Minerva Market View for Dec 11, 2023

Markets continued their slow grind upwards. Rotation into equal-weight / broader-based indices continues. All eyes on CPI tomorrow.

Good evening! Markets continue their slow upward grind, at the same time rotating into more of the equal-weight and small- to mid-cap indices as we’ve been saying here for a while.

The next two days are important because of the CPI numbers and the FOMC meeting. We’re not in the prediction business, but so far all the indicators point to gains continuing, maybe with a little dip.

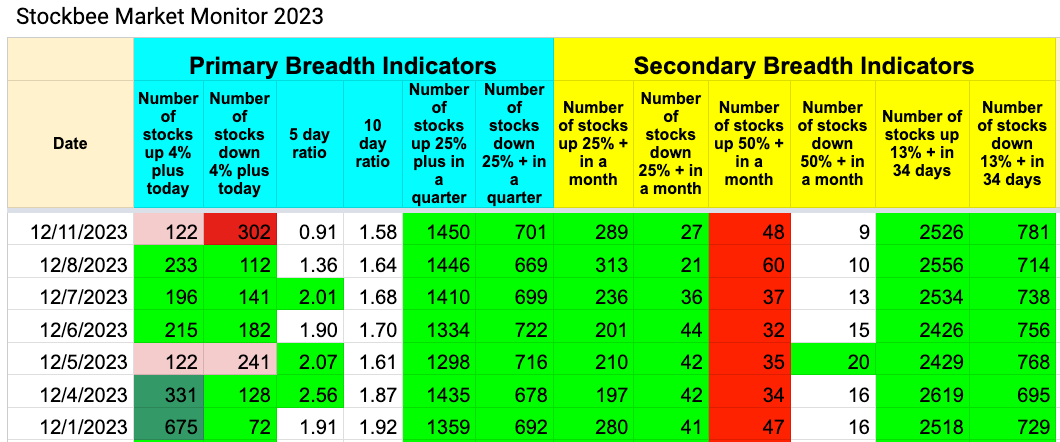

There were many bullish signs today, especially outside the mega-caps:

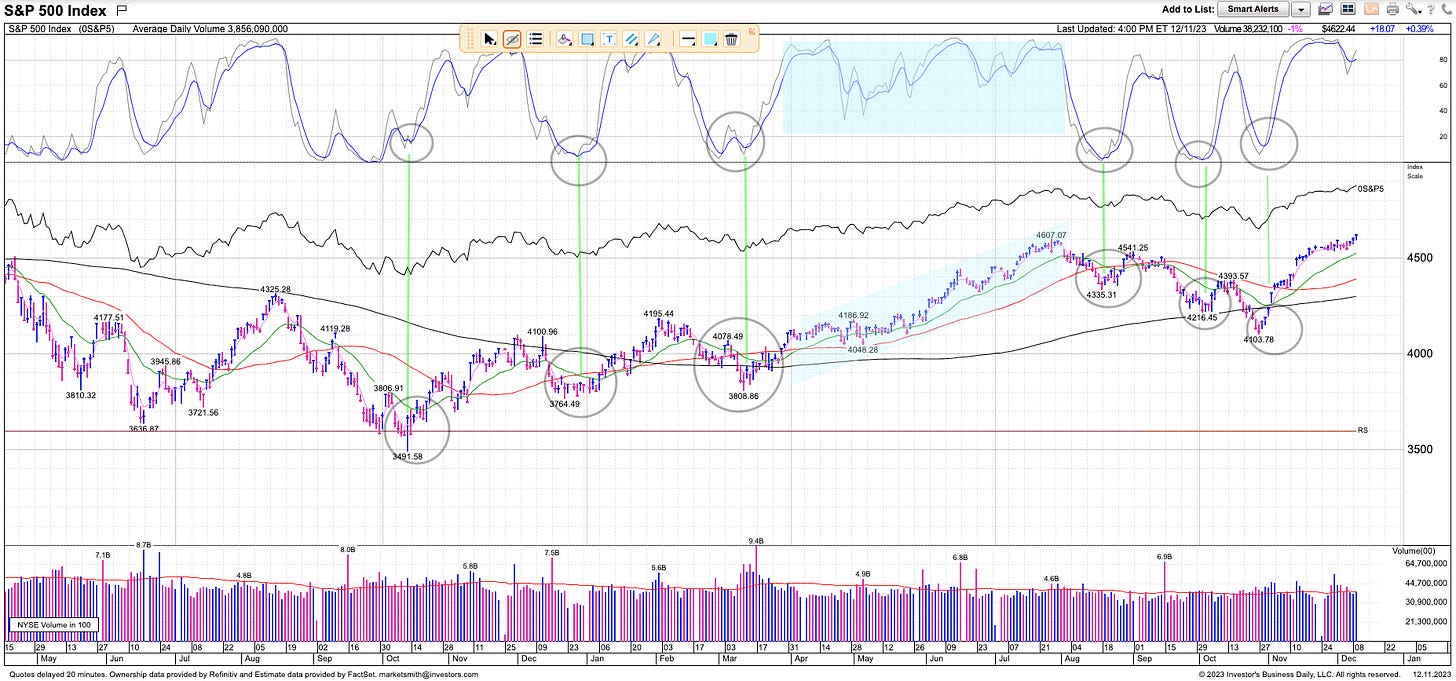

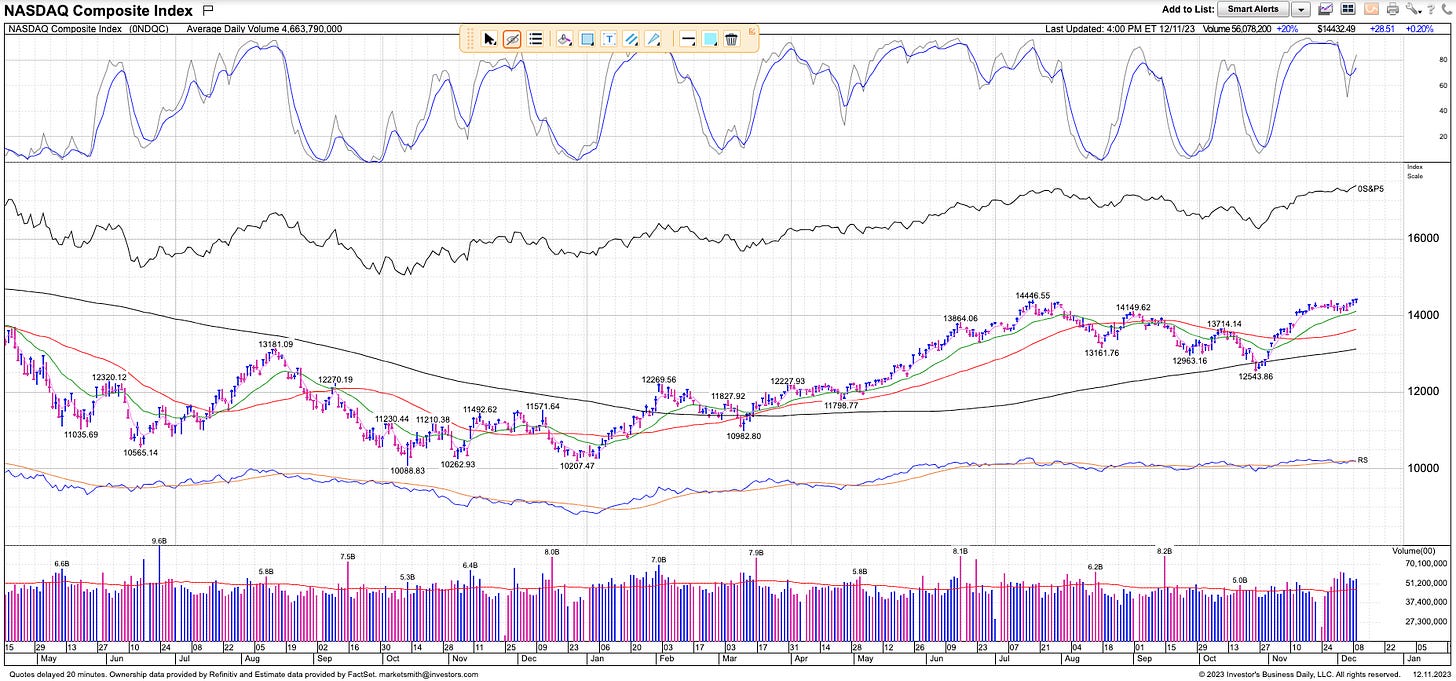

Our usual charts are firmly in uptrends:

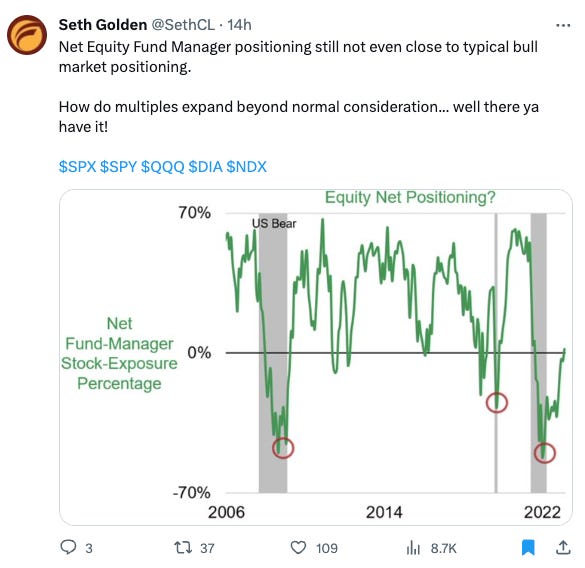

And yes, there were some concerning indicators as well:

One of the people I respect for accurate market calls also turned defensive today. However, we look at the price action to guide us, especially when no other indicators are flashing red. And that tells us to remain invested since we’re still in a confirmed uptrend:

Our core strategy remains to be adding exposure if the market continues to rally, but at the same time keep tight trailing stops in case market action turns ugly. Several stocks are setting up good bases, which we will cover next.

