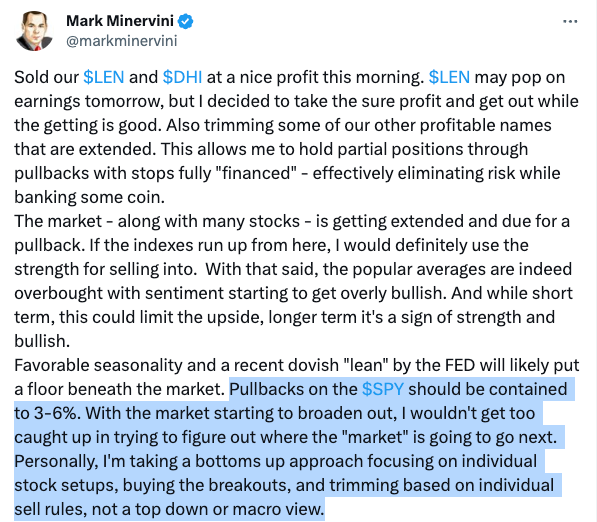

We will keep reporting our important buys on Twitter:

Watchlist

For tomorrow, we will be looking at these tickers and adding them based on price/volume action:

AAON 0.00%↑ TNC 0.00%↑ LPG 0.00%↑ VRTX 0.00%↑ XME 0.00%↑

Worth checking out

That’s all for now. Happy Trading!