Minerva Market View for Dec 13, 2023

We might be in a "life changing" rally. Execution is going to be key to capture the most gains.

Good evening! We had the best day of the year today in the Minerva portfolio. In the words of a recent webinar speaker, we might be in the middle of a “life-changing” rally. Execution will be the name of the game over the next few weeks – capturing good stocks as they’re breaking out, weeding out the laggards, and adding to the faster-moving holdings all the while trailing your stops.

We had a busy day doing all the above so we will keep today’s update brief. The next few days are likely going to be “lockout rally” days which will hardly give a chance to enter. Any dips will likely be bought.

We shared this likely path over Twitter:

The path to 4920 on the $SPX: Markets can trace a similar ~20% rally as they did in the summer from the lows around 3800 to highs around 4600 before taking some rest. Dips to the value zone between the 21D-EMA and 50D-SMA will provide valuable buying opportunities:

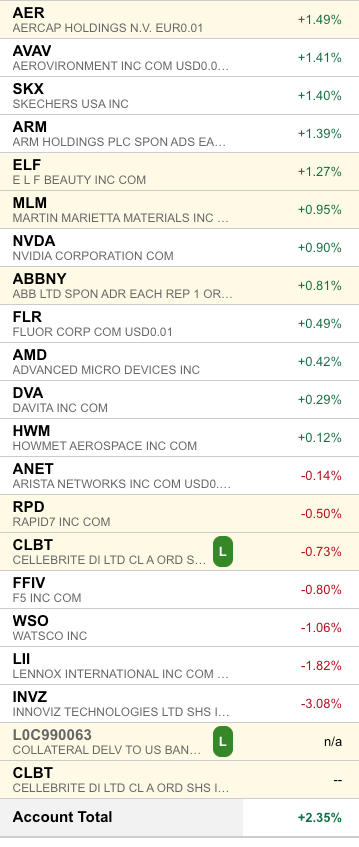

Portfolio and Performance

Here’s what our trading portfolio looks like today:

Besides this, we have VOO 0.00%↑ and VGT 0.00%↑ in our longer-term portfolio.

Watchlist

For tomorrow, we will be looking at these tickers and adding them based on price/volume action:

ETFs: SOXX 0.00%↑ VNQ 0.00%↑ XBI 0.00%↑ EWZ 0.00%↑ ILF 0.00%↑ WCLD 0.00%↑

Stocks: LLY 0.00%↑ PFSI 0.00%↑ CLS 0.00%↑ GPN 0.00%↑ NVO 0.00%↑ SPXC 0.00%↑ RAMP 0.00%↑ PAY 0.00%↑ BX 0.00%↑ FOR 0.00%↑ NECB 0.00%↑

No shorts

Worth checking out

Today I learned that Bard gives great book summaries. Of course not an excuse to skip the book, but better than trying to infer from Amazon reviews whether you should read it or not. Here's the summary for:

The Hour Between Dog and Wolf by John Coates: Summary

John Coates, a former Wall Street trader turned neuroscientist, explores the biological and environmental factors that influence risk-taking behavior, specifically within the high-pressure world of finance.

Key points explored in the book:

The role of hormones: Coates identifies testosterone and cortisol as key players in risk-taking. Testosterone increases confidence and risk-taking propensity, while cortisol triggers fear and risk aversion.

The influence of stress: Chronic stress impairs judgment, damages health, and can lead to poor financial decisions.

The importance of "gut feelings": These intuitive hunches are often based on unconscious bodily signals, influenced by hormones and past experiences.

The impact of environment: Social hierarchies, group dynamics, and even the time of day can influence risk-taking behavior.

How to improve decision-making: Coates suggests various strategies, including mindfulness practices, meditation, and biofeedback, to manage stress and enhance decision-making in high-risk situations.

The book draws on various sources, including:

Coates' personal experience as a trader

Scientific research on neurobiology, psychology, and economics

Historical and anecdotal accounts of financial crashes and booms

Overall, "The Hour Between Dog and Wolf" offers a fascinating and insightful look at the interplay between biology, environment, and human behavior in the context of risk-taking and financial decision-making. It provides valuable insights not only for traders and investors but also for anyone interested in understanding the psychology of risk and making better decisions under pressure.

Additionally, some key takeaways from the book include:

Financial markets are not solely driven by rational economic factors.

Our bodies play a significant role in shaping our financial decisions.

We can learn to manage our stress and emotions to make better choices.

Understanding the biology of risk-taking can help us become more resilient and successful in the face of uncertainty.

That’s all for now. Happy Trading!