Portfolio and Performance

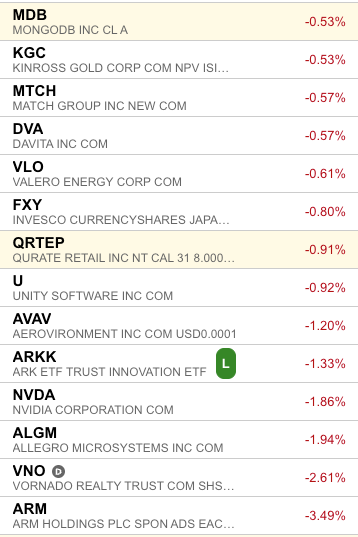

Today was a mixed day for our portfolio – we ended in the green but underperformed the SPY 0.00%↑. Here are the major movers in our portfolio today:

We bought FFIV 0.00%↑ HWM 0.00%↑ INTU 0.00%↑ MDB 0.00%↑ NXT 0.00%↑ QRTEP 0.00%↑ RSP 0.00%↑ and booked 8% profits on XBI 0.00%↑in 3 weeks.

Watchlist

For tomorrow, we will be looking at these tickers and adding them based on price/volume action:

Long: INVZ 0.00%↑ RAMP 0.00%↑ CPRT 0.00%↑ RPD 0.00%↑ ELF 0.00%↑ HOV 0.00%↑ VIRC 0.00%↑ AMPH 0.00%↑

Short: NVST 0.00%↑

Worth checking out

That’s all for now. Happy Trading!