Minerva Market View for Dec 10, 2023

The Friday jobs report was right in the Goldilocks zone and supportive for bulls. Here's what to watch for this week.

Good evening! The NFP jobs report on Friday came out neither too hot nor too cold and was just what bulls were looking for:

There’s a lot of action coming up this week as well, so let’s get right into it. Our main driver for this period until Dec 13 has been to follow the market’s reaction to these main events, and that’s what we will continue to do:

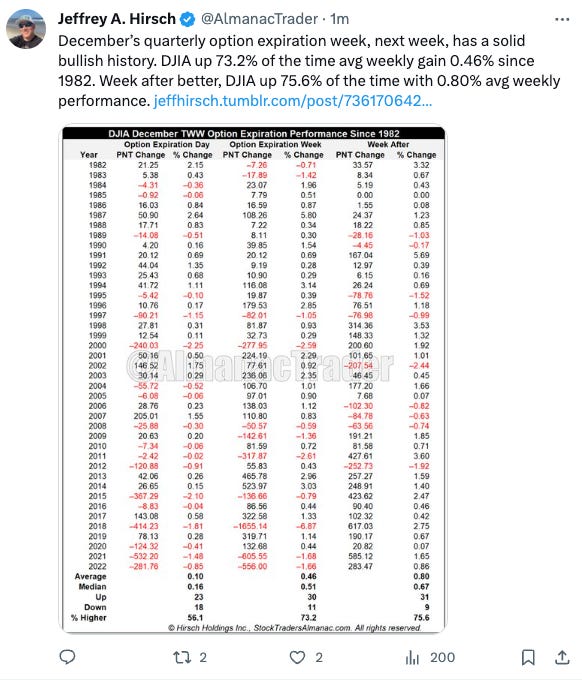

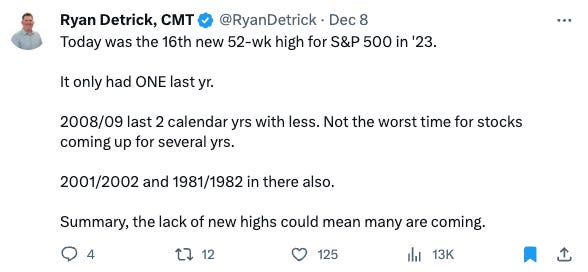

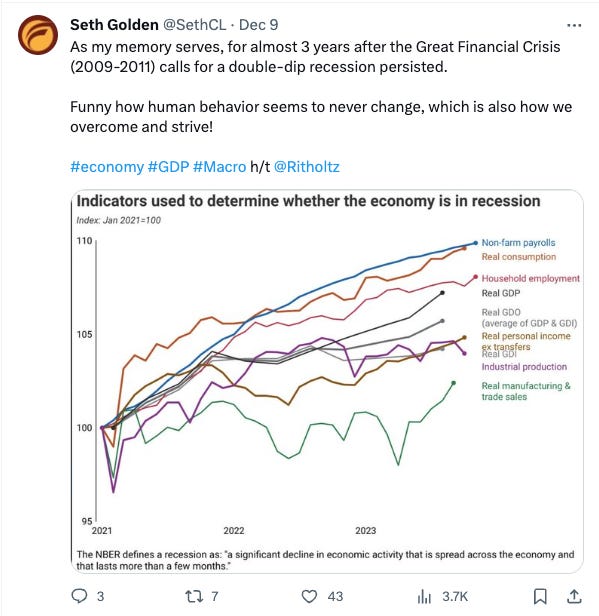

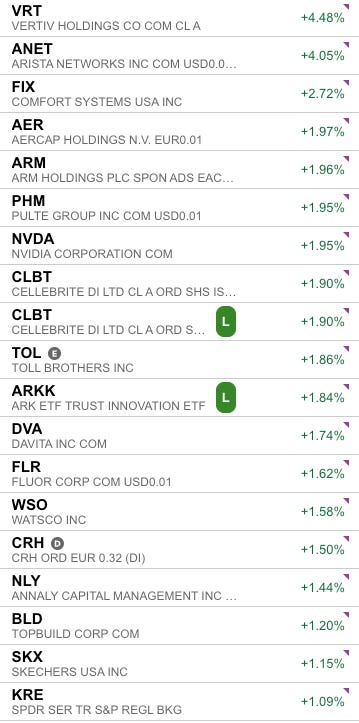

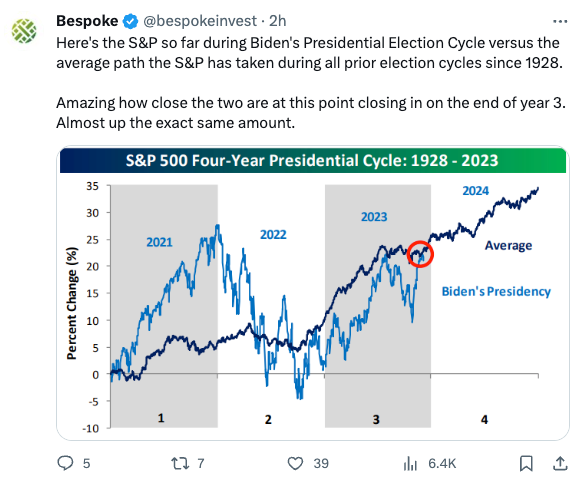

The bulls have a lot of support from various angles:

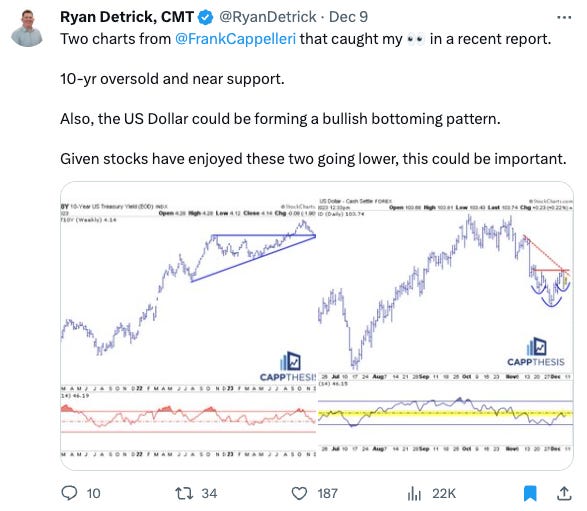

Thus, almost all indicators from a fundamental, technical, and macro perspective point to the rally continuing. The only minor worry on a short-term basis could be bond prices and the USD reverting:

In any case, we will continue to monitor and react to the market over the coming days, and our strategy remains to continue adding exposure if the rally continues, but with tight trailing stops along the way to protect profits if a dip materializes.

Portfolio and Performance

Our portfolio continues to do well, beating the S&P on a risk-adjusted basis, with several winners and few losers:

We bought AMD 0.00%↑ ARM 0.00%↑ AVAV 0.00%↑ and U 0.00%↑ on Friday in alpha and VGT 0.00%↑ and VTWO 0.00%↑ in beta to get to a net long of 57%. Over the next few days, if the market continues to do well, we will aim to get to 80% net long.

Watchlist

For tomorrow, we will be looking at these tickers and add them based on price/volume action:

Long: ELF 0.00%↑ JPM 0.00%↑ AAPL 0.00%↑ GOOGL 0.00%↑ IOT 0.00%↑ NXT 0.00%↑ ARRY 0.00%↑ SMCI 0.00%↑ FFIV 0.00%↑ TK 0.00%↑ HWM 0.00%↑ INTU 0.00%↑ RPD 0.00%↑ CRM 0.00%↑ ELF 0.00%↑ VIRC 0.00%↑

Short: FLYW 0.00%↑ NVST 0.00%↑ GH 0.00%↑

Worth checking out

That’s all for now. Happy Trading!