Minerva Market View for Dec 12, 2023

Bears are running out of arguments. Several indices are at all-time highs and it looks like we still have a long way to go...

Good evening! The CPI report came out right in the Goldilocks zone just like the NFP jobs report before it. Several major indices are now at all-time highs:

At the same time, there is widespread disbelief in this rally. Almost everyone I’ve spoken to is parked in a lot of cash. As it becomes more apparent to everyone that the rally is not going away, there will be a lot of FOMO dollars chasing it. As Peter Lynch said:

The final hurdle for 2023 is in the form of the FOMC meeting tomorrow but Sec. Yellen seems to have already front-run it:

We will cover several more bullish indicators towards the end of the post. More importantly, several great stocks and sectors are setting up for epic bull runs, which we will cover next.

Portfolio and Performance

Here are just a couple of picks we posted on our Twitter today:

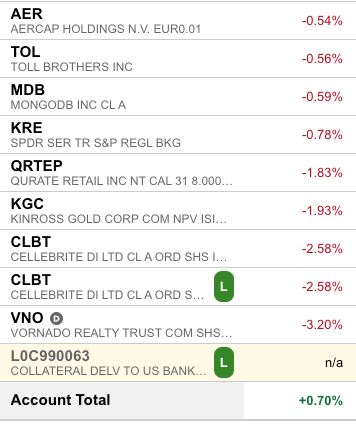

We had several big moves in our portfolio today and matched the SPY 0.00%↑ performance while being just 70% net long:

For tomorrow we will be looking at adding another 10 percentage points of net-long exposure to get to 80% net-long with a mix of the names below.

Watchlist

For tomorrow, we will be looking at these tickers and adding them based on price/volume action:

Long: VOO 0.00%↑ ERIE 0.00%↑ CSWC 0.00%↑ GE 0.00%↑ RPD 0.00%↑ GTX 0.00%↑ XBI 0.00%↑

Short: TOST 0.00%↑ NVST 0.00%↑ HAS 0.00%↑ RCM 0.00%↑ KW 0.00%↑

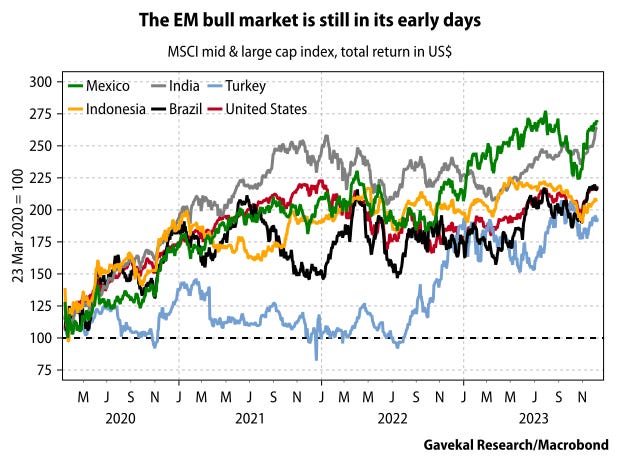

Among sectors, International stocks (especially Emerging) are still early in the rally:

Worth checking out

That’s all for now. Happy Trading!